The impact of the COVID-19 pandemic has brought health and medical systems worldwide into the spotlight. Even before the pandemic, there were growing concerns about doctor shortages as populations continue to grow and older citizens require greater access to healthcare. In the US alone, it is estimated that there will be a shortage of 150,000 full-time physicians by 2025.

Students around the world have heard these concerns, and many have elected to pursue careers as medical professionals or within the health industry. This has resulted in a growing demand for medical, biomedical, and health science post-secondary programs in Canada, especially at the nation’s top research institutions.

In this edition of ApplyInsights, I’ll be providing an in-depth analysis on the growing popularity of health science programs at U15 institutions.1 I’ll also look at other popular fields of study for international students.

Here’s what this article will include:

- A brief introduction to Canada’s U15 institutions

- An overview of the most popular fields of study for new international students at U15 institutions between 2016 and 20202

- A comparison of new international student growth in medical, biomedical, and health sciences programs at U15 institutions

- My thoughts on how these trends will evolve in 2021 and beyond

For this article, I’ll exclusively be looking at the number of new study permits issued to international students in a given year.

U15 Institutions

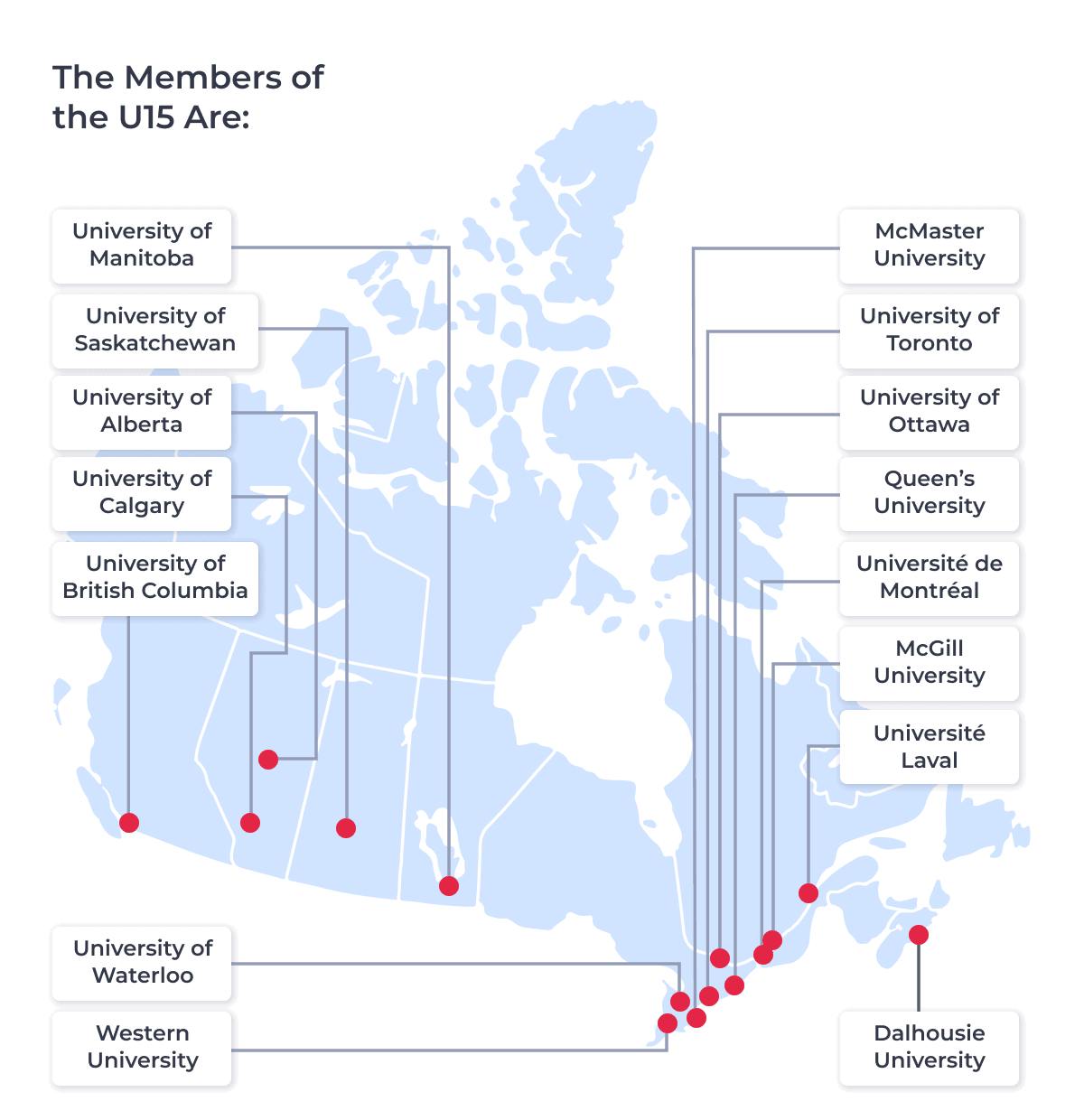

The U15 Group of Canadian Research Universities includes research-intensive institutions throughout Canada. Originally founded as a group of ten schools in 1991, the association grew to its current membership in 2011.

The U15 institutions have a major role in conducting and facilitating fundamental and applied research. Together, these universities undertook 80% of all contracted private-sector research and received 79% of all competitively allocated research funding in Canada in 2019.

The map below shows the name and location of all U15 institutions.

U15 institutions were home to 46% of all university students in Canada, including 70% of all full-time doctoral students, in 2019. However, the U15’s share of study permits issued for new international university students has fallen in recent years. In 2016, 51.8% of all new study permits for university studies were issued to U15 students. By 2020, U15 students received only 36.6% of new university study permits. I’ll be digging into this notable decline further in a future article.

For now, let’s take a closer look at what programs international students are choosing to study at U15 institutions.

Top Fields of Study at U15 Schools

