Algeria remained one of the most stable markets for Canadian institutions in 2020, in spite of the global pandemic. The number of new Canadian study permits issued to Algerian students fell 41.3% in 2020.1 However, this remained well ahead of the 73.5% all-market decline and the 62.6% decline in the Middle East and North Africa (MENA) market.

In this edition of ApplyInsights, I’ll be analyzing study permit trends for Algerian students to evaluate how the Algerian market has shifted over time. I’ll also be looking at where and what Algerian students are studying in Canada, what roadblocks are currently preventing greater market growth, and what institutions can do to target this growing market.

Key Insights at a Glance

- Despite a 70.3% issued study permit decline across all markets, 19.3% more study permits were issued to Algerian nationals in 2020 than in 2018.

- The number of Algerian students applying for Canadian study permits increased by almost 400% from 2016 to 2020.

- Algerian student interest in English language education is growing due to increased global demands for multilingual graduates.

- New PR pathways for international graduates and French-speaking immigrants could increase Algerian student interest in Canada.

This is the second article in our ApplyInsights series exploring high-potential international student markets in Canada. Our first article in the series covered the growing Hong Kong market, and future installments will be available in the coming weeks.

Canadian Study Permit Applications and Approval Rate – Algeria

Canada received 9,557 study permit applications from Algerian nationals in 2020. This represented a 12.6% drop in applications from 2019. But it was a 75.5% increase from 2018, primarily because Canadian study permit applications from Algerian students more than doubled between 2018 and 2019. As a result of this impressive growth followed by relative stability, residents of Algeria submitted the fourth most applications for Canadian study permits among all markets in 2020.

From 2016 to 2020, the number of Algerian students applying for Canadian study permits increased by almost 400%.

This clearly shows that Algerian student interest in Canada is high and growing. The major roadblock preventing more Algerian students from studying in Canada has been low study permit approval rates. In 2019, Algerian student study permits were approved at a rate of 22.6%. In 2020, that rate fell to 14.9%. Though this decline was in line with the 8.9% drop in the all-market approval rate, it was higher than the 4.9% decline in the MENA market approval rate.

The table below summarizes the year-over-year changes in the Algerian market:

