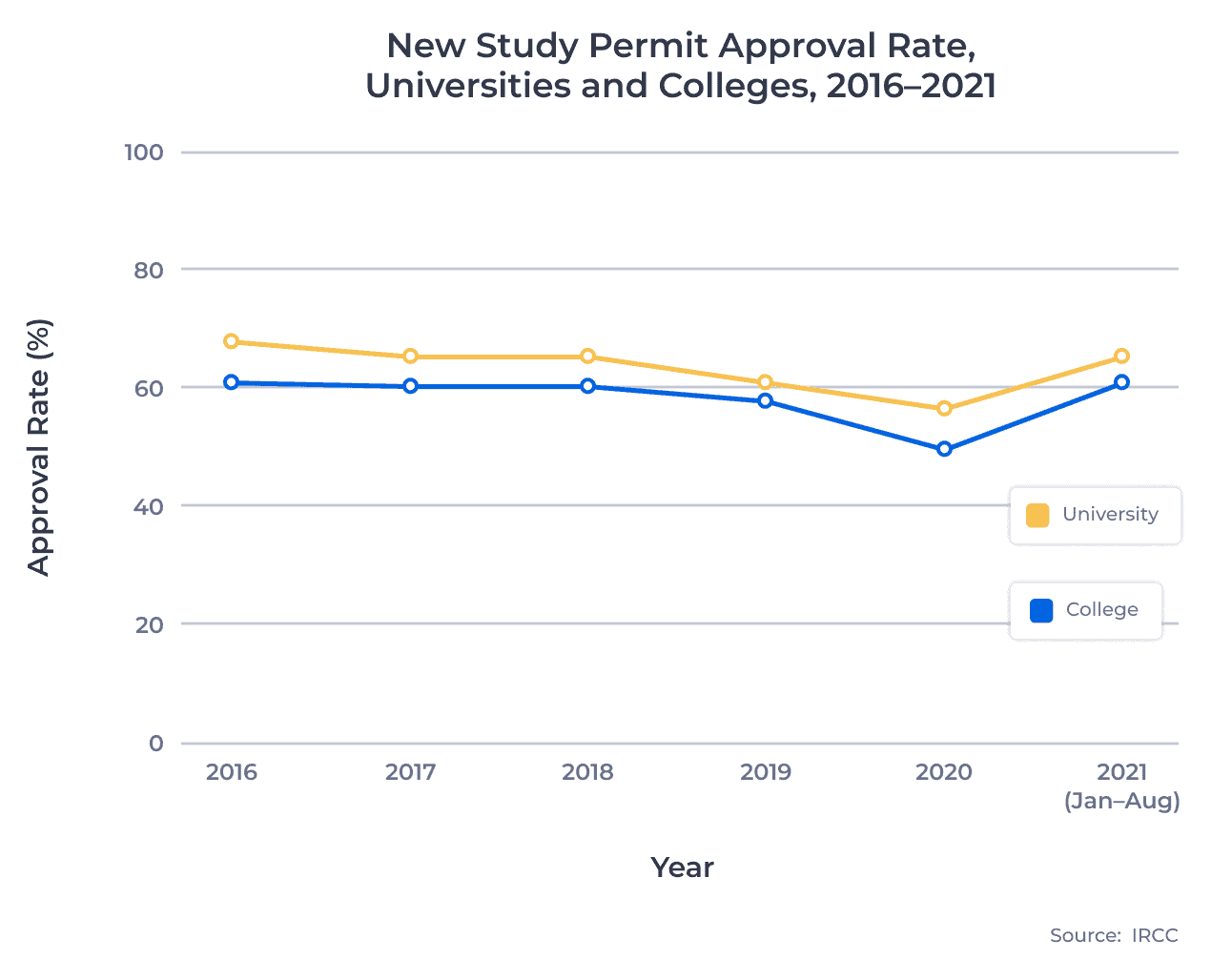

After dipping in 2019 and falling further during the pandemic in 2020, student visa1 approval rates for both Canadian universities and colleges are returning to recent highs.2 Impressively, the rebounding of approval rates is occurring while the number of study permit applications tracks to shatter previous full-year highs.

