This edition of ApplyInsights is the fourth in a series of articles looking at the international education market in Canada by province. In this article, I’ll be looking at trends in study permits issued in Canada’s three Prairie provinces: Alberta, Saskatchewan, and Manitoba. Check out my previous articles in this series for study permit trends in Ontario, British Columbia, and Quebec.

Here’s what this blog post will include:

- A comparison of study permit trends in the Prairie provinces and Canada’s other regions

- A breakdown of study permits issued in each Prairie province by study level

- Top source countries for study permits issued in the Prairie provinces

- A summary of my findings and thoughts about the future

Throughout this article, I’ll be using data for new study permits issued in 2018, 2019, and January through October 2020,1 as full-year 2020 data isn’t available yet.

Let’s start by looking at how international student enrollment in the Prairie provinces compares to the rest of Canada.

Issued Study Permits: Canada Regional Breakdown

The Prairie provinces accounted for 6.4% of new Canadian study permits issued in 2020. This was down slightly from 8.9% in 2019 and 9.4% in 2018.

However, these decreases were largely reflective of growing market shares for Quebec and Ontario. Total new study permits issued to students attending institutions in the Prairie provinces rose by 3.7% from 2018 to 2019.

The following table breaks down these changes in more detail:

| Region | 2018 | 2019 | 2020 (Jan-Oct) | % Change 2018–2019 | % Change 2019–2020 (Jan-Oct) |

|---|---|---|---|---|---|

| Atlantic Canada* | 12,239 | 13,010 | 1,664 | +6.3% | -87.2% |

| British Columbia | 48,271 | 49,130 | 9,498 | +1.98% | -80.7% |

| Ontario | 107,456 | 119,112 | 20,271 | +10.8% | -83.0% |

| Prairies | 20,377 | 21,129 | 2,874 | +3.7% | -86.4% |

| Quebec | 27,364 | 35,908 | 10,971 | +31.2% | -69.5% |

| Territories** | 72 | 124 | 34 | +72.2% | -72.6% |

| * Atlantic Canada includes New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island ** Territories includes the Northwest Territories, Nunavut, and Yukon |

|||||

The Prairie provinces were not immune to the impacts of COVID-19 and saw a higher drop in international student numbers compared to other regions. I’m interested to see how the Prairies recover in 2021 and 2022 as the effects of the pandemic on international enrollment wane.

