In this edition of ApplyInsights, I’m sharing my observations on Nigeria as a major source of international students to Canada. Nigeria has been the leading African source country for Canadian students over the past five years.1 In 2019, Nigeria was the 13th-largest source country for Canadian institutions overall.

Full-year data for 2020 is not yet available, so I’ll be focusing on the 2019 numbers throughout this article. I’ll provide analysis of initial 2020 data at the end of the article, and I’ll revisit this analysis later in 2021 as well.

Here’s what this blog post will cover:

- Study permit application, approval, and approval rate numbers for Nigerian students, compared with all source countries and African countries between 2015 and 2019

- A breakdown of Nigerian study permit approvals by study level

- A breakdown of Nigerian students by province of study

- My thoughts on the future of Nigerian students in Canada

Canadian Study Permit Trends – Nigeria

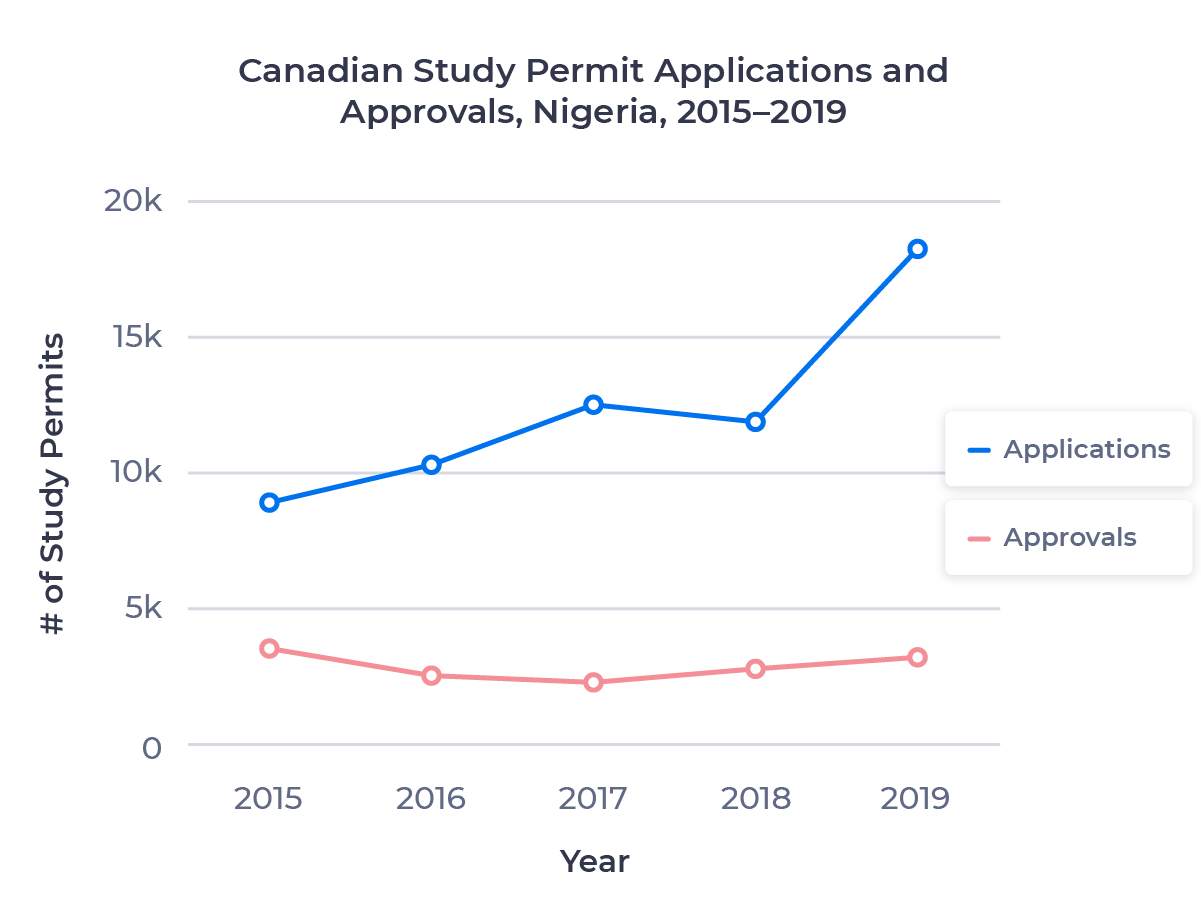

Canadian study permit applications for Nigerian nationals saw a marked increase in 2019, rising from 11,983 in 2018 to 18,220 in 2019. This 52.0% increase shows growing Nigerian interest in studying in Canada. From 2015 to 2019, study permit applications from Nigerian students roughly doubled. The Nigerian market saw 16.5% overall growth for approved Canadian study permits year-over-year. This growth was fifth-highest among the top 20 source countries in 2019.

