Today’s ApplyInsights takes us back Down Under to examine Australian student visa approval rates and how they changed between 2016/17 and 2020/21.1 Getting approved for a student visa is a critical step in the study abroad process, so looking at student visa trends can indicate the direction of the international student market.

This article is our second look at the Australian market. Our previous post covered the top 20 source markets for Australian tertiary institutions in 2019/20. In our upcoming articles about Australia, we’ll look at broader international students trends over the past five years to help frame more specific analysis down the road.

Here’s what this blog post will cover:

- Changes in key Australian student visa statistics between 2016/17 and 2020/21

- Analysis of student visa statistics for the top five source countries for Australian international students from 2018/19 to 2020/21

- Analysis of student visa statistics by study level for Australian international students from 2018/19 to 2020/21

To receive an Australian student visa, students must meet eligibility criteria which include already being enrolled in a course of study at an Australia institution. Student visa applicants (primary applicants) can include their partners or dependent children on their visa application (secondary applicants), but I’ll only be looking at primary applicant visas in the sections below.

For more information about the Australian education system and the Australia student visa system, check out the Australia 101 posts on the ApplyBoard Blog.

It’s worth noting that data for 2020/21 is partial year data,2 and that both the 2019/20 and 2020/21 years were impacted by the COVID-19 pandemic, which decreased international student enrollment worldwide.

