When international students think about their academic and professional future, what do they see? Which programs are most attractive to international students? Which destination markets are losing ground, and which are emerging as sector leaders?

To get these answers, we connected with hundreds of future international students living in almost 90 countries this February in the latest edition of our Student Pulse Survey.1 Particularly when viewed in combination with earlier surveys, results give us insight into international student mindsets. Read on for a look at career trends, which destination markets are at the top of these students’ lists, and more.

Key Insights at a Glance

- Only 2.5% of respondents said they do not intend to work during their time as an international student.

- Over 40% of students surveyed are considering destinations beyond the major Anglophone destination markets. Germany, Finland, the Netherlands, and Italy were mentioned most often. New Zealand rounded out the top five markets.

- Ireland’s 2023 campaigns to attract international students are successfully building awareness. 26% of survey respondents were “extremely interested” in studying in Ireland, nearly double the proportion from our Fall 2023 survey.

European Markets Attract Growing Student Audience

In 2023, the “big four” Anglophone destination markets—Australia, Canada, the United Kingdom, and the United States—hosted 44% of all international students.2

While interest in these markets remains strong, our Spring 2024 Student Pulse Survey data revealed that 43% of students were also considering other destinations. In an open-ended question, respondents shared almost 60 additional markets:

Germany topped the list: 85 respondents indicated interest in studying there (25% of students who answered this optional question). It was nearly double that of the next option, Finland, with 46 nods (13%). The Netherlands is on the radar of 32 future students (9%), 28 mentioned Italy (8%), and New Zealand rounded out the top five with 27 (8%). In our survey, 16 markets received more than 10 mentions.

This level of interest shows students are keeping their options open, and looking beyond the largest cities or most well-known institutions. As they do, they’re often leaning towards Europe and the European Union (EU). In fact, seven students specifically noted they’re open to studying anywhere in the EU.

International Student Interest in Ireland Continues to Rise

Our Spring 2024 survey shows shifting student preferences around major Anglophone destination markets, but the changes, when compared to past surveys, are largely more gradual than tectonic.3

Ireland continues to catch the eye of more students, a trend continuing from our Fall 2023 survey. Over the past year, the near-majority of student interest shifted from negative to positive: in Spring 2024, 48% of respondents were “extremely” or “very” interested in Ireland. Comparatively, the same percentage was “slightly” or “not at all” interested in Ireland in Spring 2023.

Canada started the year with sweeping policy changes to its international education sector, but student interest has not shifted notably from its Fall 2023 results. Additionally, of the five countries in our poll, it remains the only one that over 80% of respondents have a strong level of interest in (“extremely” and “very” interested answers). However, when compared to the spring 2023 survey, where 81% of respondents were “extremely” interested in Canada—and a further 10% were “very” interested—overall opinion is becoming less enthusiastic.

Canada Retains Positive Student Interest into 2024

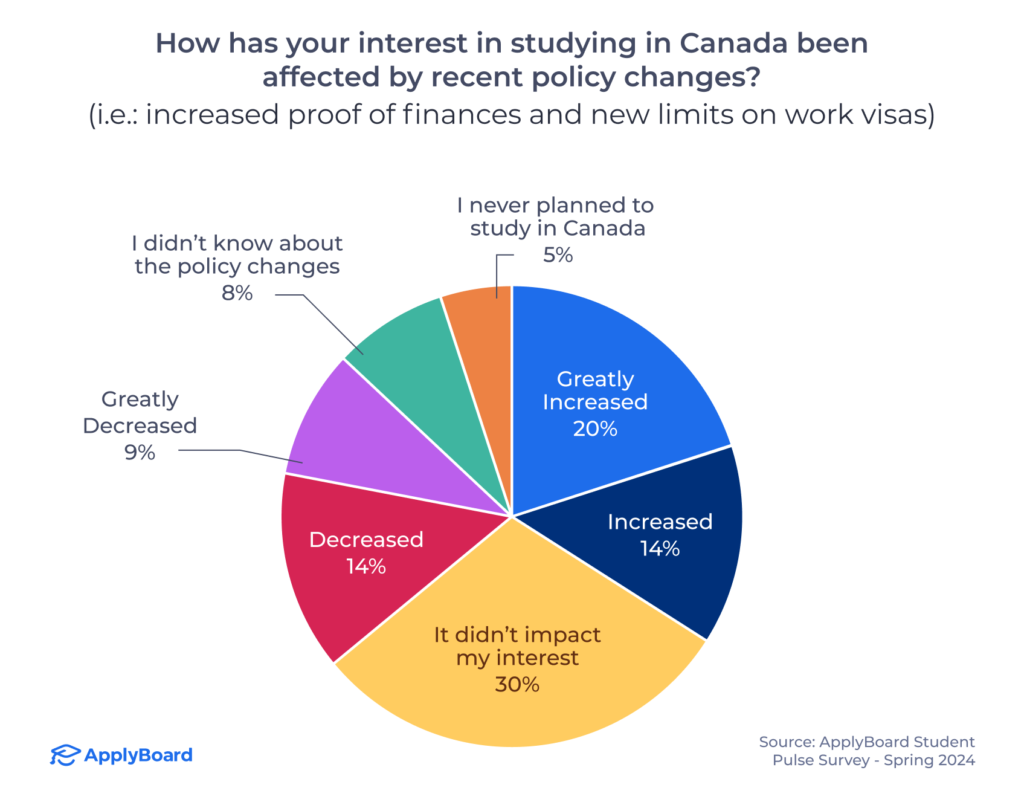

We also asked students how specific changes to Canada’s International Student Program have affected their interest in studying in Canada.