The 5.4% decline in study permit approval rates for Nigerian nationals was lower than the Canadian average (6.4%). But, the study permit approval rate for Nigerian students remained well below the average for all source countries.

Only 17.6% of study permits were approved for Nigerian nationals in 2019, compared to 60.1% for all markets.

The chart below compares total Canadian study permit applications to Canadian study permit approvals for students from Nigeria from 2015 to 2019:

Study Permit Approval Rates – Nigeria vs. Africa

The declining approval rates for Nigerian students are especially striking when compared to the rates for other large African source markets:

| Country | Change in Application Volume, 2018–2019 | Change in Application Volume, 2015–2019 | Change in Approval Rate, 2018–2019 |

Change in Approval Rate, 2015–2019 |

|---|---|---|---|---|

| Algeria | +100.1% | +613.8% | +1.4% | -3.2% |

| Cameroon | +48.2% | +189.5% | -2.9% | -3.8% |

| Democratic Republic of the Congo |

+86.0% | +288.1% | -2.9% | -6.4% |

| Ghana | +9.6% | +88.2% | +16.5% | -0.3% |

| Morocco | +44.9% | +161.6% | +4.2% | +7.4% |

| Nigeria | +52.3% | +104.9% | -5.4% | -22.5% |

It’s clear that there’s growing interest from African students in studying at Canadian institutions. Data for 2019 shows higher application volumes from many African source markets, including Nigeria. However, approval rates for Nigerian nationals continued to decline. The study permit approval rate for Nigerian nationals ranked 121st out of 137 source markets with 50 or more Canadian study permit applications in 2019.

Study Permit Approval Roadblocks

At ApplyInsights, we’ve observed a strong negative correlation between applicant age and study permit approval rate across source markets. This relationship holds true for Nigeria as well.

In 2019, Nigerian nationals under 20 had a Canadian study permit approval rate of 44.1%, but students aged 20 to 25 were approved only 14.6% of the time. For Nigerian applicants over 25, approval rates were even lower, at 6.0%.

I’ve heard from our relationship partners in Nigeria that the lower approval rates for older students negatively impact the Nigerian market. Students in many source markets finish secondary school when they reach 18 or 19 years old. However, Nigerian students often finish secondary school at 20. As 20-year-old applicants, Nigerian students would be far less likely to be approved based on age alone.

This also extends to Nigerian nationals pursuing post-graduate education. College and university programs in Nigeria often extend beyond the typical four-year window. This means Nigerian students may not graduate until they are 25 or older. All Nigerian post-secondary graduates must then complete a year with the National Youth Service Corps. As a result, Nigerian post-graduate applicants are often near 30 years old.