Prairie Provinces Study Permits Issued by Study Level

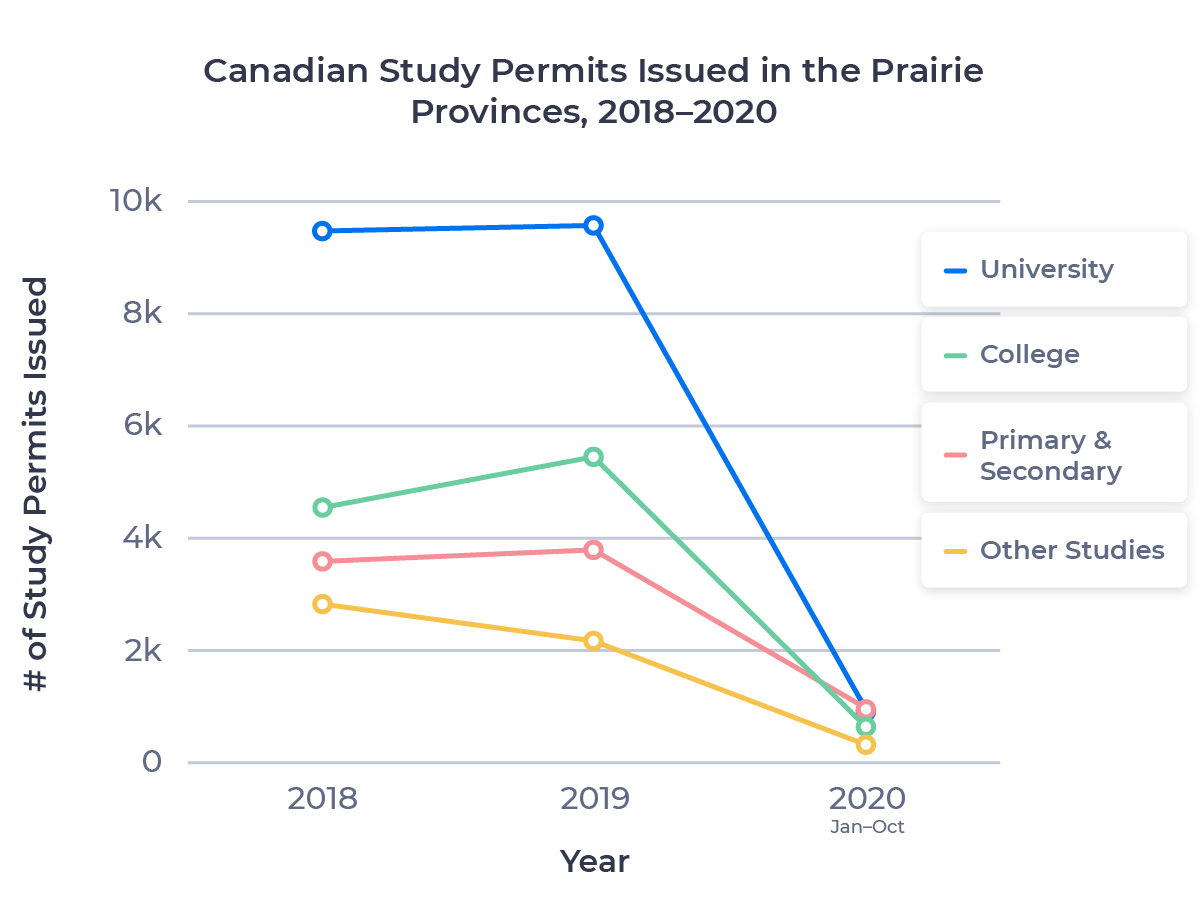

The growth in study permits issued in the Prairies in 2019 largely came from increasing college enrollment. The number of study permits issued to college students in the Prairie provinces grew by 21.8% in 2019, outpacing university (+1.7%) and primary and secondary growth (+6.5%). Conversely, the number of study permits issued to students pursuing Other Studies2 dropped by 22.7% between 2018 and 2019.

The figure below shows the number of study permits issued between 2018 and 2020 to students attending schools in the Prairies, broken down by study level:

Though the full impact of the COVID-19 pandemic on international students in the Prairies is not yet known, we can already see some interesting trends. Study permits for the primary and secondary sector fell by 72.5% in 2020, compared to 85% or greater declines for all other sectors. This smaller decline meant the market share of the primary and secondary sector in the Prairies exploded from 18.1% in 2019 to 34.4% in 2020.

As we saw in my recent deep dive on primary and secondary student trends during the pandemic, the primary market declined less than the secondary and post-secondary market through the first ten months of 2020. This may reflect a greater willingness among older students and working adults to move ahead with their plans to come to Canada with their young children. As a result, more new study permits were issued for primary and secondary students together in the Prairie provinces than all other sectors in 2020.

Let’s take a closer look at how the market share by study level has shifted in each Prairie province.