| 2019 | 2020 | Change | ||

|---|---|---|---|---|

| Algeria | Applications | 10,936 | 9,557 | -12.6% |

| Approvals | 2,476 | 1,425 | -42.4% | |

| Approval Rate | 22.6% | 14.9% | -7.7% | |

| All Markets | Applications | 425,990 | 220,932 | -48.1% |

| Approvals | 256,216 | 113,304 | -55.8% | |

| Approval Rate | 60.1% | 51.3% | -8.9% |

Canadian Study Permits Issued – Algeria

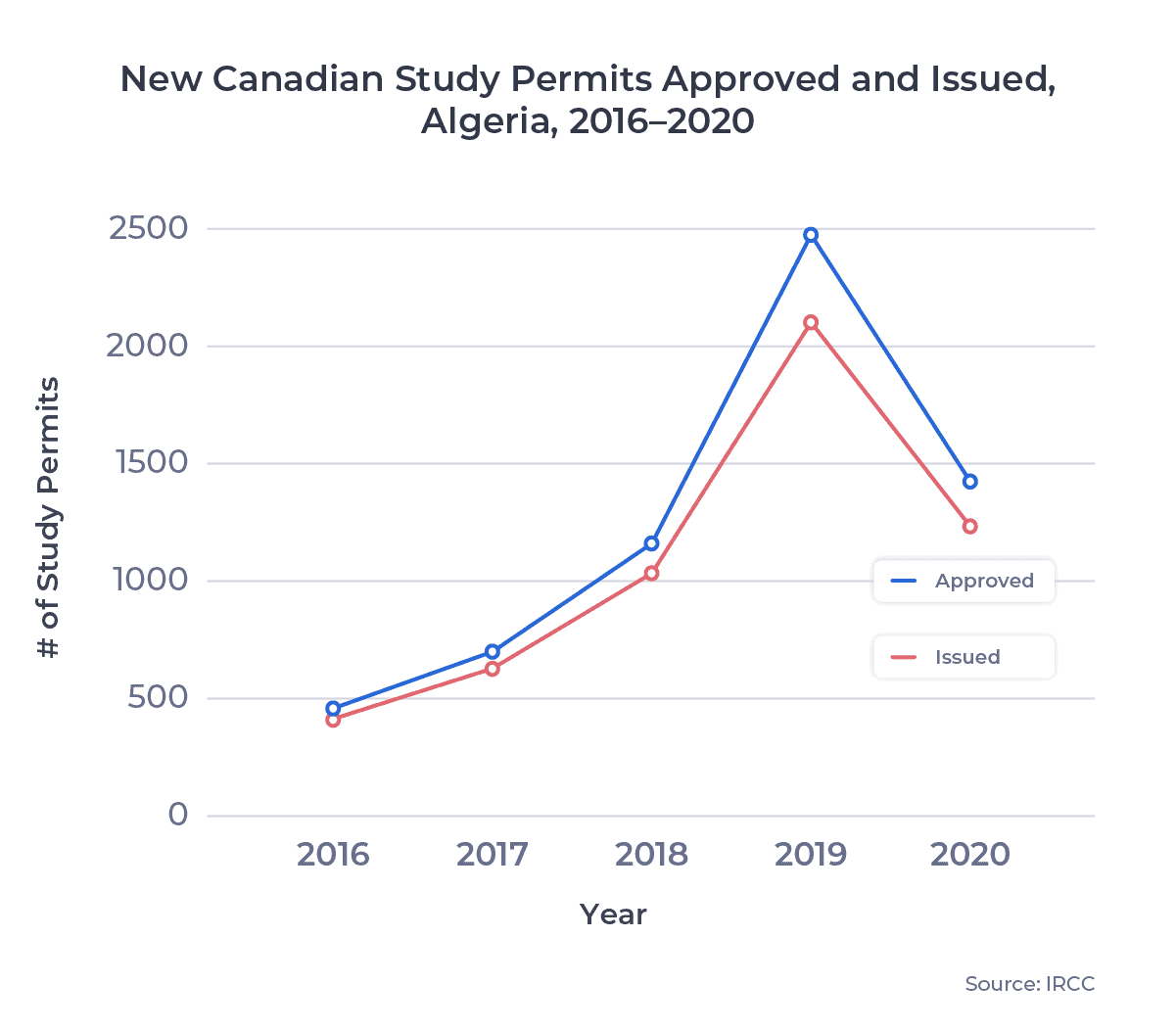

As I noted in the previous Canadian study permit article about the Hong Kong market, study permits approved and study permits issued are different. An applicant with an approved study permit may not be issued a study permit for a variety of reasons. From 2016 to 2019, 95% of study permits approved were issued. But in 2020, this rate fell to just 57%, primarily due to travel restrictions and pandemic-related uncertainty.

Algerian students largely avoided this significant decline in study permits issued, with study permit issued-to-approved rates remaining above 85%. The chart below presents a comparison between study permits approved and issued for Algerian nationals:

This high issued rate has helped Algeria remain a growing market for Canadian institutions. In fact, 19.3% more study permits were issued to Algerian nationals in 2020 than in 2018, compared to a 70.3% decline across all markets. Algeria was the only major source market that saw growth between 2018 and 2020, as the table below shows:

| Source Market | 2018 | 2019 | 2020 | % Change, 2018–2020 |

|---|---|---|---|---|

| Algeria | 1,034 | 2,103 | 1,234 | +19.3% |

| Hong Kong (SAR China) | 986 | 975 | 951 | -3.5% |

| Morocco | 1,409 | 2,128 | 1,162 | -17.5% |

| Tunisia | 716 | 879 | 545 | -23.9% |

| Philippines | 2,932 | 4,811 | 1,830 | -37.6% |

| Colombia | 2,511 | 3,281 | 1,338 | -46.7% |

| Côte d’Ivoire | 592 | 809 | 297 | -48.8% |

| Democratic Republic of the Congo | 591 | 903 | 291 | -50.8% |

| Cameroon | 747 | 971 | 328 | -56.1% |

| Nigeria | 2,565 | 3,043 | 1,062 | -58.6% |

| * Minimum 500 study permits issued in 2018 | ||||

Algeria was also a highly resilient market throughout the early months of the pandemic. The average year-over-year issued study permit decline for all source markets was 73.5%. By comparison, the Algerian market lost only 41.3% in 2020. This made Algeria the fourth most resilient Canadian market in 2020, behind only Hong Kong, Tunisia, and Sri Lanka.