Australian Student Visa Approval Rates

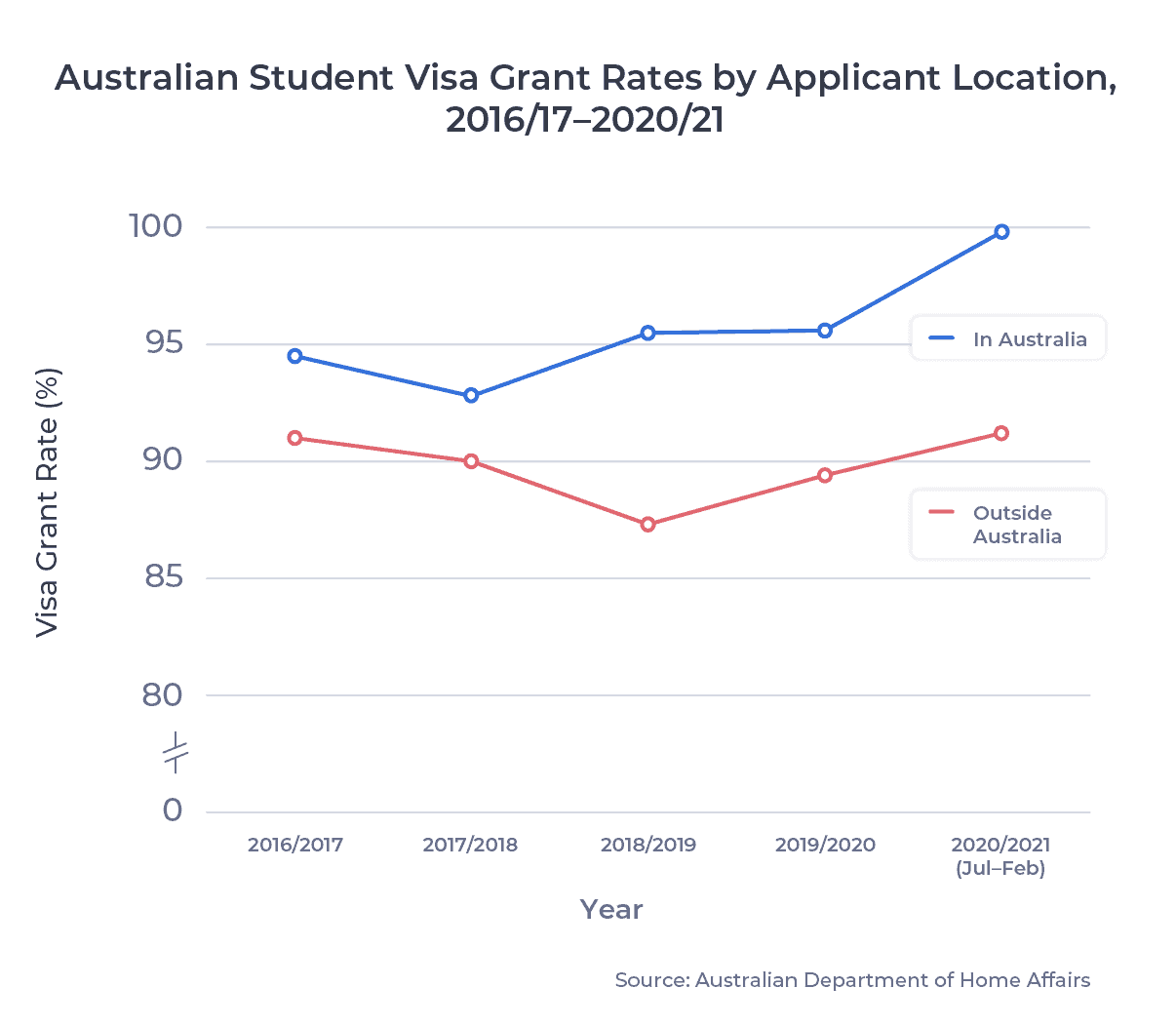

The Australian government tracks student visa statistics separately for in-country3 and out-of-country student visa applicants. In-country students have often seen higher grant rates,4 due to prior approval to enter the country. But out-of-country applicant volumes have historically been much higher. This means that overall visa grant rates have been more directly tied to out-of-country grant rates.

But one question to consider is whether the pandemic shifted these trends, as inter-country travel has become more restrictive? The chart below shows Australian student visa grant rates based on applicant location over the past five years:

Overall Australian student visa grant rates stayed relatively stable from 2016/17 to 2019/20. Despite the early impacts of the pandemic in 2019/20, overall Australian student visa grant rates increased to 96.8% in 2020/21. This 4.7% rise in overall grant rates was tied primarily to decreased out-of-country visa applications compared to more stable in-country application rates.