Alberta

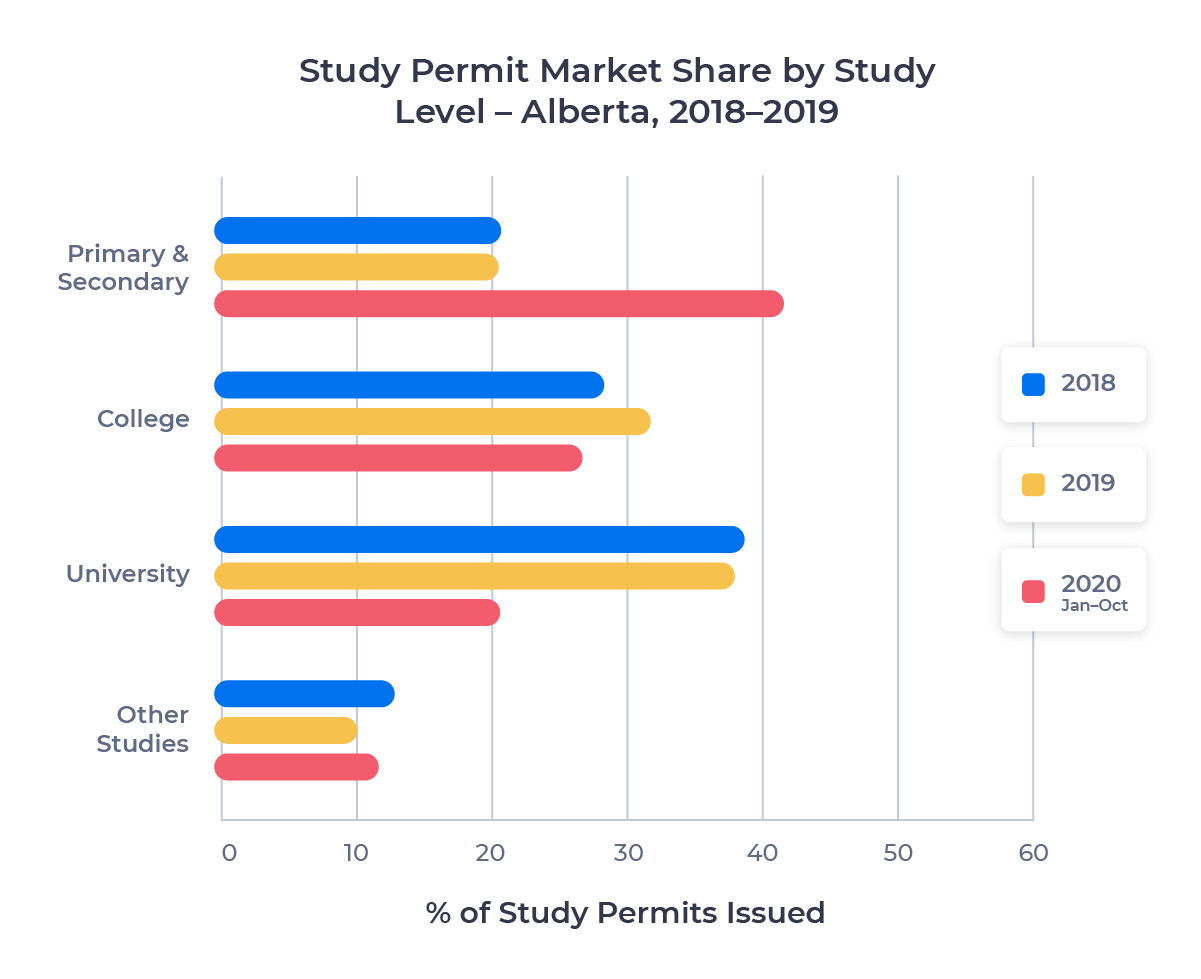

Pre-pandemic, Alberta had the most uniform distribution of study permits issued by study level among the three Prairie provinces. But the pandemic has significantly changed the international enrollment landscape in Alberta.

The market share of new study permits issued to international primary and secondary students in Alberta more than doubled from 2019 to 2020, rising from 20.4% to 41.5%. New study permits issued to college students surpassed university students in Alberta in 2020, as well. While the primary and secondary market share is likely to decline post-pandemic, I’ll be keeping an eye on Alberta’s colleges to see if they can hold their market share.