Canadian Study Permits Issued by Province – Algeria

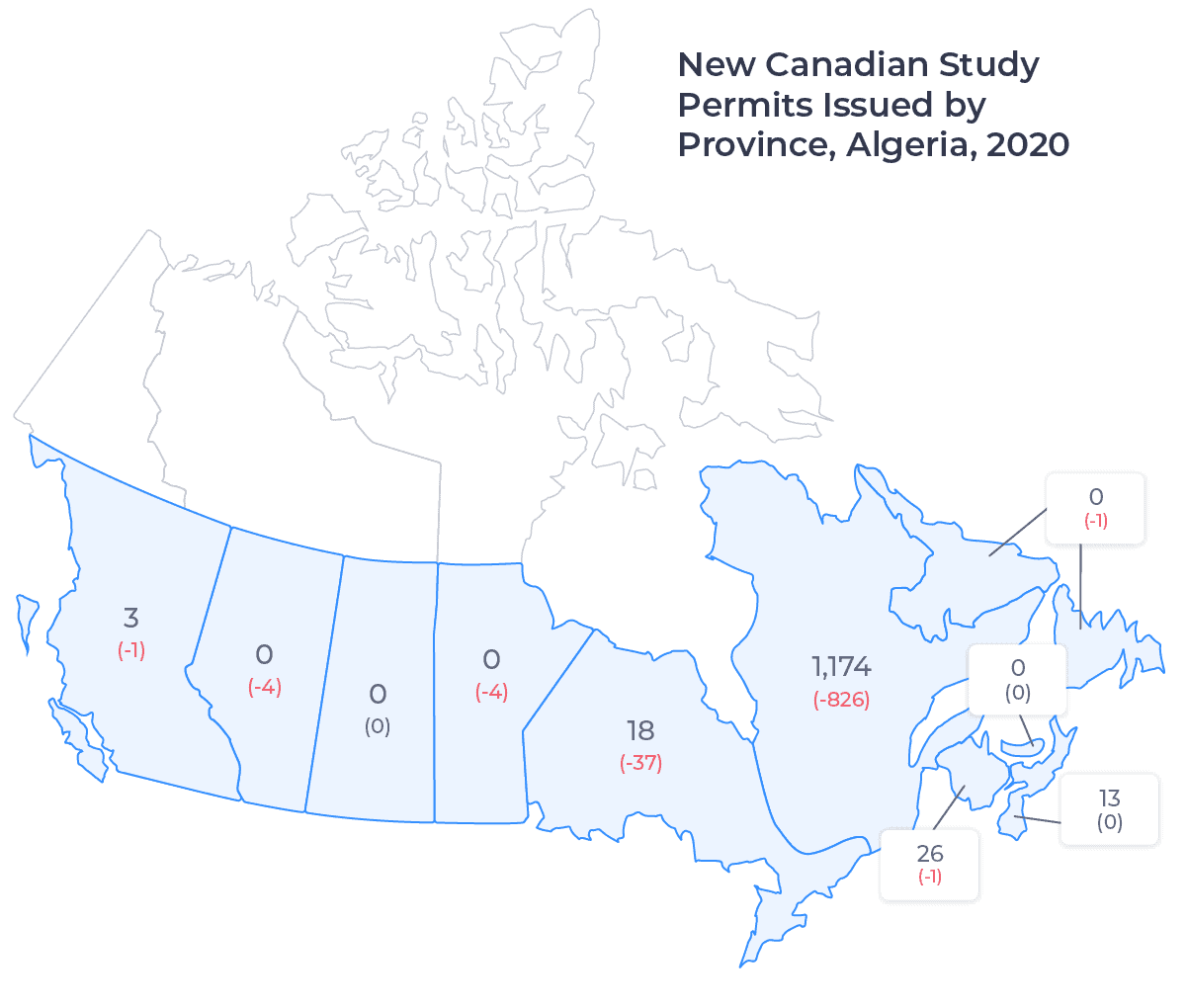

The map below shows the number of study permits issued to Algerian students for studies in each of Canada’s 10 provinces in 2020. It also includes the change in study permits issued between 2019 and 2020:

Quebec has always been the primary Canadian destination for Algerian students. Though French is no longer an official language of Algeria, it remains widely used and understood throughout the country. This means that Algerian students are often able to avoid paying international student fees at Quebec-based institutions, making studying in Quebec significantly more affordable. These factors helped Quebec attract 2,000 Algerian students in 2019 and 1,174 Algerian students in 2020, accounting for over 95% of study permits issued to Algerian nationals in each year.