How do approval rates differ between universities and colleges? Which markets are growing post-pandemic? And what does this mean for students moving forward? Join me as I delve into the approval rates data for 2021 and answer these questions.

Key Insights at a Glance

- Combined, new study permits to Canadian universities and colleges were approved at a rate of 64% in 2021. This is a substantial increase from 48% in 2020.

- Many source countries have doubled their application output compared to 2019 while sustaining approval rates above 70%.

- France and Mexico are the only countries with approval rates 90% or higher and more than 1,000 approvals for both sectors.

Approval Rates Return to Pre-Pandemic Levels

Earlier this year, I explored the approval rate spike across all Canadian sectors during the first four months of 2021. We can now see that approval rates for new study permits for universities and colleges maintained this momentum as the year progressed.3 Let’s dive deeper:

The gap between approval rates for Canadian universities and colleges closed after widening in 2020. The 7 percentage point gap returns the difference between the two sectors to 2019 levels. This narrowed the 8 percentage point difference in 2017 and 2018, meaning we could see this gap continue to shrink moving forward.

The 68% approval rate for new study permits to Canadian universities returns the sector to 2018 levels. This is just shy of the full-year high of 72% in 2016. Approval rates for new study permits to universities fell to 61% in 2019 and 54% in 2020, so it’s exciting to see rates rebound alongside the market growth.

The 61% approval rate for Canadian colleges matches the sector’s highest rate over the past six years, set in 2016. Like universities, approval rates for this sector declined over the previous two years, dropping to 52% and 43% in 2019 and 2020.

I delved into the approval rate decline of 2020 earlier this year. In short, international students found it increasingly difficult to secure documentation as offices shut down, and it wasn’t until July 2020 that the government implemented a COVID-19 policy for study permit applications.

Approval Rates for Top Source Countries

How are study permit approval rates shaping up for the top 10 source countries for Canadian universities and colleges? Let’s take a look:

| Source Market | Approvals | Approval Rate, All Levels | Approval Rate, University | Approval Rate, College |

|---|---|---|---|---|

| India | 96,678 | 69% | 81% | 65% |

| China | 15,341 | 89% | 93% | 62% |

| France | 8,401 | 97% | 97% | 97% |

| Philippines | 6,367 | 66% | 76% | 65% |

| Iran | 3,996 | 43% | 47% | 22% |

| USA | 3,829 | 94% | 95% | 91% |

| Mexico | 3,260 | 91% | 93% | 90% |

| Brazil | 2,836 | 84% | 92% | 81% |

| Nigeria | 2,694 | 29% | 33% | 22% |

| Bangladesh | 2,662 | 55% | 64% | 28% |

Approval rates grew for seven of the top 10 markets this year compared to 2020. France (99%), Iran (52%), and the USA (98%) were the only countries with a higher approval rate last year compared to this year.

Approval rates also increased in 2021 compared to the 2016 to 2020 average for several markets. The averages over the past five years for India (63%), France (95%), the Philippines (63%), Mexico (85%), Brazil (79%), and Nigeria (17%) were all surpassed this year.

Iran has shifted 20 percentage points, dropping from a 63% approval rate average between 2016 and 2020 to 43% in 2021. This is the largest shift among the top 10 markets. The Philippines’ 56% to 66% approval rate growth is the only other double-digit change.

The top 10 source countries account for 79% of all new study permit approvals to Canadian universities and colleges in 2021.

What do the approval rates look like in each sector? And are there some emerging markets we should pay attention to in the coming years? Let’s find out.