Study Permits Issued by Study Level

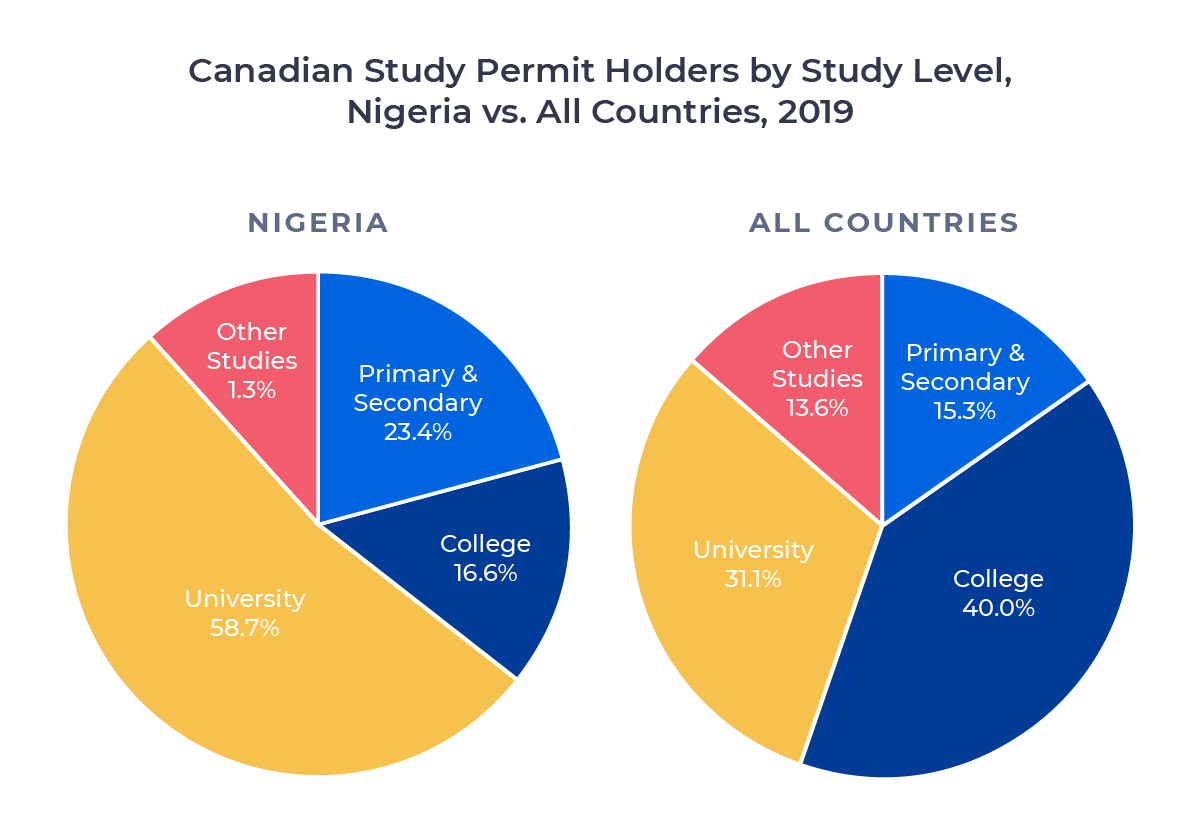

These large differences in approval rate based on age align with shifting education level priorities for Nigerian students. Nigerian students are more likely to pursue post-secondary education in Canada than students from other source markets. In 2019, 89.1% of all study permit applications from Nigerian students were for college and university studies, compared to 71.7% for all markets.

The figure below shows the study permit distribution by study level for Nigerian students compared to students from all source markets:

This trend may reflect higher approval rates for university applicants compared to college applicants from source markets throughout Africa. Our recruitment partners in Nigeria have also told me that Canadian university degrees are highly valued due to the perception that they lead to more stable and higher-paying jobs.