Saskatchewan

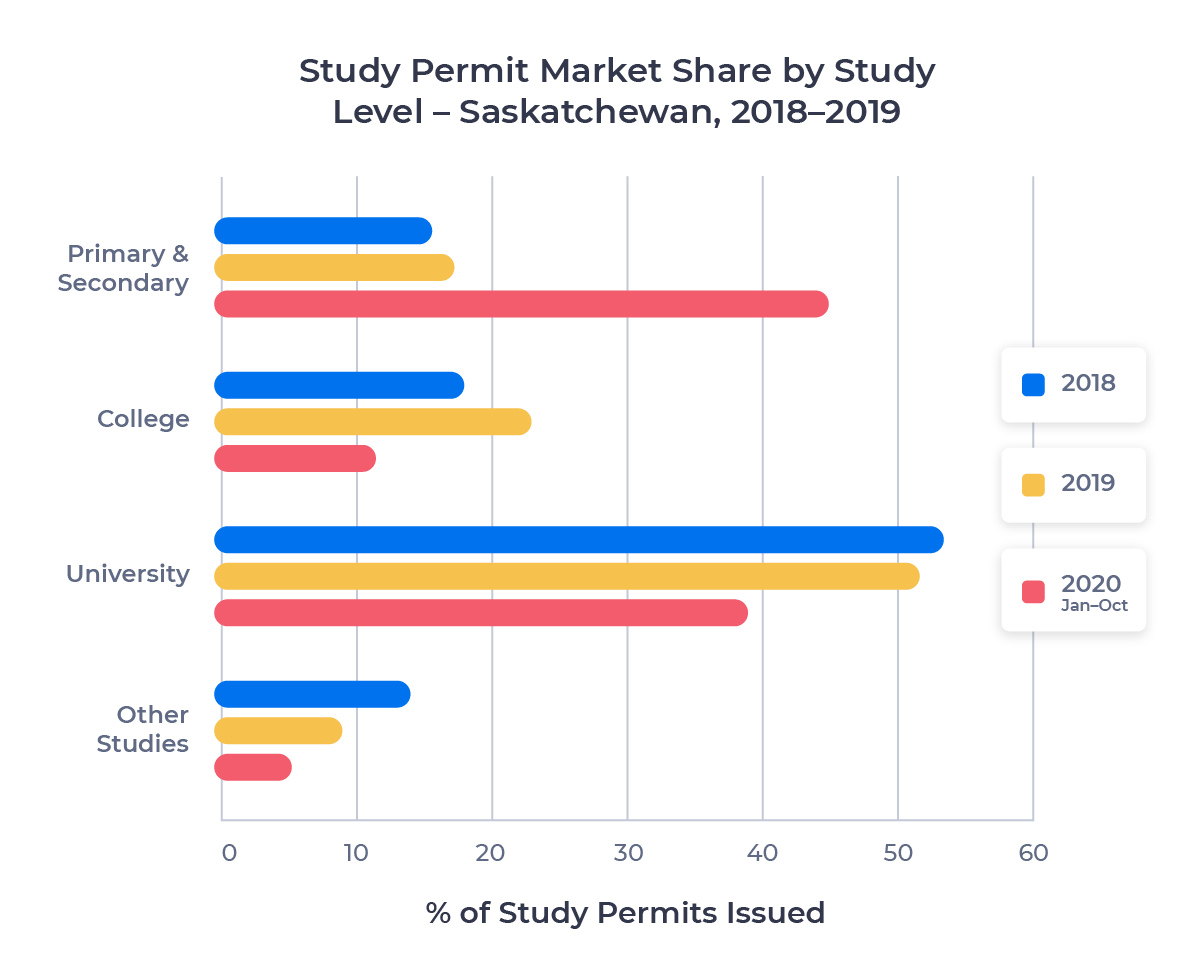

Compared to Alberta, international students have largely been drawn to university studies in Saskatchewan. However, Saskatchewan’s pandemic-related trends are similar to what we saw with Alberta. More study permits were issued to international primary and secondary students than any other study level in Saskatchewan in 2020.

Unlike Alberta, Saskatchewan saw nearly identical declines in new study permits issued to both university and college students in 2020. But in 2019, the market share for Saskatchewan’s colleges grew by 3.3%, compared to a 1.4% decline for Saskatchewan’s universities.

