The COVID-19 pandemic has accelerated many trends in the Canadian international post-secondary student sector. Student interest in health studies and business programs rose sharply in 2020 after years of slow and steady growth. University study permit approval rates continued to decline, falling to a five-year low of 54.5% in 2020.1 Simultaneously, colleges gained market share against universities, experiencing less severe declines in new study permits issued between 2019 and 2020.

The Canadian university sector will need to adapt to these changes to stay competitive as global competition for international students increases. This is especially true for Canada’s U15 institutions, which ceded 15% of Canada’s international university student market to non-U15 universities over the past five years. In this article, I’ll assess major source markets for U15 schools and identify source market growth opportunities for the rest of 2021 and beyond. I’ll also provide a snapshot of the trends within each market and give my thoughts on what U15 institutions can do to regain international student market share.

Key Insights at a Glance

- U15 institutions have been over-reliant on mature markets, including China and the US, which offer limited opportunities for future growth.

- International students from India, Bangladesh, and Algeria are significantly under-represented at U15 schools compared to non-U15 universities.

- U15 institutions will need to turn their focus to recruiting from emerging markets to achieve increased market share and long-term growth.

I’ll start by looking at mature source markets that U15 schools have relied on for large student volumes in previous years.

U15 Over-Reliant on Mature Source Markets

In 2016, students attending U15 schools accounted for 51.8% of all new study permits issued for university studies in Canada. By 2020, they accounted for only 36.6%. This market share decline was mainly caused by slower growth at U15 schools compared to non-U15 universities. This slower growth helps demonstrate why mature markets should not be a major developmental focus for the U15 due to their limited potential for future growth.

U15 institutions were over-reliant on mature source markets pre-pandemic. By comparing 2019 and 2020 study permit numbers, we can show how over-reliance on those markets caused a greater year-over-year decline for U15 schools compared to non-U15 universities.

