In this edition of ApplyInsights, I’m sharing my observations on the Philippines as a key supplier of international students to Canada. The Philippines was the eleventh-largest source market for Canadian students in 2019, with more than 6,300 Filipinos holding Canadian study permits. It was also the second-largest source market in the Southeast Asia region, after Vietnam.1

Here’s what this blog post will cover:

- Canadian student visa2 application, approval, and approval rate numbers for the Philippines, contrasted with all source countries

- Trends in the number of Canadian study permits issued to students from the Philippines between 2015 and 2019

- A breakdown of Filipino students in Canada by province of study

- The distribution of study permit holders from the Philippines by study level

- My thoughts about the future of Filipino students in Canada

Canadian Student Visa Trends – Philippines

In 2019, Canada received 8,389 student visa applications from Filipino students. This marked a massive 71.5% increase in applications from 2018. While the visa approval rate for Filipino students did decline 1.6% year-over-year, this was well below the average decline for all countries (6.4%).

The boom in applications and modest decline in approval rate combined to produce a 67.2% increase in the number of Canadian student visas issued for Filipino students in 2019.

The following table summarizes these changes:

| 2018 | 2019 | Change | ||

|---|---|---|---|---|

| Philippines | Applications | 4,891 | 8,389 | +71.5% |

| Approvals | 3,080 | 5,150 | +67.2% | |

| Approval Rate | 63.0% | 61.4% | -1.6% | |

| All Countries | Applications | 342,702 | 426,594 | +24.5% |

| Approvals | 227,798 | 256,546 | +12.6% | |

| Approval Rate | 66.5% | 60.1% | -6.4% |

With a huge influx of student visa applications and a drop in approval rate well below average, 2019 was a great year for the Filipino student market in Canada.

Philippines vs. Other Southeast Asian Markets

If we compare trends for the Philippines to those for other major Southeast Asian markets, we can further see how much the Filipino market flourished in 2019:

| Change in # of Applicants | Change in # of Approvals | Change in Approval Rate | |

|---|---|---|---|

| Vietnam | -11.7% | -36.5% | -19.0% |

| Philippines | +71.5% | +67.2% | -1.6% |

| Indonesia | +6.8% | -7.5% | -12.3% |

| Thailand | +2.4% | +16.3% | +9.8% |

| Malaysia | -7.3% | -9.6% | -2.2% |

| Singapore | +36.2% | +21.9% | -9.8% |

The growth in applications from the Philippines was roughly twice that of Singapore, a much smaller source market, and far ahead of the other four countries. The growth in Thailand’s approval rate was an outlier, but the decline for the Philippines was less than those for its remaining neighbours.

Despite staying relatively stable year-over-year, the Canadian student visa approval rate for the Philippines, 60.1% in 2019, remains low compared to other Southeast Asian countries. It ran ahead of just Vietnam (48.9%) and the tiny Cambodia market (58.1%) last year.