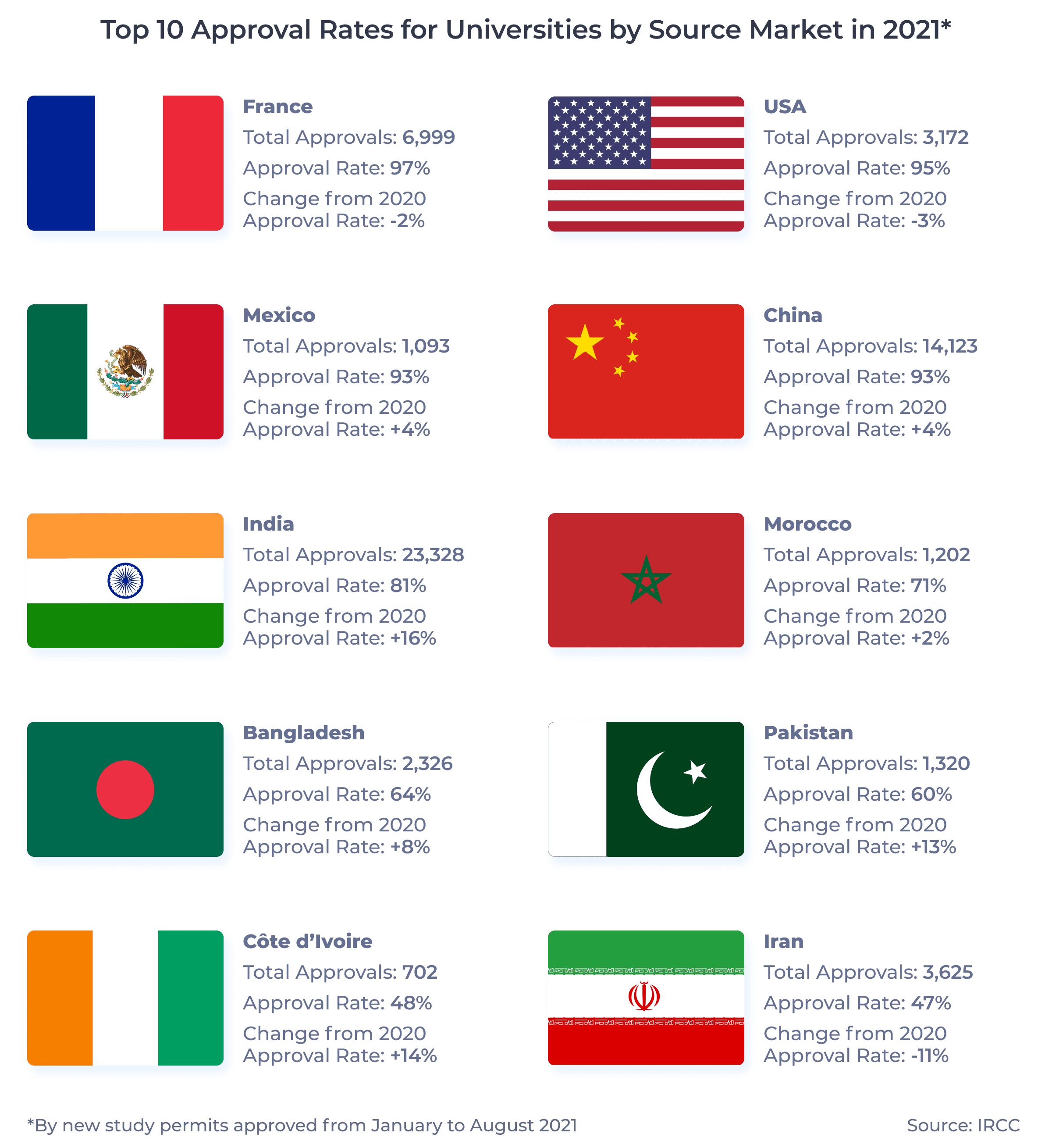

Top Approval Rates by Source Market in 2021 – University

What markets lead the way for study permit approval rates to Canadian universities? Let’s take a look at the top 10 source markets for this year.4

India is rebounding strongly post-pandemic: Its 81% approval rate represents a new high for the country over the past six years. India previously hovered around a 70% approval rate pre-pandemic, and dropped to 64% in 2020.

Conversely, Iran’s approval rates lag post-pandemic. The country posted approval rates above 80% pre-pandemic, but this plummeted to 59% and 47% in 2020 and 2021, respectively. Iran’s declining approval rate coincides with a significant increase in new study permit applications: in 2021, there were more than 7,600 applications from Iran, representing a growth of 56% compared to 2019 and the largest increase among the top 10 markets.