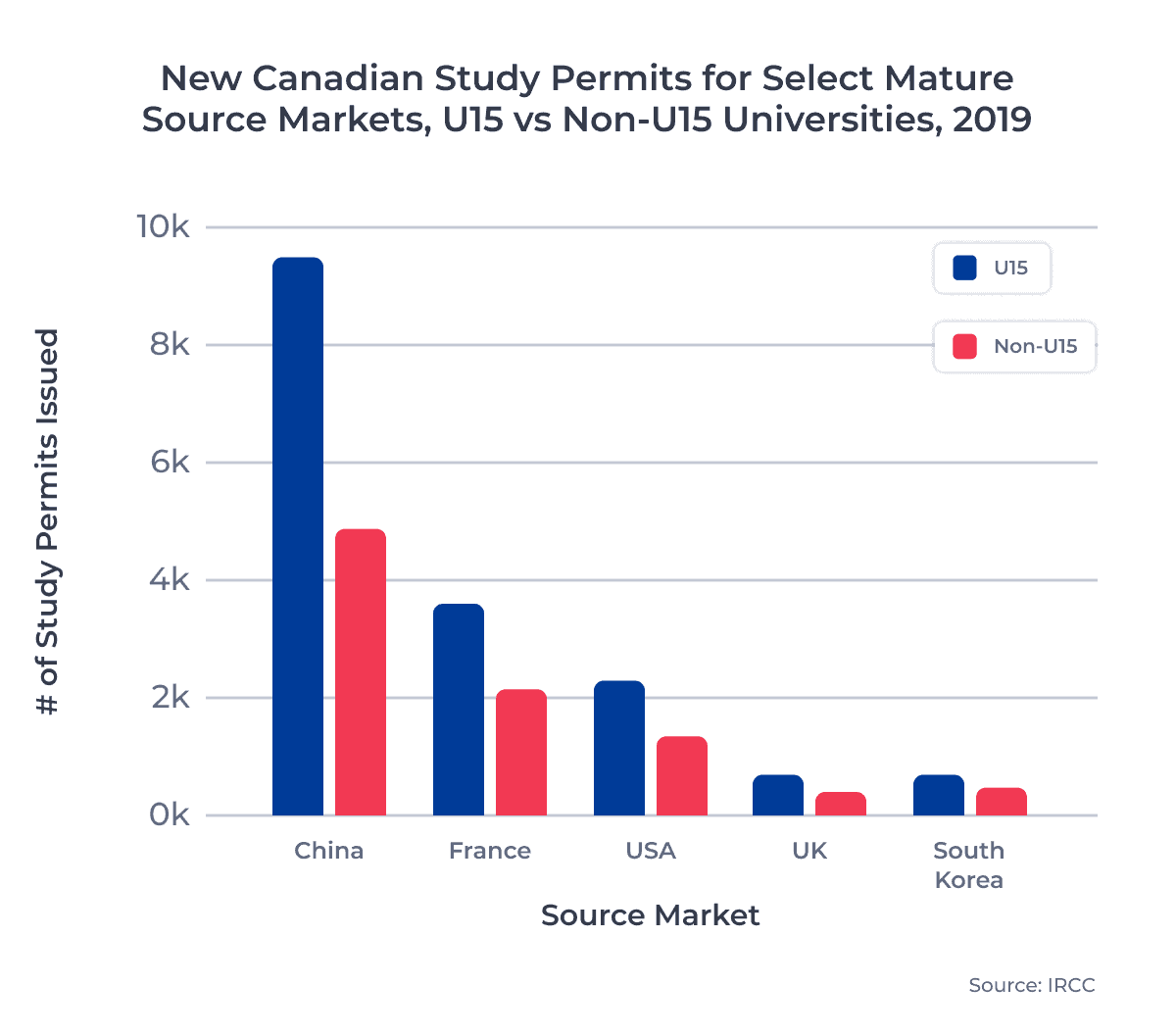

In 2019, U15 schools relied heavily on three major mature source markets.2 In each case, U15 institutions accounted for over 50% of all study permits issued to students from that source market for university studies. This means that U15 schools were more likely to be affected by volatility in those markets compared to non-U15 institutions. Let’s first take a look at 2019 study permit numbers for select mature source markets for U15 and non-U15 institutions in the chart below:

In 2019, China, France, and the US collectively accounted for 44.0% of all new U15 study permits. But these three source markets only accounted for 29.0% of non-U15 study permits in 2019. This means that, heading into 2020, U15 schools were more vulnerable to changes in these markets than non-U15 institutions.

Now let’s take a closer look at how each market fared in 2020 and how this impacted U15 universities.

The Chinese international student market collapsed in 2020, largely because China was an early epicentre of the pandemic. The number of new university study permits issued to Chinese students fell 95.1% from 2019 to 2020. But university study permits for Chinese students also fell pre-pandemic, dropping 8.0% from 2018 to 2019. While almost 10,000 new Chinese students received study permits for U15 universities in 2019, this number dropped to less than 400 in 2020.

The risk associated with over-reliance on the Chinese student market had a severe impact in 2020. The decline in new Chinese students was responsible for 31.4% of the total drop in new international students for U15 schools from 2019 to 2020, compared to only 8.0% for non-U15 institutions. Critically, study permits for Chinese primary and secondary students also fell 87.3% over this period. This decline will lead to a long-term contraction of the Chinese on-shore student market for Canadian post-secondary institutions.

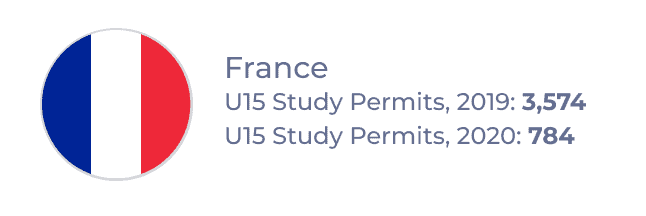

The number of new university study permits issued to French students fell 80.3% from 2019 to 2020. Of the new French students who were issued university study permits in 2020, almost 70% of them enrolled at U15 institutions. Many of these students opted to attend Quebec-based U15 schools, largely due to preferential international student tuition fees and French language programs.