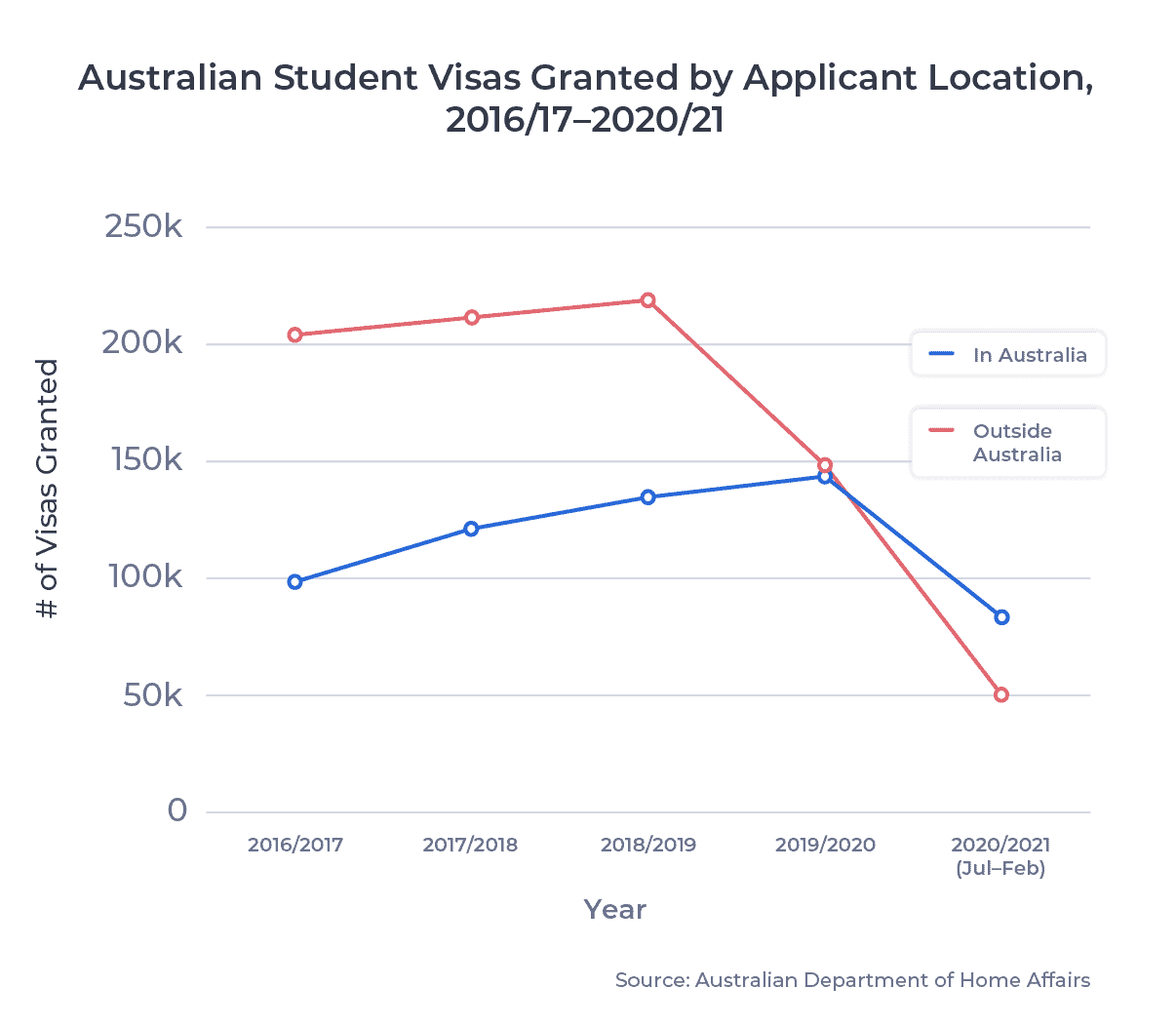

The chart below shows the number of student visas granted per year broken down by applicant location from 2016/17 to 2020/21:

As a result of the pandemic, 2020/21 is on track to see visas granted to in-country applicants outnumber those granted to out-of-country applicants. Even in 2019/20, when the pandemic began, the number of visas granted to out-of-country applicants fell by 32.3%. By comparison, the number of visas granted to in-country applicants rose by 6.4%.

Let’s take a closer look how these shifts impacted the top five source markets for international students at Australian institutions.

Visa Grant Rates for Top Source Markets

In-country applicant rates have risen over the past five years. In 2016/17, in-country applicants submitted 32.5% of all student visa applications. Through the first eight months of 2020/21, in-country applicants submitted 65.1% of all applications. Given higher in-country grant rates, we would expect student populations from most markets to see higher visa approval rates as in-country application rates rise. But have rising in-country applicant rates positively influenced grant rates for the top five source markets for Australian international students?

The table below shows Australian student visa grant rates for the top five source markets from 2018/19 to 2020/21, as well as their in-country applicant rate:

| In-Country Applicant Rate | Grant Rate | |||||

|---|---|---|---|---|---|---|

| 2018/19 | 2019/20 | 2020/21 (Jul–Feb) | 2018/19 | 2019/20 | 2020/21 (Jul–Feb) | |

| China | 36.8% | 41.9% | 34.8% | 94.2% | 98.1% | 98.6% |

| India | 33.0% | 52.7% | 63.3% | 74.5% | 76.8% | 80.7% |

| Nepal | 35.8% | 63.3% | 84.8% | 70.4% | 76.2% | 80.9% |

| Brazil | 51.6% | 59.3% | 96.0% | 93.2% | 98.1% | 97.9% |

| Colombia | 44.0% | 52.7% | 95.1% | 92.4% | 94.1% | 84.6% |

Visa grant rates for the top four markets increased between 2018/19 and the first eight months of 2020/21. Chinese applicants saw a 4.4% increase in student visa approval rates, and applicant location rates for Chinese nationals remained comparatively stable. Indian and Nepalese students were also more likely to have their visas granted, at a rate of +6.2% and +10.5%, respectively. But both these source markets also saw a major shift towards in-country applications, which could at least partially account for these gains.