Canadian Study Permit Trends – Philippines

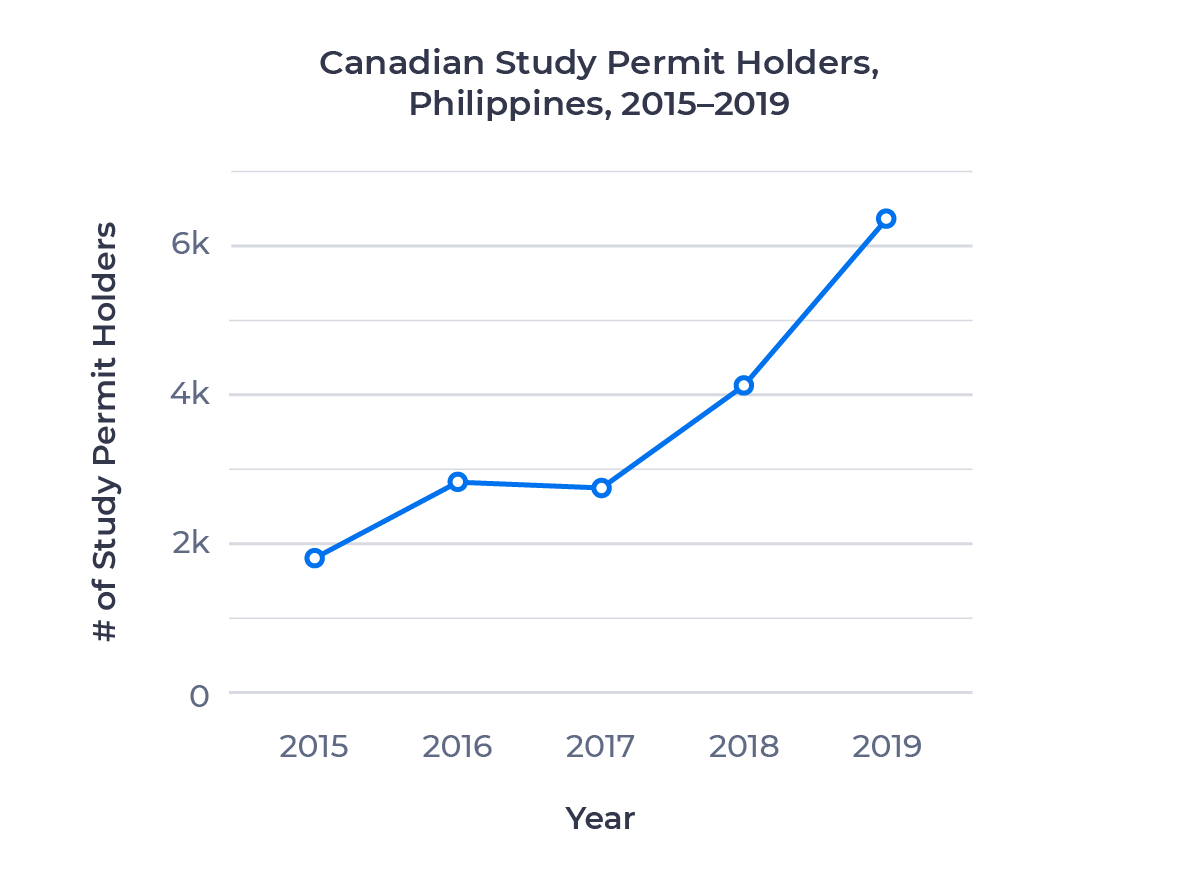

Canada has seen explosive growth in Filipino study permit holders as well. Canadian study permits for Filipino nationals increased from 1,880 in 2015 to 6,365 in 2019. This represented almost 240% growth over the period. In contrast, growth in study permits for all countries was just under 85%.

The chart below shows the growth in Filipino holders of Canadian study permits from 2015 to 2019:

Growth was particularly strong between 2017 and 2019. In fact, more than 80% of the growth in the market over the four-year period occurred during those two years.

Student Direct Stream (SDS)

In June 2018, the Canadian government introduced the Student Direct Stream (SDS) to the Philippines. SDS is a simpler and more efficient study permit processing system available only to citizens of specific countries. Applicants must meet stricter eligibility requirements, but processing times can be as short as three weeks. SDS typically has much higher approval rates than the standard study permit application process.

SDS was in place for roughly half of 2018 and all of 2019. The growth in the Filipino market—1,330 new study permit holders in 2018 and another 2,285 in 2019, after a decrease in the market in 2017—tracks closely with the introduction of SDS, suggesting SDS has been a key contributor to the expansion of the Filipino market.