Manitoba

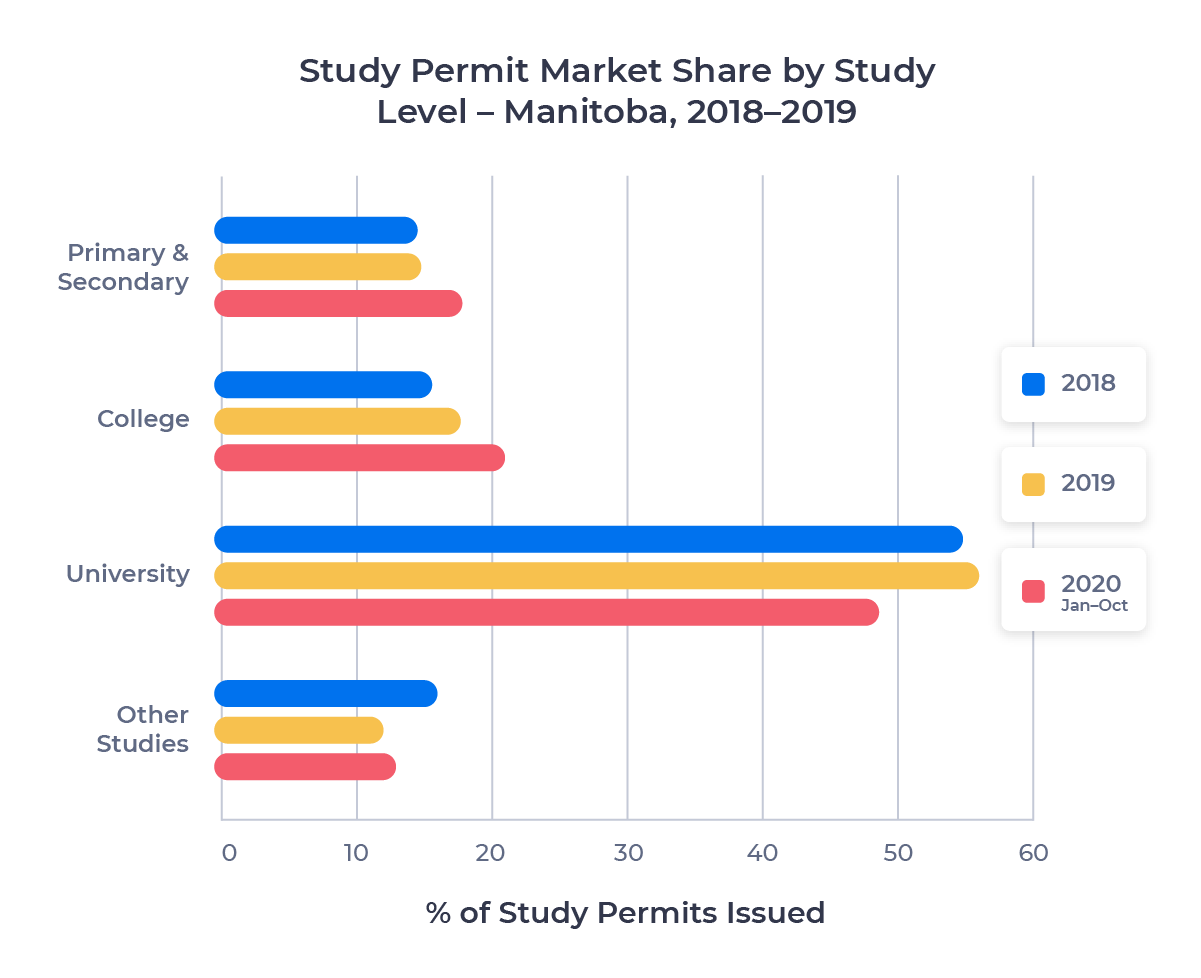

Before COVID-19, the market share for each study level in Manitoba looked very similar to Saskatchewan. Even with a small drop in 2020, university studies far outpaced college studies for international students in Manitoba.

The number of study permits issued to college students, primary and secondary students, and other studies students have remained quite close over the past three years. In 2018, they were all within 1.5% of each other.

Top Source Countries for Prairie Province Students, 2018–2020

What are the largest source markets for international students to Prairie province schools? Let’s take a look at the top six source markets over the 2018 to 2020 period.

India was the top source country for international students to Canada in 2018, 2019, and 2020. In 2019, over 111,000 study permits were issued to Indian nationals. Many of these students went to schools in Ontario, British Columbia, or the increasingly popular destination of Quebec. Even so, Indian students accounted for 38.3% of all new study permits issued for institutions in the Prairie provinces in 2019. This rate dropped to 27.6% in 2020, but it’s very likely to rebound post-pandemic. This would be great news for schools like the University of Regina, which was the number four university for new Indian student enrollment in 2019.

China was the second largest source market for international schools in Canada, and for the Prairie provinces, in 2018 and 2019. But the pandemic saw China fall one spot for Prairie province institutions in 2020, surpassed by the Philippines as the second largest source market. The number of study permits issued to Chinese nationals for Prairie province schools fell by 92.5% in 2020, dropping their overall market share from 11.5% in 2019 to 6.4% in 2020.