Only one of the top source markets, Colombia, saw lower visa grant rates in partial 2020/21 compared to 2019/20. This is in spite of significantly higher in-country applicant rates. By comparison, Brazilian students saw an increase from 2018/19 to 2019/20, before a minor decline of 0.2% to partial 2020/21. For Colombian nationals, the decrease was more substantial, with their visa grant rates rising 1.7% from 2018/19 to 2019/20 before falling 9.5% through partial 2020/21.

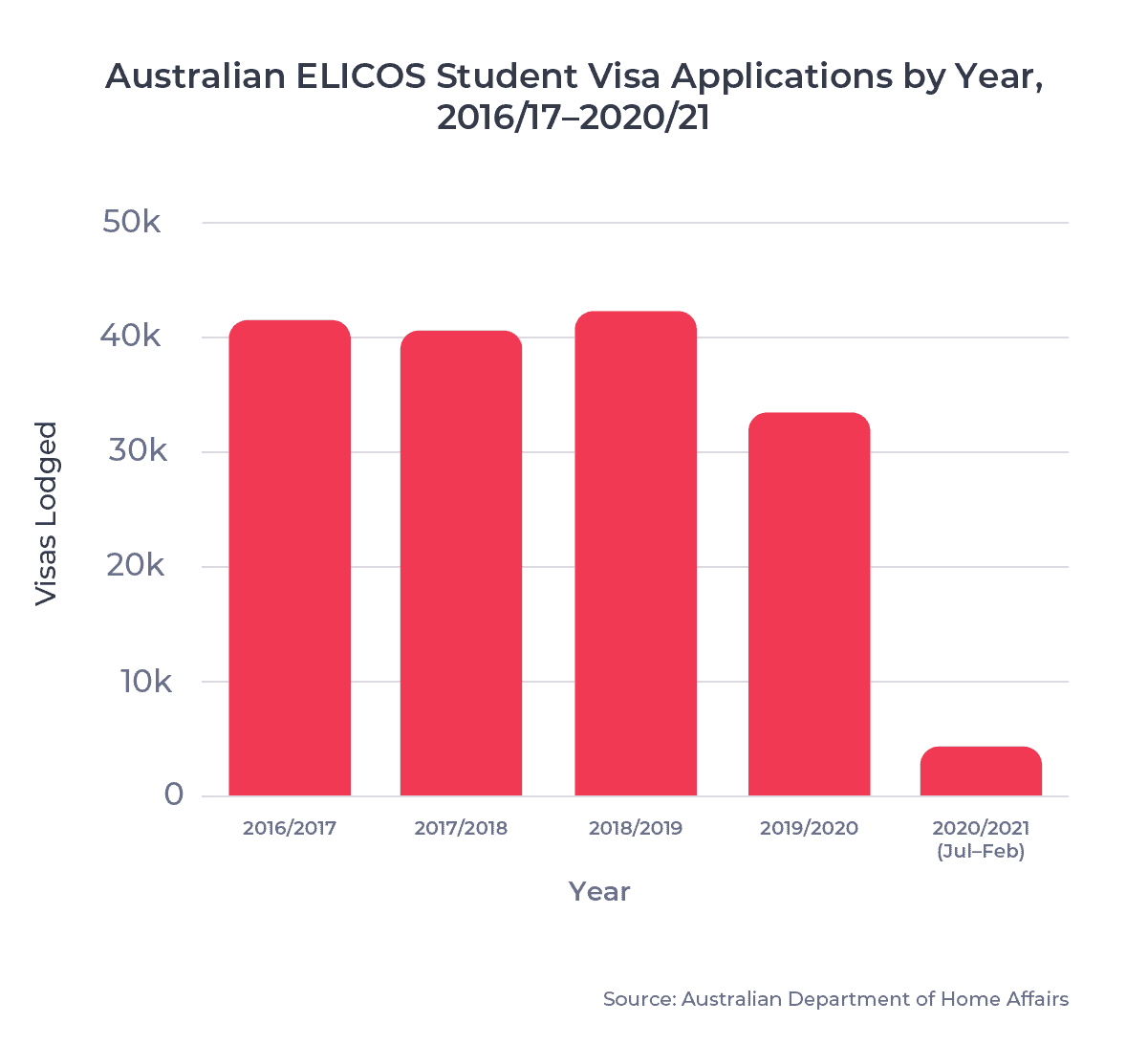

What caused the significant decline in grant rates for Colombian students? It was caused, in part, by the collapse of the Australian independent ELICOS sector5 amid the ongoing Australian travel ban. Though 2020/21 is not yet complete, the number of Colombian visa applicants for ELICOS studies declined 87.0% from full-year 2019/20 through the first eight months of 2020/21.