Emerging Source Markets – University

There are several growing source markets likely to find themselves in the above top 10 list by year-end. The following markets should be tracked closely as we move into 2022 and beyond.

Hong Kong (SAR China) and Germany are on track to smash through the 1,000 new study permit applications threshold to Canadian universities. Both source markets have had consistently high approval rates–Hong Kong above 80% and Germany above 90% since 2016. Currently, Hong Kong’s approval rate sits at 87% and Germany’s at 98%.

Lebanon and the Philippines are also growing, both on pace to exceed 1,000 new study permit applications to Canadian universities by year-end. Approval rates for Lebanese students sat at 76% from 2019 to 2020 before dipping this year to 71%. Conversely, approval rates for Filipino students spiked from 66% in 2019 to 75% this year.

In 2021, Hong Kong, Germany, Lebanon, and the Philippines saw new study permit approval rates for Canadian universities higher than 70% even as their application volumes more than doubled compared to 2019.

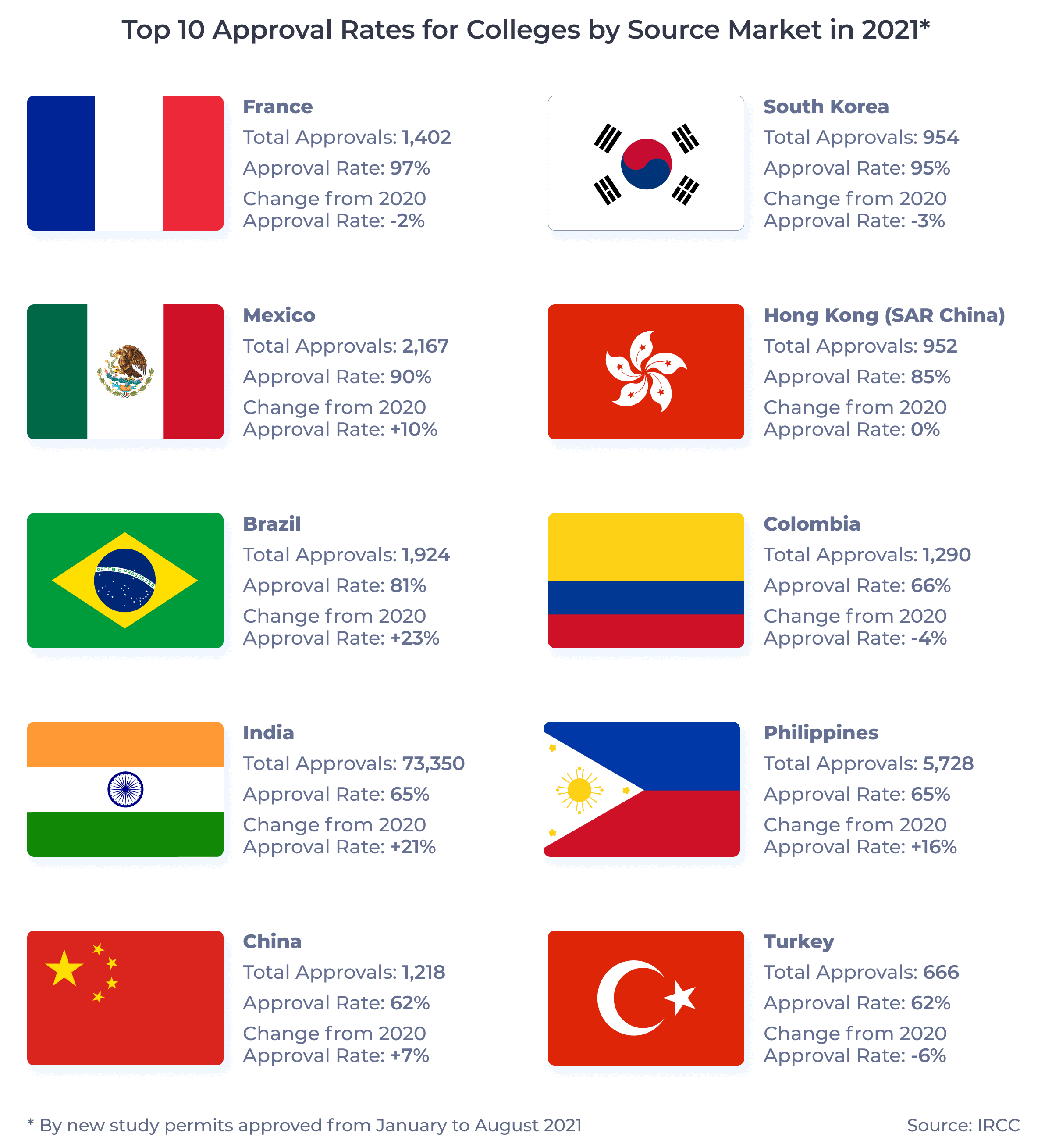

Top Approval Rates by Source Market in 2021 – College

Four countries appear in the top 10 approval rates for both sectors:5 France, Mexico, India, and China. Let’s take a look at the remaining six markets for Canadian colleges, as well as some other noticeable trends.

Hong Kong has exploded onto the scene, increasing its new study permit applications from 171 in 2019 to 1,124 in 2021, representing 557% growth. The approval rate for students from Hong Kong has also risen. In 2019, Hong Kong had an approval rate of 76%, but this grew to 85% in both 2020 and 2021.

Like Hong Kong, the Philippines grew substantially in both study permit applications and approvals. Applications grew 58% from 2019 to 2021. Approval rates for Filipino students hovered around 60% pre-pandemic, fell to 49% during the pandemic in 2020, and have risen to 65% this year.

Several other markets have rebounded well post-pandemic too. Mexico’s approval rate rose from 80% in 2020 to 90% in 2021, Brazil’s from 58% to 81%, and India’s from 44% to 65%.

Emerging Source Markets – College

Markets in Latin America showed exciting growth this year, and could challenge for a top 10 spot in a few years if this momentum is sustained.

Peru is tracking to double its new study permit applications this year compared to 2019. Peru’s 81% approval rate is also a new high over the last six years: Between 2016 and 2020, the country’s approval rate remained between 58% and 73%. Similarly, Chile already doubled its new study permit applications this year compared to 2019, and the market’s 93% approval rate is a slight increase over its 90% average from 2016 to 2020.

