The global pandemic and travel restrictions for international students have severely impacted Australia’s tertiary education sector.1 Student visa applications were already falling pre-pandemic for higher education2 as they fell 17.8% from 2018/19 to 2019/20.3 They then dropped another 48.8% through the first eight months of 2020/21, compared to full year 2019/20. These low application numbers, coupled with declining student satisfaction ratings, mean that Australia’s higher education sector may take longer to recover post-pandemic than other study abroad destinations.

But Australia’s vocational education and training (VET) sector4 has remained more stable throughout 2020 and 2021. Pre-pandemic, VETs gained international tertiary student market share every year since 2014/15. What long-term impacts could this shifting focus have on Australia’s tertiary education industry? In this ApplyInsights, I’m going to compare the growth and stability of the Australian VET and higher education sectors over the past five years. I’ll also provide my thoughts on current roadblocks and potential next steps for both sectors post-pandemic.

Key Insights at a Glance

- The number of Australian international student visas granted for VET studies increased by 23.6% from 2016/17 to 2019/20.

- Nine source markets saw more than 1,000 students receive Australian higher education visas in the first eight months of 2020/21 compared to fourteen source markets for Australian VET visas.

- Student source market diversification will be critical for the long-term success of Australia’s tertiary education sector.

Let’s start by looking at international student trends for all Australian tertiary education institutions over the past five years.

Student Visa Trends for Australian Tertiary Education Sector

Prolonged border closures and travel restrictions have delayed travel plans for many students looking to study abroad in Australia. As a result, the number of tertiary education student visa applications declined 15.0% from 2018/19 to 2019/20, when the pandemic began. Through the first eight months of 2020/21, this number fell even further, dropping 48.8% compared to full-year 2019/20.

This application decline caused a parallel decrease in the number of tertiary education student visas granted over this period. In 2019/20, 15.3% fewer tertiary education visas were granted to international students compared to 2018/19. Through the first eight months of 2020/21, tertiary student visa grant volumes fell an additional 48.9%.

Despite these visa application and grant decreases, average student visa approval rates increased significantly over the same period. Tertiary student visa grant rates rose from 91.7% in 2019/20 to 96.3% in the first eight months of 2020/21.

Student Visa Trends for Australian Higher Education Institutions

University studies have historically been the main draw to Australia for international students. Higher education students have received over 50% of all student visas granted in a given year5 since 2012/13. University visa approval rates have also remained high over this period, at about 92.0%.