This issue extended beyond just Colombian students. The ELICOS sector attracted over 175,000 international students to Australia over the past five years. But the pandemic caused a substantial decrease in visa applications for ELICOS studies, as the chart below shows:

From 2018/19 to 2019/20, ELICOS visa applications dropped 21.6%. ELICOS visa applications dropped a further 86.6% from 2019/20 through the first eight months of 2020/21. This was the largest study level decrease across all award-conferring sectors.

Visa Grant Rates by Study Level

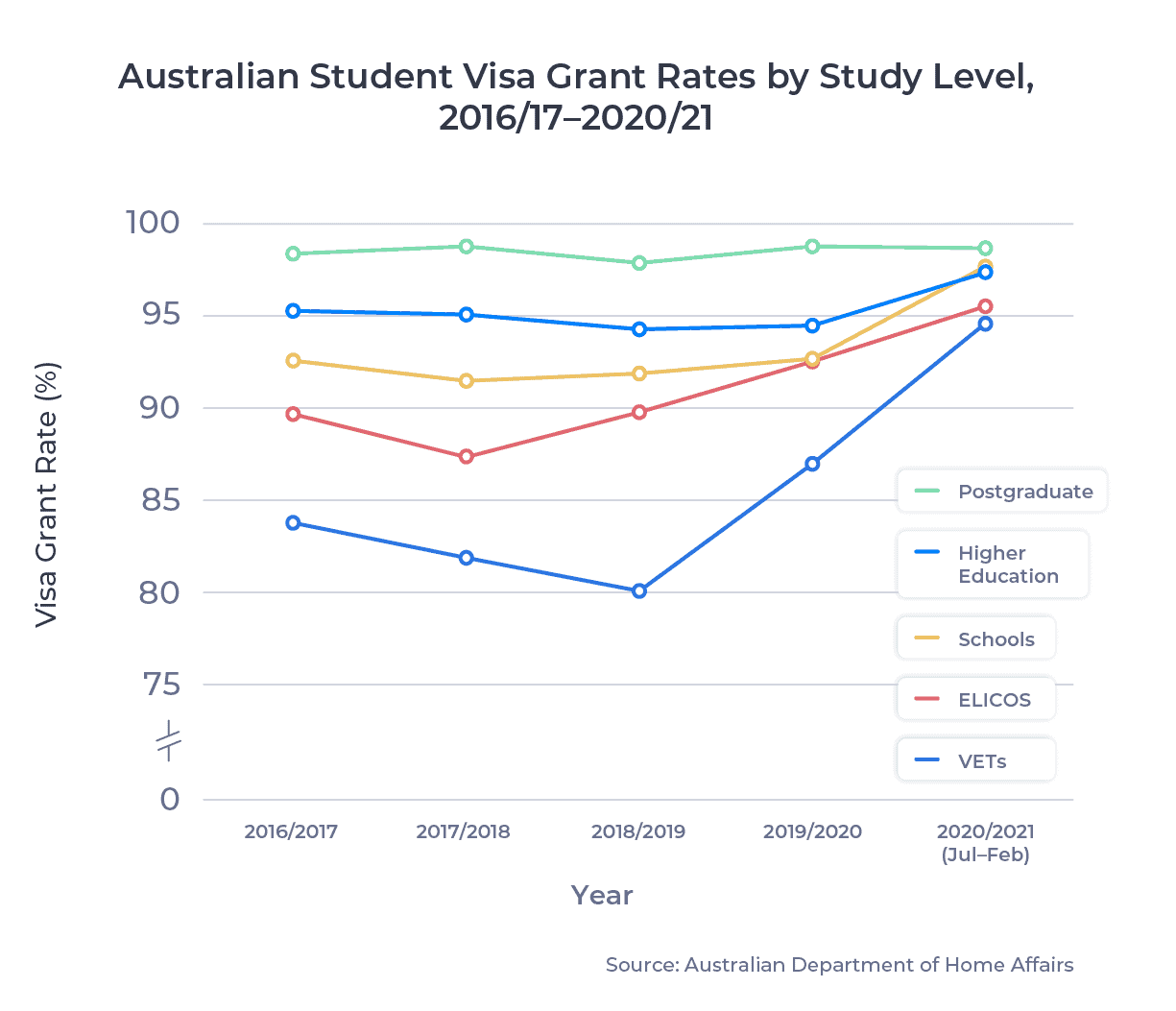

To determine whether the collapse of the ELICOS sector impacted visa grant rates for Colombian students, we need to look at visa grant rates by study level. The chart below shows the visa grant rate for award-conferring study levels between 2016/17 and 2020/21 compared to the average visa grant rate for all award-conferring study levels in those years:

The pandemic has led to increased parity for visa approval rates between all study levels, due to decreased out-of-country application numbers and higher in-country visa approval rates. Relatively high and stable visa grant rates for higher education and postgraduate applicants have benefitted post-secondary focused markets like China and India. But international students pursuing VET studies have consistently experienced the highest visa rejection rates.

ELICOS Sector

Many source markets with high ELICOS applicant populations pre-pandemic also had higher VET applicant populations, compared to schools or higher education applicants. For Brazil, and especially for Colombia, a significant decrease in ELICOS visas led to VET applicants comprising a larger share of the overall applicant pool. In 2019/20, ELICOS applicants accounted for 48.0% of all Colombian student applicants. In the first eight months of 2020/21, they accounted for just 17.6%. By contrast, VET applicants accounted for 45.1% of all Colombian applicants in 2019/20, and 71.9% of all applicants through eight months of 2020/21.

The difference between Colombia’s steep visa grant rate decline and Brazil’s minor decrease comes down to in-country vs. out-of-country applicant populations. 71.1% of Brazilian ELICOS applicants from July 2020 to February 2021 were in-country. For Colombian students, the in-country rate was 44.5%.

Looking Forward