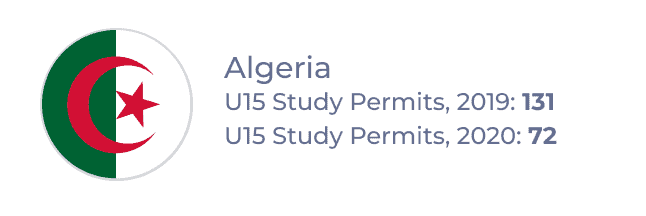

These factors make it likely that the French student market will rebound quickly post-pandemic. However, Quebec-based U15 schools should look to other growing Francophone markets to ensure long-term stability and growth. The French university student market grew by only 6.6% from 2017 to 2019. By comparison, the Algerian university student market grew by 520% over the same period.

Like France, the US has been a stable source market for Canadian universities over the past five years. But market growth has been limited. From 2018 to 2019, the number of new university study permits issued to US nationals declined by 5.1%. From 2019 to 2020, new study permits dropped by an additional 64.9%.

As a result of declines across many other major markets, the US became the second largest source market for Canadian universities in 2020 and the top source market for U15 schools.

Ease of travel and the strong ties between the US and Canada will help this market recover. Yet the long-term growth potential for this market was already diminishing pre-pandemic. Increased competition from the UK, Australia, and domestic US schools after COVID-19 may result in diminishing returns for Canadian universities recruiting US students.

Other Mature Markets

The UK and South Korea also present low growth potential as major international student markets for U15 schools. Both markets saw minor study permit declines (~5%) from 2018 to 2019 before dropping over 80% in 2020. 1,340 new students from the UK and South Korea received study permits for U15 programs in 2019. In 2020, only 202 such study permits were issued. As with France and the US, these mature markets may rebound quickly post-pandemic, but they present very limited growth opportunities over the next five years, evident through their pre-pandemic decline.

Future U15 Growth Through Emerging Source Markets

Instead, U15 institutions should look to key emerging markets that have shown strong growth for non-U15 universities. Many students from these emerging markets have strong academic records and potential, and they could be major assets for U15 institutions as they look to rebuild their international student intake post-pandemic.

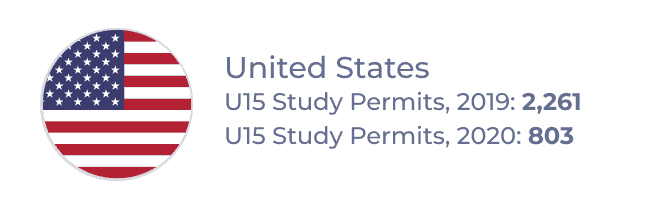

Within the top 20 source markets for all Canadian universities in 2019, there were three under-represented, major emerging source markets at U15 institutions. For each of these three markets, U15 schools accounted for 30% or less of new issued university study permits. The chart below shows the number of study permits issued to students from select emerging markets for U15 and non-U15 university studies:

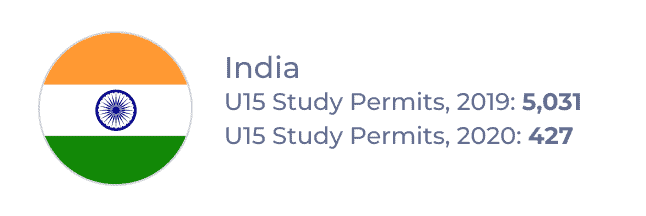

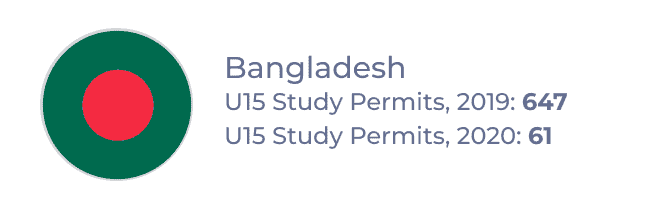

New students from India, Bangladesh, and Algeria were the most under-represented at U15 institutions in 2019, compared to non-U15 universities. In 2019, students from these three markets accounted for 35.5% of all new university study permits, but only 16.7% of U15 study permits. Let’s dig a little deeper into the opportunity presented by each of these markets.