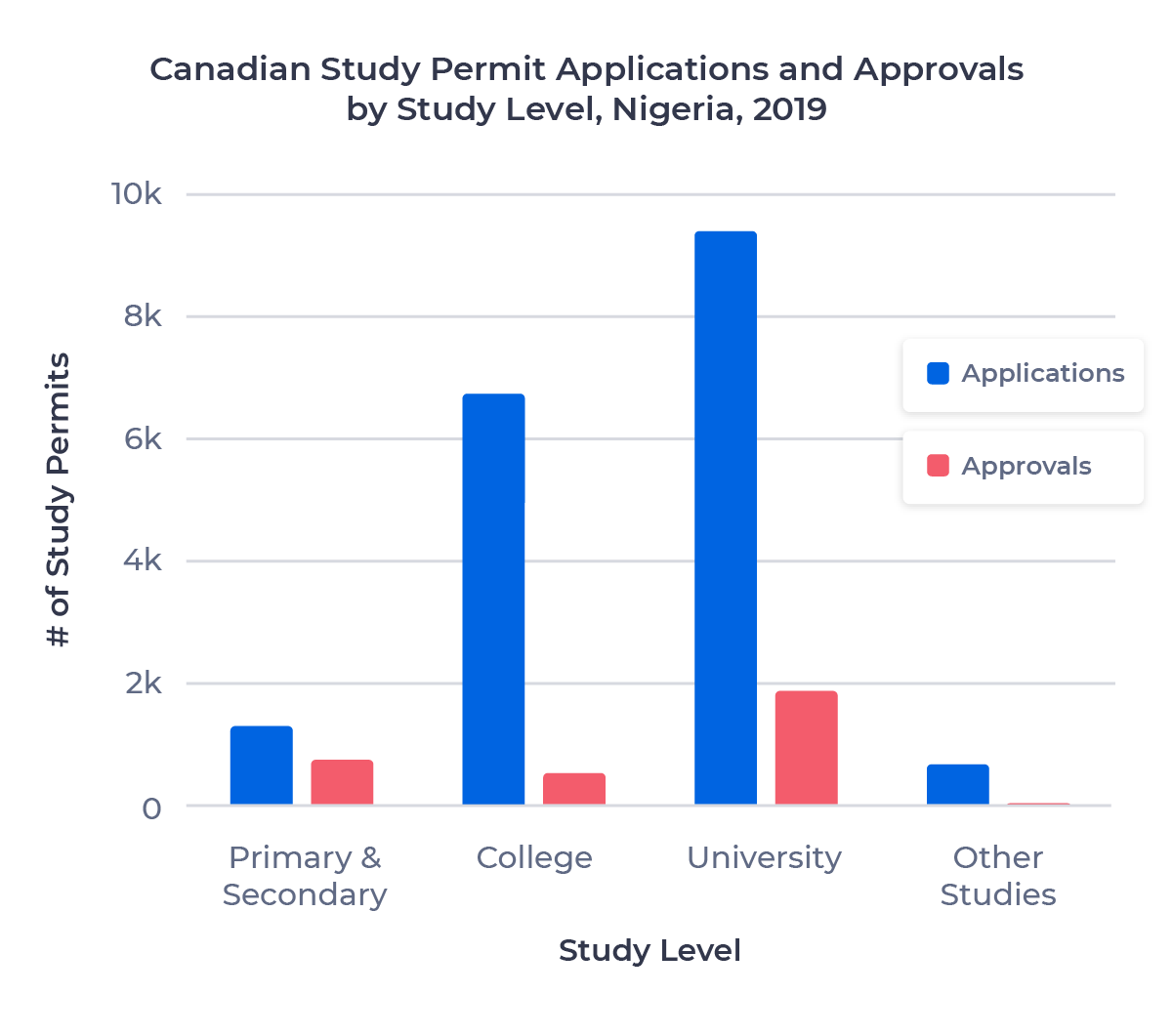

The figure below shows the distribution of Nigerian study permit applicants and study permit approvals by study level:

As English is the official language of Nigeria and is widely spoken by Nigerians, few students apply for language programs in Canada. The other studies category, which includes language programs such as ESL and FSL, had the lowest approval rate of all study levels. Only 5.9% of other studies applications were approved in 2019, a 2% decline year-over-year and a 19.4% decline since 2015.