Australian student visa approval rates have remained high throughout the pandemic, especially for in-country students. Out-of-country students have also seen increased approval rates, exceeding 90% for the first time since 2016/17. However, border closures and travel restrictions have caused a significant decline in out-of-country student visa applications so far in 2020/21.

But the rest of 2020/21 could see student visa application numbers recover somewhat, as the Australian government continues to make positive announcements for international students. The temporary halt on out-of-country student visa processing was rescinded in July 2020, allowing out-of-country students to secure their visa before the borders reopen. As well, current temporary graduate student visa holders can use online studies to count towards their Australian study requirement for a post-study work visa.

Additional time is also being granted to applicants to provide English language testing results, biometrics, and health checks. Students who need to extend their visas to finish their studies due to COVID-19 can file another student visa application for free. And the government of Australia has also introduced new flexible requirements for their Temporary Graduate Visa, Global Talent Visa program, and their work in Agriculture program.

Australia remains an exciting and popular study abroad destination. As travel restrictions decrease in the post-pandemic period, I expect a strong recovery for the Australian international student market. I’ll be back looking at Australia later this month. Stay tuned!

Published: April 7, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of the Australian Department of Home Affairs. All data reported according to Australian governmental financial years, which span from July of one year to June of the next year. (For example, July 2019 to June 2020 was the 2019/20 year.) The data used for this article includes subclass 500 and subclass 570 to 576 visas granted to primary applicants only.

2. Partial year data for 2020/21 spans July 1, 2020 to January 31, 2021. Where noted, partial year 2020/21 data will be compared against parallel seven-month spans in previous years.

3. “In-country” signifies that the student was already in Australia, on a previous visa or due to other circumstances, when the visa application was filed.

4. Australian student visa grant rates are defined as the number of granted visas divided by the number of visa decisions made in a given period, with the number of decisions equal to the number of granted visas plus the number of refused visas.

5. ELICOS stands for English Language Intensive Courses for Overseas Students.