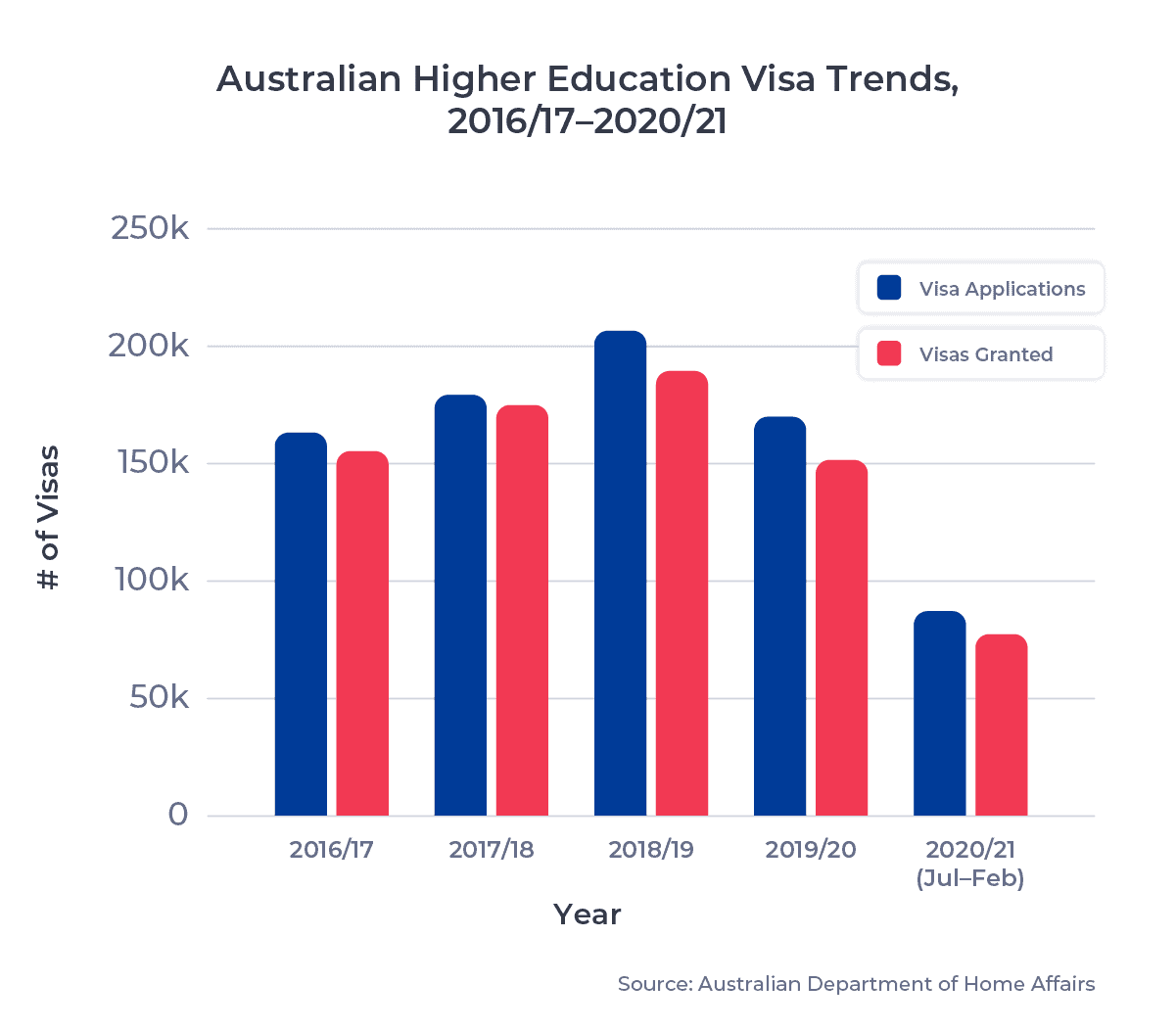

Before the pandemic, the number of international students at Australian universities had increased steadily. From 2014/15 to 2018/19, the number of student visas granted to higher education students increased by 42.6%. The chart below shows the number of student visa applications and approvals for Australian higher education each year since 2016/17:

Student Visa Trends for Australian VET Institutions

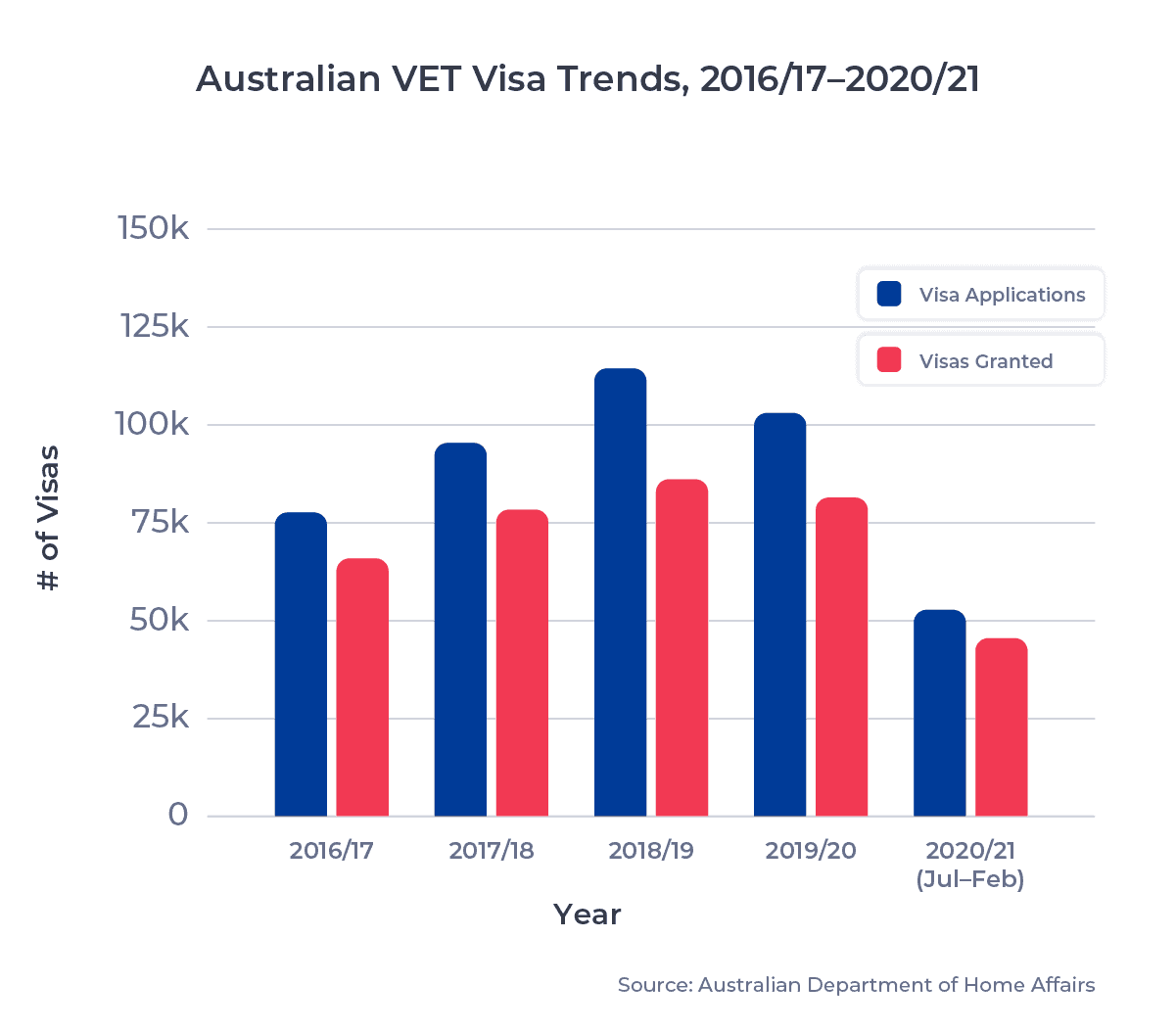

The demand for Australian VET studies rose significantly pre-pandemic, dominantly due to the emergence of Latin America as a growing source maret. From 2014/15 to 2018/19, the number of visas granted to VET students rose by 58.7%. However, over the same period, VET visa applications increased by 86.1%.

The main bottleneck preventing greater VET growth has been lower visa approval rates. Since the Australian government introduced visa assessment levels per source country, visa approval rates for VET studies have fallen significantly. From 2014/15 to 2018/19, VET visa approval rates fell from 89.2% to 80.1%. But the pandemic has caused a substantial change in VET visa approvals. For the first time since 2007/08, VET visa approval rates rose above 90%, hitting 94.6% in the first eight months of 2020/21. The chart below shows the number of student visa applications and approvals for Australian VET studies between 2016/17 and the first eight months of 2020/21:

Collaboration and Diversification Key to Australian Tertiary Sector Recovery

The 5% difference in visa declines between higher education and VET studies may seem minor, but this difference points to a larger trend. One of the major factors which helped VETs grow pre-pandemic is also likely to provide greater post-pandemic stability: greater source market diversity.

VET institutions have achieved greater success in recruiting students from a wide variety of source markets over the past five years.

Nine different source markets saw over 1,000 students receive Australian higher education visas in the first eight months of 2020/21. Over the same period, fourteen source markets saw over 1,000 students receive Australian VET visas.