Study Permit Holders by Province

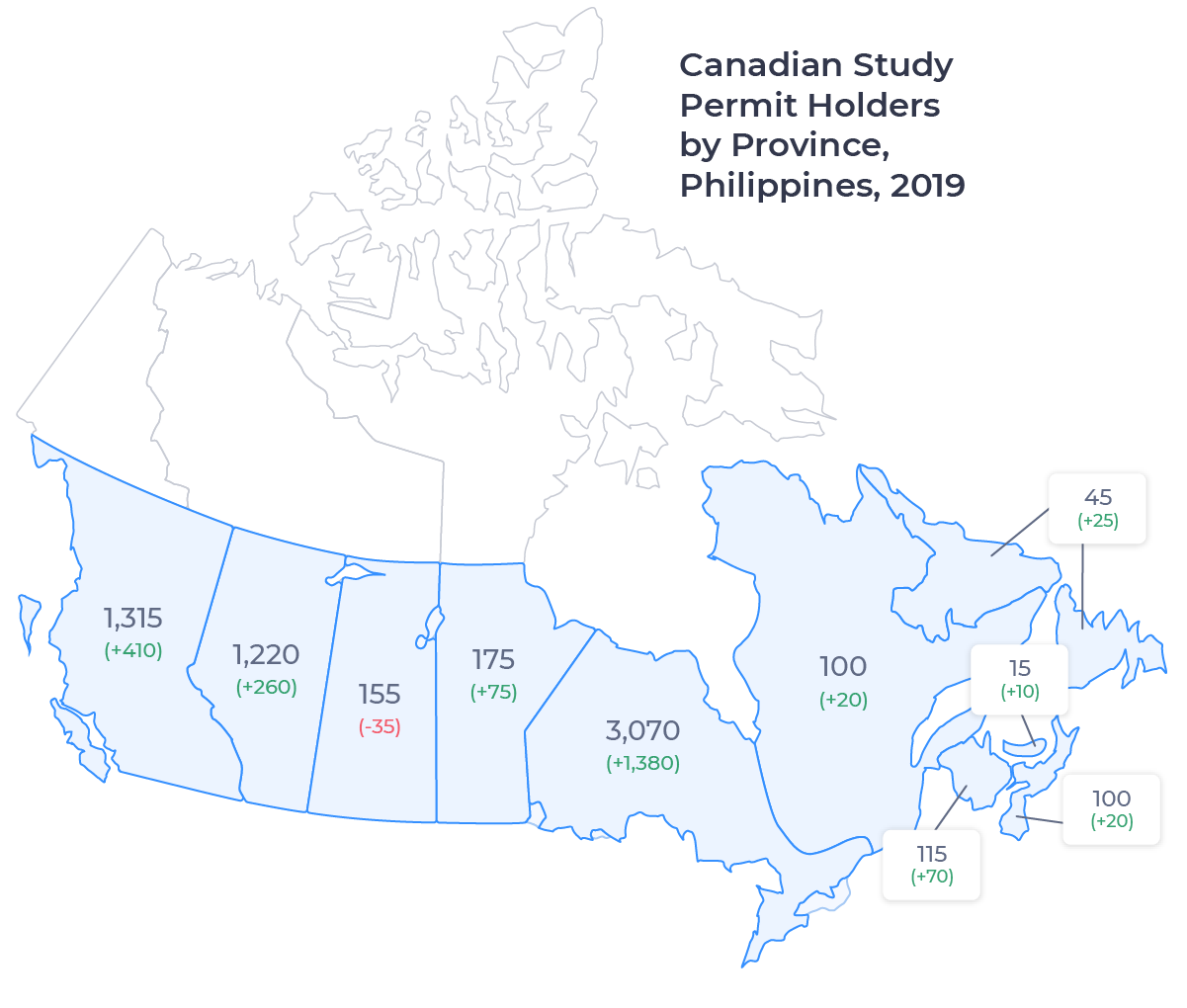

The image below shows the number of study permit holders from the Philippines in each of Canada’s 10 provinces in 2019, along with the change between 2018 and 2019:

Ontario is the runaway leader for Filipino enrollment. In 2019, 48.2% of Canadian study permit holders from the Philippines studied in Ontario. This is right in line with the 49.1% of study permit holders from all countries who studied in Ontario that year. 20.7% of Filipinos in Canada studied in British Columbia, also in line with the all-countries average (21.3%).

The big outlier compared to the all-countries data is Alberta. 1,220 Filipino nationals studied in Alberta in 2019, comprising 19.2% of the Filipino students in Canada. In contrast, only 5.1% of Canada’s international students overall studied in Alberta.

Why the discrepancy? We can point to the fact that Filipinos make up the largest group of immigrants in Alberta, accounting for 4.3% of the province’s total population. Alberta was also the top destination in Canada for Filipino immigrants between 2011 and 2016.3 Where their family and friends are located frequently drives student decisions about where to study abroad. And in speaking with our recruitment partners in the Philippines, I’ve heard repeatedly that this is the number one consideration for many Filipino students coming to Canada.