Most respondents’ interest either remained steady (30%) or increased (34%).4 However, 23% of prospective students reported lower interest levels, which, especially when considered alongside the temporary study permit caps, will impact institutions’ admission numbers in Fall 2024.

That said, Canada’s ongoing strength as a destination market came through later in the survey. Some open-ended responses to students’ perceptions of Canada nodded to its northern climate (“cold” appeared 29 times). Students also acknowledged the impact of increased tuition and living costs (“cost” appeared 23 times, and “rent” appeared 11 times).

Of the 704 responses, 16% of students surveyed included either “opportunity” or “opportunities” in their answers. These words appeared 115 times. The only complex word5 which appeared more often was “education,” with 75 respondents specifically mentioning Canada’s “quality of education.” This signals students’ continued belief in Canadian programs’ abilities to further their academic and career goals.

“Friendly people, great and available health care, quality education, and wonderful work opportunities.”

– Student response to “When you think of studying in Canada, what comes to mind?”

Most International Students Aim for Postgraduate Study

In our Spring 2024 Student Pulse Survey, we found that four out of five respondents are interested in postgraduate studies. In fact, just over half of all respondents plan to pursue a master’s degree. A further 21% intend to apply for postgraduate certificate or diploma programs, and 12% aim to complete a PhD or doctoral degree.

This is a topic our team will follow with interest in future surveys. The high percentage of prospective master’s degree students aligns with sector-wide changes, and opportunities open specifically to postgraduate students. For example, in Canada, master’s degrees and doctoral degrees are exempt from the new provincial attestation letter process. Meanwhile, in Australia, master’s grads have longer temporary graduate visa eligibility (three to five years, versus two to four years for a bachelor’s degree).

International Student Interest in STEM Remains Strong

Students’ responses about their future careers were inspiring. Many are planning to start, or build on, careers in STEM, particularly in engineering and technology. Students also showed strong interest in high-demand fields like data, software, and analytics:

While business, management, and engineering terms were mentioned most often, many respondents also talked about health care, both in a practical sense and as an academic. A common theme was returning to care for communities in their home country—often with very modern approaches, as this response shows:

After completing my studies in Data Science, I plan to pursue a career in health data analysis. My purpose will be to create a consulting venture specialized in health, with the aim of collaborating with various organizations focused on serving vulnerable or rural communities in Colombia.

– Student response to “What career(s) do you plan to pursue after completing your studies”?

Employability and Institution Quality Remain Key Factors

Quality of institution, employability, and building a professional network were the three top factors shaping students’ general drive to study abroad, per this spring’s survey. Interestingly, 45% of students said that improving their English language skills was an extremely influential part of their decision, up from 34% last fall.

This increased interest might indicate students are looking for more support to be successful in English-speaking classrooms. So, institutions may wish to build awareness of programs like foundation years and pathway programs, where available, through their marketing and external recruitment teams. These programs help international students develop their academic skills and confidence before starting a full-time degree, but might not be a well-known option.

Students’ employability both during and after their studies is top of mind. Only 2.5% of respondents said they do not intend to work during their international study program. Some students plan to find a part-time job, others will pursue a co-op or internship, while another group aims to do both.

Employability is central to choosing a study destination market, as the chart below shows. Respondents could choose up to five selections from a range of options:

Affordability of studying and affordability of living narrowly missed the top five this year, with votes from 38% and 37% of participants, respectively. This may allude to more students’ optimism that with good earning potential, they can still apply to programs aligned with their career goals, versus a higher focus on affordability. Interestingly, when compared to the Fall 2023 survey, destination reputation slipped from the second-most important factor to the eighth, hinting at a shift towards more practical drivers—or perhaps a cohort more immune to being swayed by external reputation.

Key Takeaways

As the international education sector evolves, students’ priorities are shifting. Our survey results show their interest, often simultaneous, in choosing destinations and programs with diverse employment options and using their studies to address industry shortages and challenges, from tech to healthcare. As such, these are some recommendations for institutions and destination markets looking to maintain and build their international student population:

- Interest in established Anglophone markets remains strong, but students’ awareness of other study destinations, particularly European ones, is growing. This may mean optimizing current outreach in the face of increased competition for top students.

- While Canada’s international student policy shifted significantly, many students still value its high quality of education. To retain these students, highlight specific opportunities, whether through relationships with local industry, co-op programs, graduate employment rates, or unique research avenues. Use accessible language to explain admissions processes, and be transparent about challenges beyond the classroom, like rising costs of living.

- Rules around working while studying are changing in many markets, which can be confusing for international students. Institutions who can keep up with policy updates, and clearly share what international students can do for work—and what they can’t—will help incoming students succeed, and feel more welcome.

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

About the ApplyInsights Team

FOOTNOTES:

1. Sent via email to prospective international students, and received 728 responses. Survey ran from February 9, 2024, to March 1, 2024.

2. Institute for International Education. “Project Atlas: A quick look at global mobility trends.” 2023 release.

3. The 2023 Student Pulse Surveys were sent via email to prospective international students. The spring 2023 survey ran from May 2, 2023 to May 19, 2023, and the fall survey ran from Oct. 20, 2023 to Nov. 1, 2023.

4. The survey did not investigate respondents’ reasoning. However, it is possible that knowing a more accurate proof of finances amount has bolstered students’ preparedness for, and confidence in, study abroad in Canada.

5. Here, a “complex word” is in reference to a specific idea or entity, not something like “and,” “the,” or “to.”