Within Quebec, Algerian students dominantly chose to attend constituent universities of the Université du Québec system. In 2020, over 73% of Algerian students issued Canadian study permits studied at Université du Québec schools. Around half of those students enrolled at l’Université du Québec à Trois-Rivières (UQTR), with many studying applied science or business and commerce.

The next most popular provincial destination for Algerian students, New Brunswick, only accounted for 2% of all study permits issued to Algerian nationals in 2020. At the same time, there was a significant decline in new Algerian students in Ontario. In both Ontario and New Brunswick, Algerian students largely elected to attend French-language and bilingual universities, such as the University of Ottawa, Laurentian University, and l’Université de Moncton.

Canadian Study Permits Issued by Study Level – Algeria

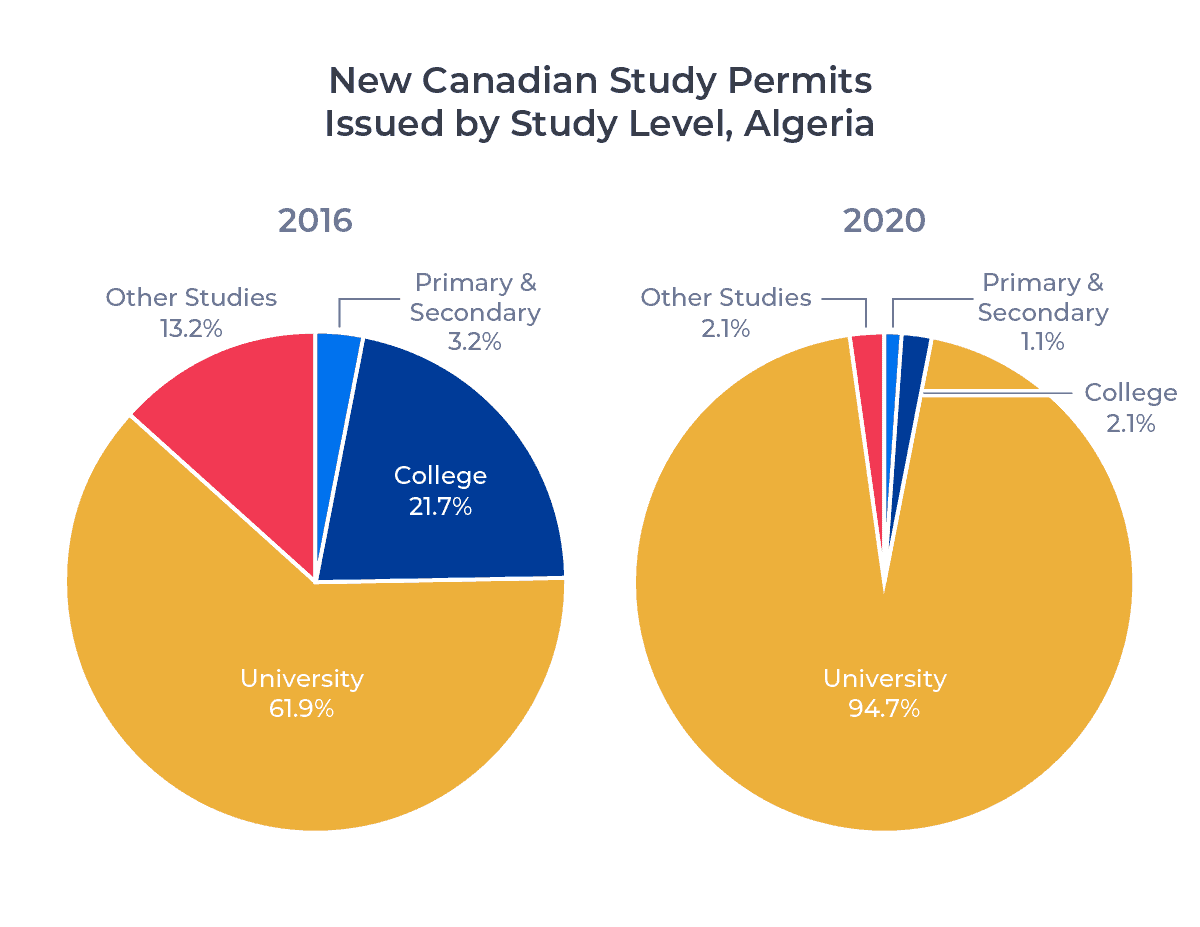

The circle charts below show the change in the distribution of study permits issued to Algerian students by study level in 2016 and 2020:

University remains the primary draw for Algerian students, who value the perceived career and financial stability associated with completing a university degree. This is why, by 2020, university students were far and away the most represented from the Algerian market. The market share of study permits issued to Algerian university students increased by 32.8% from 2016 to 2020, hitting 94.7% in 2020. Algeria had the highest proportion of university students among all major source markets in 2020.2

Around 63% of all university study permits issued to Algerian nationals in 2019 and 2020 were for bachelor’s degree programs. By comparison, Algerian master’s degree students received approximately 32% of all study permits issued to Algerian students in both 2019 and 2020.

Study Permit Approval Rates Limiting Market Growth

Many markets have shown that young adults are less likely to proceed with study abroad plans due to the pandemic. But for Algeria, the number of university study permit applicants fell only 6.7% from 2019 to 2020. The main driver of year-over-year issued study permit decline was lower acceptance rates.

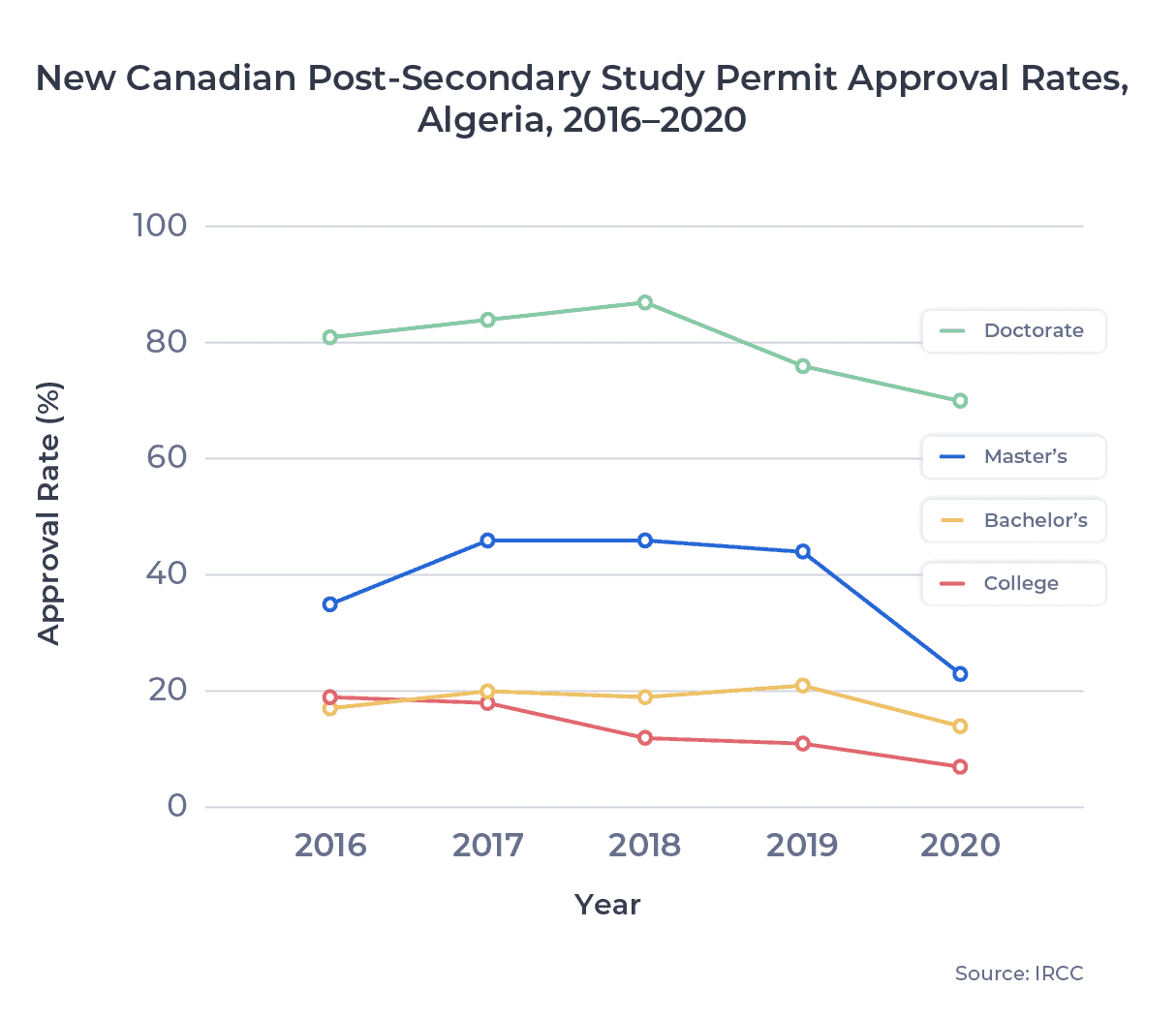

The chart below shows the approval rate for post-secondary study permits for Algerian students over the past five years:

College study permit approval rates for Algerian students have been below 20% for many years. This likely reflects a trend of Algerian students with university degrees applying for college post-graduate programs, which often results in additional application scrutiny. But Algerian study permit approval rates for bachelor’s degrees fell from 21% in 2019 to 14% in 2020, and master’s degree approval rates fell from 43% to 23%. This was likely partially caused by Algerian students being unable to prove sufficient financial resources due to significant economic contraction during the pandemic and government-imposed limits on financial transfers.

Interest in English Language Education on the Rise in Algeria

The good news for the university sector across Canada is that Algeria is likely to be a growing opportunity post-pandemic.

Many Algerians speak at least two languages, including French. From speaking with our network of partners in Algeria, there is growing interest among Algerian students in pursuing English language education abroad. By completing a degree in English, Algerian students can reinforce their multilingual skills and become more desirable employees in the workforce. As more companies expand their global presence and try to reach out to more diverse communities, the demand for multilingualism will continue to grow.