India was the top source market for Canadian universities in 2018 and 2019, and the second largest market for U15 schools in those years. Over 25,000 Indian students received new university study permits in 2019, though only 20% of those students attended U15 institutions. In 2020, the Indian university student market shrank by 83.7%. But U15 schools saw a 91.5% drop in new Indian students year-over-year, lowering the U15 market share of Indian university students to just 10.4%.

Even though the number of new Indian students at U15 schools grew by 22.4% from 2018 to 2019, the potential for market growth is substantial. If U15 schools had captured 10% more of the Indian student market share in 2019, they would have welcomed an additional 3,500 Indian nationals. That change would also have increased the total number of U15 study permits by 10%. Recruiting Indian students after the pandemic may require U15 institutions to increase their merit-based scholarship options and to open additional international student spots in business study programs. The Indian economy has been hard hit by the pandemic, but Indian students remain highly interested in business studies at Canadian post-secondary institutions.

The number of new study permits issued to Bangladeshi university students increased by about 200% from 2016 to 2019. However, declining permit approval rates slowed significant market growth between 2018 and 2019, prior to a 90% study permit decline in 2020. In 2018 and 2019, the U15 market share of new Bangladeshi students was near 30%, but this rate fell to 20% in 2020.

Bangladeshi nationals looking to study abroad are increasingly interested in Canada’s Post-Graduate Work Permit Program (PGWPP) and its pathway to permanent residency (PR). As market knowledge about Canadian education grows in Bangladesh, so too will the Bangladeshi student market for Canadian institutions. The U15 has a role to play in not only recruiting from Bangladesh, but also educating the market about the value and strength of a Canadian U15 education.

The Algerian university market grew substantially between 2018 and 2019, with new study permits issued rising by 165%. Despite some pandemic-related decline in 2020, the number of new university study permits issued to Algerian nationals increased by 57.3% from 2018 to 2020. Algeria was the only source market for Canadian schools that saw an increase in issued study permits from 2018 to 2020.

Recent government announcements, such as the six new pathways to permanent residency, are likely to increase Algerian interest in Canadian education long-term. While these announcements mainly benefit French-language education providers, there is also increasing interest among Algerian students to complete English language education. By promoting potential in-demand careers in local communities, especially for multilingual individuals, U15 schools can attract Algerian nationals looking to settle in Canada after their studies.

Other Opportunity Markets

Vietnam and the Democratic Republic of the Congo (DRC) are also potential opportunity markets for U15 institutions. Vietnam presents a smaller opportunity, given that the U15 already recruit 30% of Vietnamese university students who attend Canadian universities. But the DRC— along with other growing African markets such as Nigeria, Ghana, and Senegal—could be a long-term opportunity for U15 schools. U15 institutions accounted for around 35% of university study permits issued to students from those markets in 2020, and maintaining that market share will be critical to post-pandemic growth. From 2018 to 2019, university study permits issued for those four markets increased by 41.6%.

Key Takeaways

Canada’s post-secondary sector has benefitted from a strong government policy response to the COVID-19 pandemic. Studies have consistently found that Canada has become a more attractive study destination for international students throughout 2020 and 2021. This is not only because of the government’s pandemic response, but also because of Canada’s perceived stability and welcoming nature. But other major study abroad destinations––including the UK, the US, and Australia––will continue to fight hard to attract top international students away from Canadian schools post-pandemic.

All Canadian institutions, but especially U15 universities, need to establish post-pandemic plans which include pursuing new recruitment strategies and markets. There are signs that some mature international student markets may have plateaued, or will take longer to recover. Recruiting from emerging markets will require an increase in short-term investment to allow for substantial long-term gain and attract the highest-performing students from those nations.

To ensure rapid post-pandemic recovery and growth over the next five years, U15 institutions should:

- Create regional source market recruitment plans which focus on growing markets such as South Asia, North Africa, and Sub-Saharan Africa.

- Leverage regional activities and centres of operation through support from local alumni in multiple countries.

- Investigate formalizing relationships with recruitment partners who have an established presence in emerging markets.

Published: May 10, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC), except where noted.

2. “Major source market” indicates that at least 500 new university study permits were issued to students from that market in 2019.