The number of Bangladeshi nationals attending Canadian institutions grew dramatically between 2015 and 2019. But a 10% drop in study permit approval rates for Bangladeshi students in 2019 had a big impact on Prairie institutions. In 2018, Bangladeshi students accounted for 5.0% of all new study permits issued for Prairie province schools. In 2019, Bangladeshi market share fell to 4.2%. In 2020, it declined further, to just 2.7%. However, in speaking with our recruitment partners, I’ve heard that Bangladeshi students are highly interested in Canadian university studies. This could be a strong recruitment market for Prairie schools in the years to come.

The Filipino market share in the Prairies has nearly doubled in the last three years, rising from 3.7% in 2018 to 6.8% in 2020. This is largely thanks to strong study permit numbers for Filipino students in Alberta, which grew 42.4% between 2018 and 2019. It’s no surprise then that two Alberta colleges were in the top 10 schools for Filipino students in 2019. The Prairies are also increasingly popular destinations for Filipino nationals in general. Winnipeg and Calgary both saw their Filipino immigrant populations increase by over 20% between 2011 and 2016.3

Study permit application numbers from Nigerian nationals for Canadian institutions rose 52.0% from 2018 to 2019. Low approval rates for Nigerian students have kept the growth in that market lower than expected. But Nigeria is still an exciting and growing market for Prairie institutions. The market share of new study permits issued to Nigerian students for Prairie schools grew from 3.8% in 2018 to 5.5% in 2020.

Study permit application rates for Vietnamese students have fallen in recent years. But the share of new study permits for Prairie province institutions issued to Vietnamese students rose from 3.7% in 2018 to 5.0% in 2020. This rise was mainly driven by relatively stable new Vietnamese student numbers in Saskatchewan during the pandemic. In 2020, the total number of issued study permits for Vietnamese students only dropped 38.8%, compared to an 84.4% drop in Manitoba and an 81.9% drop in Alberta.

Other Notable Source Markets

Beyond these top six source markets, there are a few other markets to keep an eye on post-pandemic. One such market is Iran, which saw a 27% increase in new study permits issued for Prairie schools between 2018 and 2019. South Korean students were also issued more study permits for Prairie institutions in 2019, up 4.5% over 2018. Primary and secondary students from South Africa and Hong Kong (SAR China) were issued nearly the same number of study permits in 2020 as 2018.

The Future of International Education in the Prairies

After a larger-than-average decline throughout the region in 2020, strong post-pandemic recovery plans will be needed to attract new students once it’s safe to do so.

Many schools have already begun to tackle these obstacles. Alberta has a specialized web portal for international students to provide information about Alberta schools, programs, and local living. Individual schools in Alberta are enacting international recruitment plans as well. Bow Valley College has enhanced their virtual offerings and implemented socially distant, virtual reality learning within their nursing programs. Red Deer College has pivoted their growth plans, pursuing a polytechnic university designation to give students more diverse educational opportunities.

Saskatchewan institutions are making waves too. Three of the largest institutions5 in the province announced a focused collaboration on internationalization in 2017. A network of 19 post-secondary schools in the province have worked together to increase student support through their Healthy Campus Saskatchewan initiative, launched in January 2021. It’s clear that schools in Saskatchewan have recognized a need to work together to promote the province as a desirable destination for international students with the support in place to help them succeed.

Likewise, schools in Manitoba have shown a clear commitment to growing their international student market. Pre-pandemic, the Government of Manitoba and institutions throughout the province went above and beyond to protect and support international students, culminating in the passing of the International Education Act in 2016. The pandemic hasn’t stopped this work either: Red River College won a 2021 CASE4 award for their new international student webpages.

These measures could all make a big difference in driving international students to Prairie schools once COVID-19 is passed. I’m cautiously optimistic about international student enrollment at schools in the Prairie provinces in 2021 and 2022. I’ll be sure to check back in on this region in a future ApplyInsights post.

Published: February 9, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC).

2. Includes language training programs and other study programs.

3. More recent data not yet available as the 2021 Canadian Census has yet to be completed.

4. Council for Advancement and Support of Education.

5. The University of Regina, the University of Saskatchewan, and Saskatchewan Polytechnic.