As a result of these job market factors, an increasing number of Algerian students are looking to study at English-language institutions abroad. The UK has become an especially attractive destination for Algerian nationals because of its short student visa processing times and high visa approval rates. Algerian students looking to emigrate abroad and obtain permanent residency (PR) or citizenship have also been attracted to the UK’s new two-year post-study work visa. This could pose a risk to future market growth for Canadian schools, if they aren’t proactive in promoting Canada’s Post-Graduate Work Permit Program (PGWPP) and PR pathways.

Key Takeaways

The recent announcement that Canada will offer six new pathways to permanent residency in 2021 may increase Algerian student interest long-term. This year, Canada will be accepting permanent residency applications from international students who graduated from Canadian education institutions. Though the pool for English language students will be capped at 40,000 applications, there is no such limit for bilingual or French-speaking students. This means that Algerian graduates are prime candidates for these new residency pathways. If these programs are extended, they could offer a strong opportunity for Algerian students to settle in Canada after their studies.

Canadian institutions, especially Canadian universities, should look to take advantage of the growing interest in English language education from the Algerian market post-pandemic. Algerian students want to see the value of their language skills in their post-education pathway. Promoting potential in-demand careers in local communities, especially for multilingual individuals, will help draw Algerian students towards non-Quebec destinations.

The Algerian French-language market is also poised for continued growth. Institutions with French-language or bilingual program offerings should look at Algeria as a present and future growth market. These institutions would also benefit from highlighting career advancement opportunities for multilingual individuals, especially in places where French-English bilingualism is more common.

Institutions looking to recruit Algerian students should:

- Promote Canada’s Post-Graduate Work Permit Program (PGWPP) and other pathways to PR, including new bilingual and French language graduate pathways, for Algerian students and graduates.

- Work with their recruitment partners in Algeria to increase their understanding of study permit application approval factors, including ensuring students are applying for programs that improve their credentials.

- Detail local post-education career opportunities, especially for multilingual individuals, in marketing materials for use in-market.

Published: April 19, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. Statistics used in this article are for new study permits only. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC), except where noted.

2. Minimum of 500 study permits issued across all study levels in 2020.