We’ve previously looked at the top fields of study for new international students at all post-secondary institutions in Canada. In comparison to all other fields, we found that business, commerce, and marketing programs have seen incredible growth over the past four years. But much of this growth has been concentrated at Canadian colleges. Which programs have seen significant growth, or decline, among the U15?

The table below shows the number of new study permits issued to U15 students for each field of study as a percentage of the total number issued to all U15 students in that year:

| Field of Study | 2016 | 2017 | 2018 | 2019 | 2020 | % Change 2016–2020 |

|---|---|---|---|---|---|---|

| Medical, Biomedical, and Health Sciences | 4.8% | 6.4% | 6.7% | 7.0% | 11.8% | +7.0% |

| Computing and IT | 6.5% | 7.0% | 7.6% | 8.5% | 8.3% | +1.8% |

| Business, Commerce, and Marketing | 14.0% | 13.4% | 13.7% | 14.5% | 14.5% | +0.5% |

| All Other Studies | 14.3% | 15.7% | 15.2% | 14.2% | 14.4% | +0.1% |

| Applied Science | 18.0% | 16.0% | 16.1% | 16.1% | 17.5% | -0.5% |

| ESL/FSL | 5.1% | 8.2% | 9.0% | 7.6% | 2.7% | -2.4% |

| Arts, Fine Arts, Humanities, and Social Sciences | 24.4% | 22.8% | 21.3% | 21.9% | 21.3% | -3.1% |

| General Science | 12.8% | 10.5% | 10.5% | 10.2% | 9.6% | -3.2% |

Business, commerce, and marketing studies have indeed seen an upward trend at U15 schools, though at a much lower rate.3 Computing and IT studies have also seen relatively stable growth, with a small decline as a result of the pandemic.

In contrast, the market share of ESL and FSL studies decreased substantially in 2020, losing 4.9% year-over-year. Humanities and general science have gradually declined since 2016, losing over 3% market share each after 0.6% declines in 2020.

The most significant change in market share for international students at U15 schools was for health studies. The market share for medical, biomedical, and health studies climbed from 4.8% in 2016 to 11.8% in 2020, with a huge 4.8% increase in 2020 alone.

It’s important to note that the total number of new study permits did decline at U15 schools in 2020. The total number of new study permits issued to U15 students in 2020 fell by 83.0% compared to 2019. But new study permits issued for health studies outperformed the all-fields average in 2020, declining only 71.1% from 2019.

As the market share of this field grows, the competition among U15 schools for international students looking to study health will grow too. So let’s dive deeper into health studies for international students at U15 schools in 2019 and 2020.

Health Studies at U15 Schools

In 2016, 1,264 new study permits were issued to international students for medical, biomedical, and health science studies at U15 institutions. By 2019, this number had risen nearly 50%, to 2,425. Though only 699 new health studies study permits were issued to U15 students in 2020, they accounted for 53.8% of all new international health studies students at Canadian universities.