Ecuador and Argentina are on track to nearly triple their pre-pandemic application totals. However, the approval rate for both countries has dipped below their recent norms. Ecuador has an approval rate of 68% this year after remaining between 71% and 86% from 2016 to 2020. Argentina has an approval rate of 69% after averaging a 77% approval rate from 2016 to 2020.

Mature international students are drawn to the college sector. Canadian institutions should leverage this and act now to remain competitive and attractive post-pandemic.

Key Takeaways

International education projects to only grow as the world moves forward post-pandemic. Approval rates for new study permits to Canadian universities and colleges have returned to pre-pandemic rates, and the approval rate gap between the two sectors is narrowing. This is occurring alongside study permit applications reaching new heights.

- As I wrote earlier this year, I am humbled by the fact that ApplyBoard students are more likely to be approved for a study permit. Expansion of our recruitment partners and partner school networks, as well as our ApplyBoard Counsellor Courses, enables us to help more students achieve their education goals.

- Recruitment partners should promote the approval rate growth to students. In addition, recruitment partners can leverage these positive trends by ensuring all required documents are included with the study permit application at time of submission.

- Student visa processing times are nearing pre-pandemic levels. Institutions and recruiters should promote these quicker turnaround times to attract more students.

- I also recommend that institutions assign extra resources to recruit students from emerging markets, particularly those with rapidly increasing study permit applications with continued high approval rates. These emerging markets may prove to be the next major players in international education.

Published: December 13, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United States, the United Kingdom, and Australia. Working with over 7,500 international recruitment partners, ApplyBoard has assisted more than 200,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. The terms student visa and study permit are generally used interchangeably for Canadian international students. Rather than student visas, Canada provides accepted international students with study permits, which allow those students to enroll in classes at Canadian institutions. When a student is accepted for a study permit, they are also usually provided with a visitor visa, which allows that student to enter Canada for their studies.

2. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC).

3. Note that the available data is for January to August.