Study Permit Approvals by Province

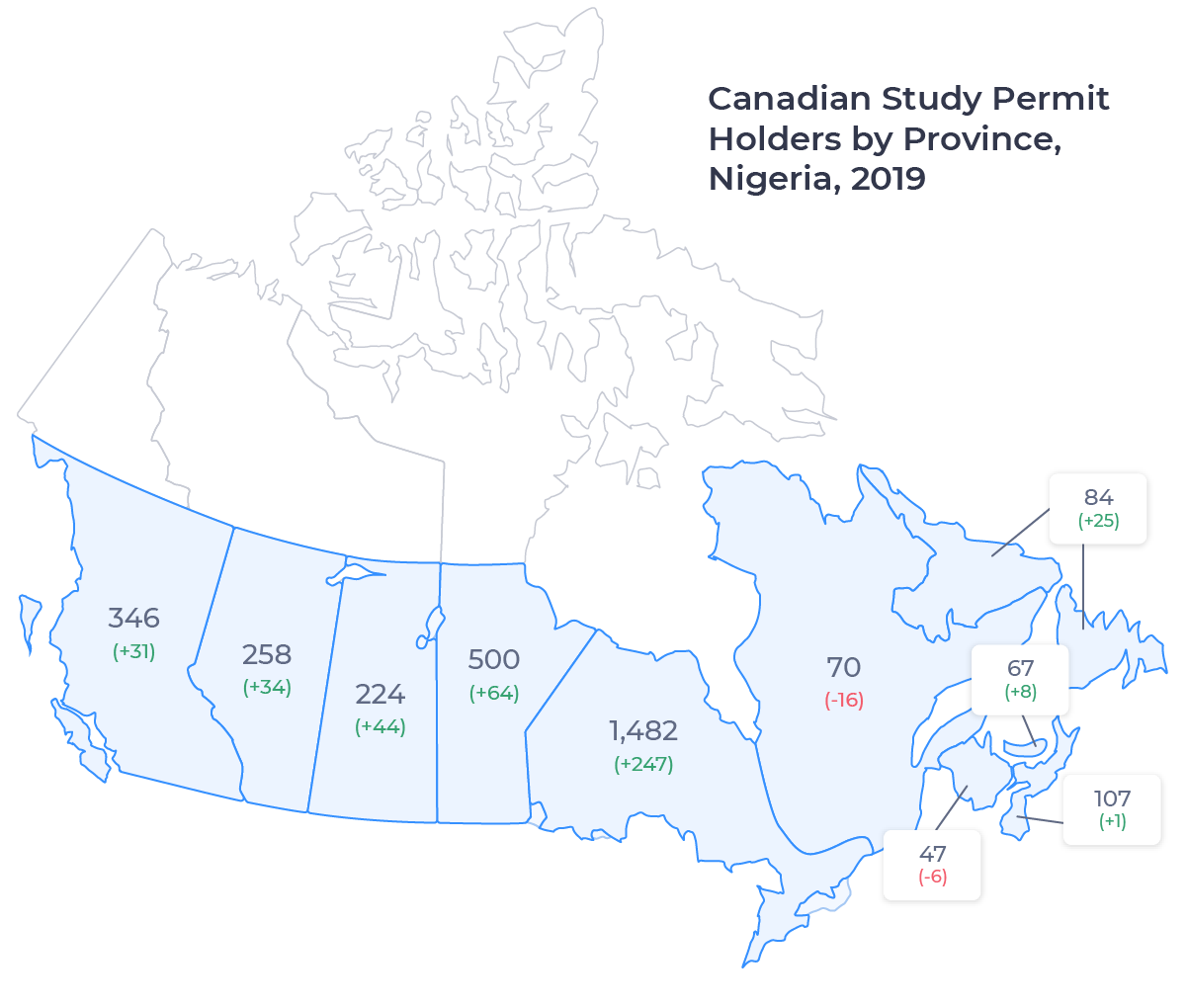

Though study permit approval rates have dropped, many provinces saw an increase in their Nigerian student populations in 2019. The figure below shows the number of study permit approvals for Nigerian nationals in each of Canada’s 10 provinces in 2019, along with the change between 2018 and 2019:

Surprisingly, Manitoba was the second-most-common destination for Nigerian students in Canada. 15.7% of Canada’s incoming Nigerian student population enrolled in Manitoba schools, and the University of Manitoba was the number one destination in Canada for Nigerian students in 2019. This trend is likely driven by affordability, a key driver for the Nigerian market. According to Statistics Canada, Winnipeg, Manitoba, has one of the lowest average costs of living among Canada’s major metropolitan areas.

The Future of Nigerian Students in Canada

Nigeria is the seventh-most-populous country in the world. Its students also submitted more Canadian study permit applications in 2019 than every country except China and India. This means that the Nigerian student population in Canada is likely to keep growing in the years to come. However, the aged-based approval roadblocks may be hard to overcome. With Nigeria mired in a recession, Nigerian students are more likely to put off studying abroad, which in turn reduces the likelihood they’ll be accepted.

However, Nigeria remains a strong market for Canadian schools. Nigerian student interest in studying in Canada has grown substantially since 2018 primarily due to the Post-Graduate Work Permit Program (PGWPP). We have specifically noticed a shift towards Canada as Australian study permit requirements have changed. Initial 2020 data2 shows more of the same. The country moved up one spot to become the second-largest source of Canadian study permit applications in the first seven months of 2020.

The Nigerian market still has exciting potential for future growth, as do many other African countries. I’ll be digging into more African student data later in 2021, and full-year 2020 data may shed further light on these trends. I’ll be keeping a close eye on the Nigerian student market in 2021 and throughout the post-pandemic recovery.

Published: January 13, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. In his role as Co-Founder and Chief Marketing Officer (CMO) at ApplyBoard, he leads the International Recruitment, Partner Relations, Sales Enablement, Sales Operations, and Marketing teams along a shared mission to educate the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America, the United Kingdom, and Australia. Working with over 4,000 international recruitment partners, ApplyBoard has assisted more than 120,000 students in their study abroad journey.

Meti was honoured in 2019 by Forbes, being named to three Top 30 Under 30 lists, including Education, Immigrants, and Big Money. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC), except where noted.