The total number of issued study permits for health studies declined by at least 60% at all U15 schools between 2019 and 2020. But, by comparing the U15 institutions to one another, we can see which schools have maintained relatively strong new health student numbers during the pandemic.

The table below details the number of new study permits issued for students pursuing medical, biomedical, and health studies at U15 schools in 2019 and 2020:

| University | 2019 | 2020 | % Change, 2019–2020 | Versus U15 Average4 |

|---|---|---|---|---|

| Université de Montréal | 376 | 143 | -62.0% | +9.0% |

| McGill University | 303 | 92 | -69.6% | +1.4% |

| University of British Columbia | 296 | 87 | -70.6% | +0.4% |

| University of Toronto | 342 | 76 | -77.8% | -6.8% |

| Université Laval | 185 | 60 | -67.6% | +3.4% |

| University of Ottawa | 148 | 47 | -68.2% | +2.8% |

| University of Manitoba | 102 | 38 | -62.8% | +8.3% |

| University of Alberta | 170 | 35 | -79.4% | -8.4% |

| University of Saskatchewan | 91 | 31 | -65.9% | +5.1% |

| University of Calgary | 123 | 29 | -76.4% | -5.4% |

| Dalhousie University | 63 | 15 | -76.2% | -5.2% |

| Western University | 83 | 15 | -81.9% | -10.9% |

| McMaster University | 68 | 14 | -79.4% | -8.4% |

| University of Waterloo | 46 | 11 | -76.1% | -5.1% |

| Queen’s University | 29 | 6 | -79.3% | -8.3% |

L’Université de Montréal claimed the top rank as the most popular U15 school for health studies among international students in 2019. L’Université de Montréal has shown strong resiliency during the pandemic. It retained 9% more new study permits for health studies, year-over-year, than the average U15 school.

The University of Manitoba and the University of Saskatchewan also demonstrated greater health studies resiliency than their counterparts. As two of the smaller institutions among the U15, this strength could be a result of lower tuition fees and focused actions to support international students in Manitoba and Saskatchewan.

The University of Ottawa was the only Ontario-based U15 institution to see higher than average retention for health studies from 2019 to 2020.

Five of the six U15 schools in Ontario experienced higher than average health study declines from 2019 to 2020. Additionally, both U15 institutions in Alberta saw declines of greater than 5% compared to the average. These decreases may reflect increased deferrals, but they are also reflective of significant declines in Indian and Chinese student populations in 2020 and low new student populations from other markets. Of the 924 health students who were issued new study permits for these eight U15 schools in 2019, 29.1% were Chinese or Indian. In 2020, of the 201 new health students, just 12.4% came from India or China.

U15 Health Studies in 2021 and Beyond

Worldwide news about aging populations, the global pandemic, and persistent medical professional shortages has had a clear impact on students looking to study in Canada. The demand for medical, biomedical, and health sciences programs is higher than ever before, and is likely to continue growing in the coming years.

U15 institutions have established themselves as education and research leaders in the health studies field. From 2016 to 2020, more than 8,500 new study permits were issued to international students to study health programs at U15 schools. There is a risk, however, of over-reliance on India and China as primary student markets. Climbing tuition fees will also be a roadblock for students from source markets that experienced dire economic impacts from the pandemic.

As competition grows among the U15 for these students, program differentiation and international student support will become even more important. It will also be crucial to target students from a variety of source markets. For example, the top source market in 2020 for new health students at the University of Manitoba and the University of Saskatchewan was Nigeria.

I’m confident that the international student market for health studies is on the verge of significant growth. All institutions, not just the U15, need to come up with new strategies to attract these students in 2021 and beyond, especially as US schools recover post-Trump presidency.

Later this month, I’ll be looking at how the U15 schools fared compared to the rest of Canada’s universities over the past five years. Have U15 institutions maintained their roles as major destinations for international students? Check back in to find out!

Published: March 30, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. Including all federated and affiliated colleges.

2. Data from Immigration, Refugees and Citizenship Canada (IRCC).

3. Compared to the average at all Canadian post-secondary institutions.

4. This column compares the percentage change in new study permits issued for the given U15 institution between 2019 and 2020 to the average decline for such permits across all U15 schools (-71.1%).