Study Permit Holders by Study Level

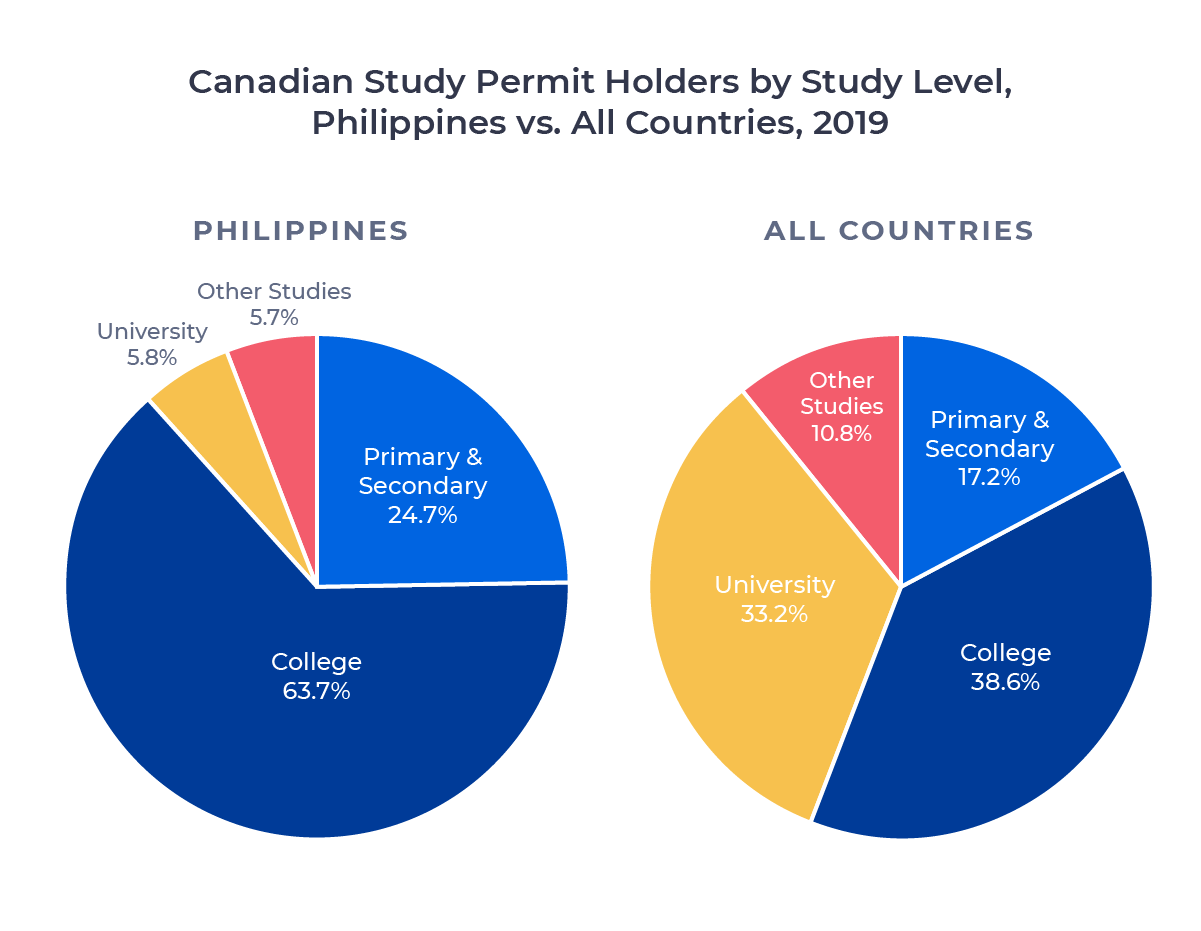

The figures below contrast the distribution by study level of study permit holders from the Philippines with the distribution for all source countries:

College study dominates the Filipino market, with almost two-thirds of study permit holders studying at that level. In fact, a larger percentage of Filipino students study at colleges in Canada than students from any other top 20 country except India. The primary and secondary numbers for the Philippines were also well above the all-countries average, driven by a 15.6% market share for primary school that was itself the second-highest rate among the top 20.

While many countries see significant numbers of university-aged students go abroad to attend higher education and then return to their home country to work, this is not the case with the Philippines.

The university sector was just 5.8% of the Filipino market. This was the smallest proportion of university students for any country that sent more than 100 students to Canada in 2019.

Rather, from conversations with our recruitment partners in the Philippines, I’ve heard that many of the students they work with are in their late 20s and 30s and already in the workforce. They’re looking to study at Canadian colleges as a way to supplement their work experience at a reasonable cost while taking the first step toward permanent resident status in Canada. The unusually robust primary numbers we’re seeing suggest that many of these students bring school-age children with them.

The Future of Filipino Students in Canada

Immigration, Refugees and Citizenship Canada (IRCC) has released limited data for 2020, making it difficult to assess the impact of the COVID-19 pandemic on the Filipino study abroad market. The Philippines’ struggle to control the virus, coupled with an economic slump that has seen many Filipino Canadians sending additional money to support their families back home, suggests the market could take a long time to recover. However, at ApplyBoard, we’ve seen stronger numbers out of the Philippines than many countries in 2020.

This, too, may reflect the demographics of the Filipino market. Many parents in source countries have understandably encouraged their children to defer their plans to study abroad by a year or more out of a desire to keep them closer to home during this uncertain time. But because so many Filipinos coming to Canada to study are working-age adults, many of them looking to relocate their families as well, they may be more willing to move, provided they are able to afford it during the economic downturn.

In light of this, I’m cautiously optimistic about the Filipino market. I believe there’s a good chance that we see a continued shift toward college and primary studies as young families move ahead with plans to relocate to Canada. Canada’s relative success at handling the pandemic—something our survey of recruitment agents surfaced—is another point in its favour. As always, I’ll keep a close eye on the data and share my thoughts on these trends as they continue to develop.

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America and the United Kingdom. Working with over 4,000 international recruitment partners, ApplyBoard has assisted over 100,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC), except where noted.

2. The terms student visa and study permit are often used interchangeably when discussing Canadian international education and immigration. Students need a visitor visa to enter Canada, but one is often issued with an approved study permit if it is required. However, a student can be issued a visitor visa without being issued a study permit, thus there are small differences in application volumes and approval rates between visitor visas for students and study permits.

3. Source: 2016 Canadian Census of Population.