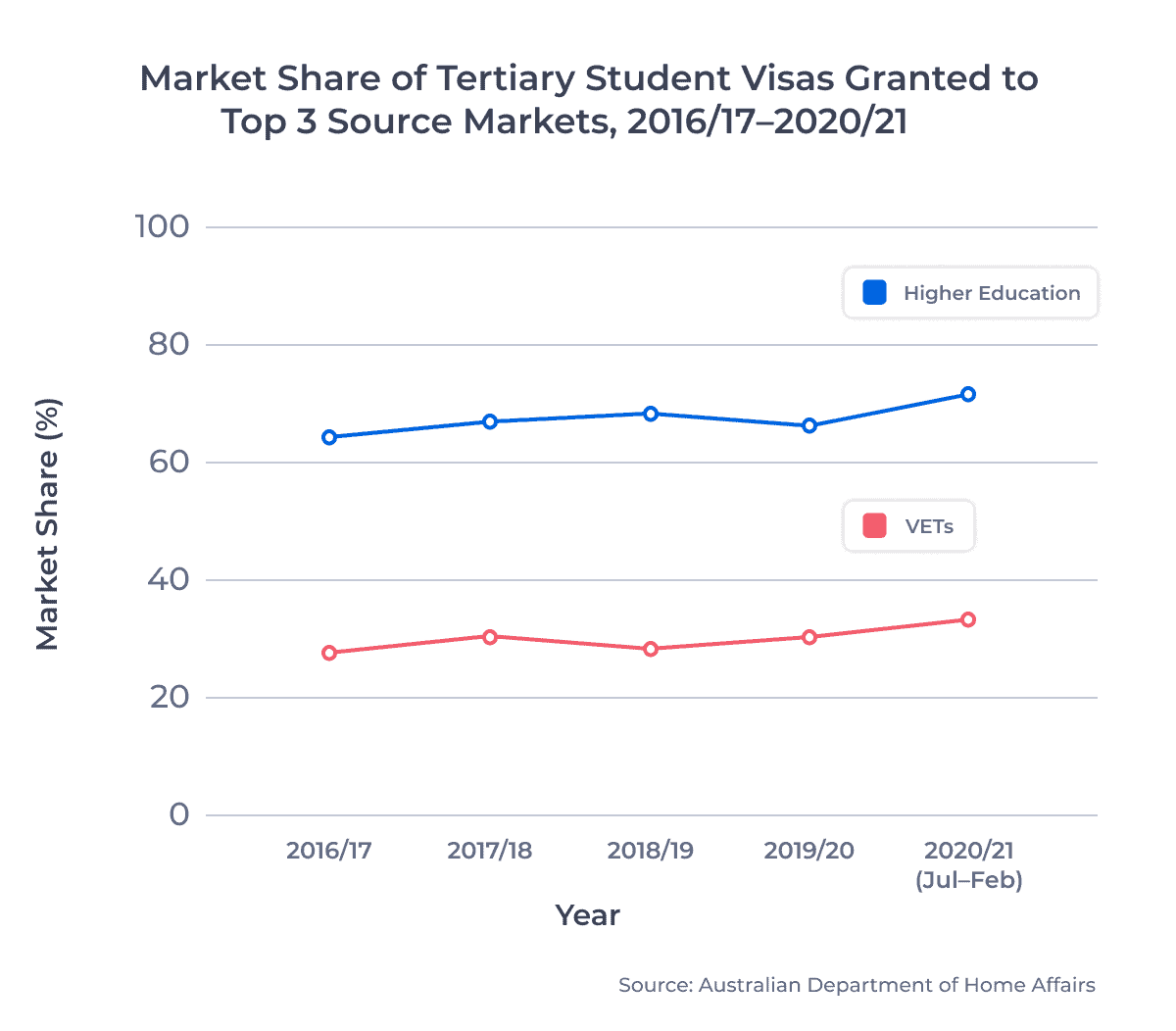

The chart below shows the market share of student visas granted to the top three source markets for each education sector between 2016/17 and the first eight months of 2020/21:

Australian VETs, by comparison, relied on their top three markets for less than a third of their international students since 2016/17. Additionally, over that period, six different countries6 made it into the top three source markets for VET students. The top three VET markets in partial 2020/21—India, Brazil, and Colombia—also demonstrated greater stability. From 2018/19 through the first eight months of 2020/21, VET visas for these markets fell by only 15.3%. From 2018/19 to 2019/20, student visas for these markets actually increased by 18.1%.

These differences show that source market diversification will be critical to Australia’s future international student growth and stability. While India, China, and Nepal remain key markets for future growth, over-reliance on these markets will weaken the industry and make it more susceptible to market shocks based on global politics and economic conditions.

Key Takeaways

Australian tertiary institutions have initiated unified meetings with the Australian government to discuss how their industry can recover. The Australian government, for their part, has launched an International Education Strategy consultation process to plan for sector recovery and success through to 2030.

But many international students won’t be able to return to Australia until 2022, according to the Australian education minister. This has created space to accommodate growing domestic demand for postgraduate studies, but Australian institutions need to prepare for strong competition from the US, the UK, and Canada as restrictions ease post-COVID.

As the Australian Strategy for International Education takes shape, Australian universities need to target growing markets that have attracted high volumes of VET students, such as Latin America. While such pivots may be difficult in the short-term, collective efforts can have a substantial impact.

I expect that Australian tertiary institutions looking to begin their recovery prior to the end of the pandemic and create momentum for post-pandemic growth will:

- Broaden their marketing focus to include growing markets such as Latin America and Southeast Asia

- Advocate for pandemic policies which will allow international students to come to Australia, such as the policy under consideration in New South Wales

- Work with other tertiary institutions to increase sector visibility in international markets and to promote international study in Australia in general

Published: May 3, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. Tertiary study includes VET and higher education courses (including postgraduate). For more information about the Australian education system and the Australia student visa system, check out the Australia 101 posts on the ApplyBoard Blog.

2. The higher education sector includes studies at Australian universities leading to the awarding of an associate’s degree, bachelor’s degree, graduate certificate, graduate diploma, coursework-based master’s degree, or higher education diploma/advanced diploma.

3. All data courtesy of the Australian Department of Home Affairs. All data reported according to Australian governmental financial years, which run from July to June. (For example, July 2019 to June 2020 was the 2019/20 year.) The data used for this article includes subclass 500 visas granted to primary applicants only.

4. The Vocational Education and Training (VET) sector includes studies leading to the awarding of a VET diploma, advanced VET diploma, vocational graduate certificate, vocational graduate diploma, or certificate I-IV.

5. Compared to VET, ELICOS, and non-awarding studies combined.

6. Brazil (2016/17, 2017/18, 2018/19, 2019/20, 2020/21), China (2016/17, 2017/18, 2019/20), India (2018/19, 2019/20, 2020/21), Nepal (2017/18, 2018/19), South Korea (2016/17), and Colombia (2020/21).