This edition of ApplyInsights is the first in a series of articles examining the international education market in various Canadian provinces. In this article, I’ll be taking a close look at trends in study permits issued in the province of Ontario.

Here’s what this blog post will cover:

- A comparison of study permit trends in Ontario and Canada’s other provinces

- A breakdown of study permit holders in Ontario by study level

- Top source countries for study permit holders in Ontario, including the study levels and schools at which those students are studying

- A summary of my findings and thoughts about the future

Let’s start by looking at how international student enrollment in Ontario compares to the rest of Canada.

Study Permit Holders: Ontario vs. All of Canada

Ontario is the most popular destination for international students in Canada, with 198,570 study permits issued in 2019. This represented 49.1% of all Canadian study permits issued that year.

From 2015 to 2019, the total number of study permit holders in Ontario more than doubled. In fact, growth in the Ontario market outpaced the growth in Canada as a whole over the same period.

The following table breaks down this growth in more detail:

| Growth 2015–2016 | Growth 2016–2017 | Growth 2017–2018 | Growth 2018–2019 | 4-Year Growth | |

|---|---|---|---|---|---|

| Ontario | 28.8% | 25.6% | 12.1% | 13.9% | 106.6% |

| All of Canada | 20.7% | 19.2% | 12.6% | 13.8% | 84.5% |

Both Ontario and Canada as a whole saw robust growth from 2015 to 2019. Growth rates of over 25% between 2015 and 2017 drove Ontario’s exceptional performance, with both the Ontario and Canada rates settling into the 12 to 14% range over the following two years.

Total growth from 2015 to 2019 was 106.6% for Ontario, while Canada as a whole came in at 84.5%.

Study Permit Holders in Ontario by Study Level

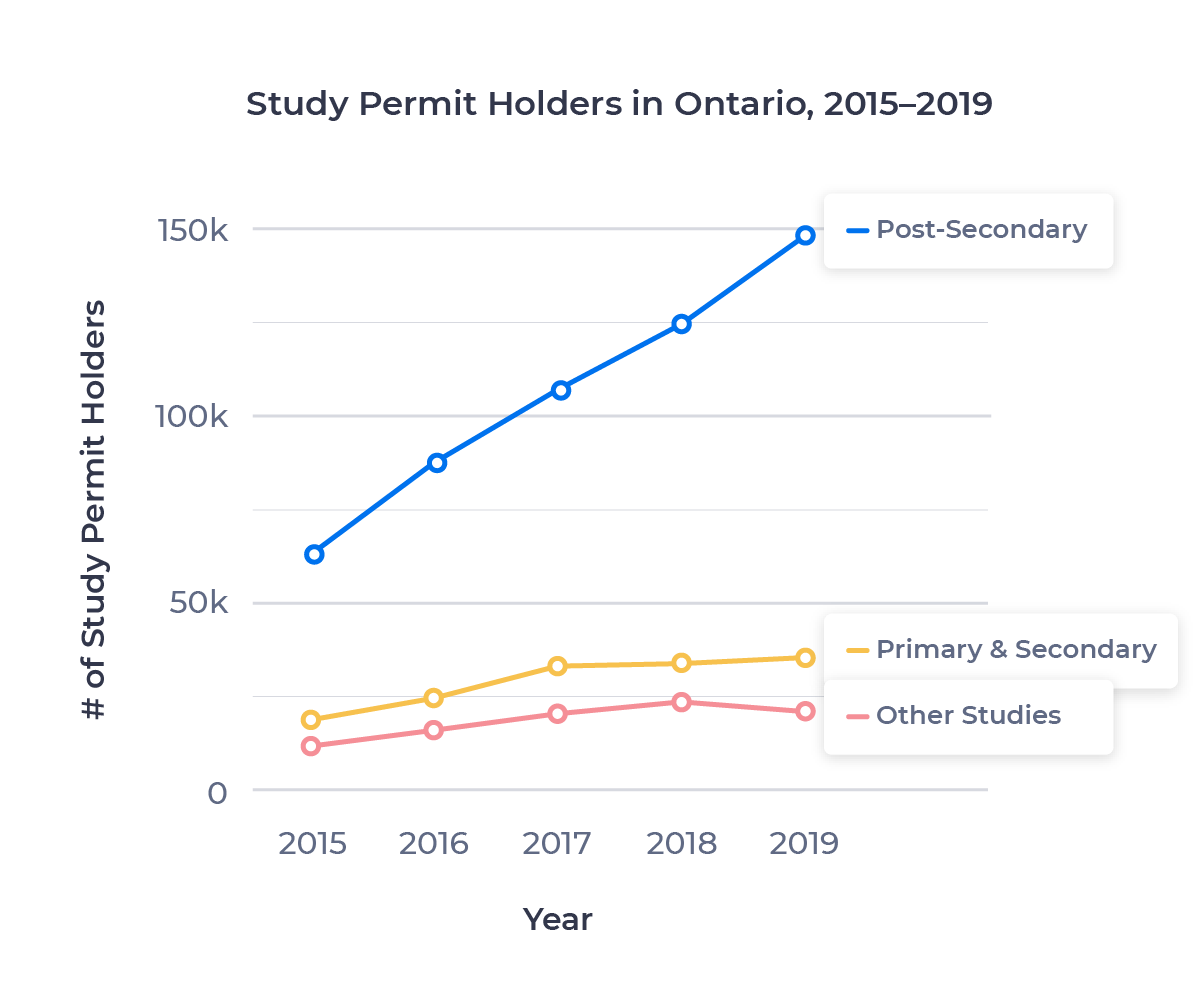

The growth in study permit holders in Ontario was not uniform across study levels. We saw strong four-year growth in the primary and secondary category (55.3%), as well as the other studies category (76.3%), which includes language training programs and any spouses or children of international students that hold a study permit themselves. However, an explosion in post-secondary enrollment drove much of the growth in Ontario’s international student market.

The figure below shows growth between 2015 and 2019, broken down by study level:

As the figure shows, post-secondary study permit holders were up 128.4% over the period. While some of that growth was concentrated in 2015 to 2017, the sector rebounded from a weaker year to post 19.0% growth between 2018 and 2019.

Primary and secondary growth slowed to single digits from 2017 to 2019, while study permits for other studies actually decreased 7.5% between 2018 and 2019. I suspect the drop for other studies is a blip. Look for the sector to rebound in line with the other sectors post-COVID-19, driven by growth at Ontario’s strong language schools.

Top Source Countries for Ontario Students

Next, I’d like to take a look at the source countries that are sending the most international students to study abroad in Ontario.

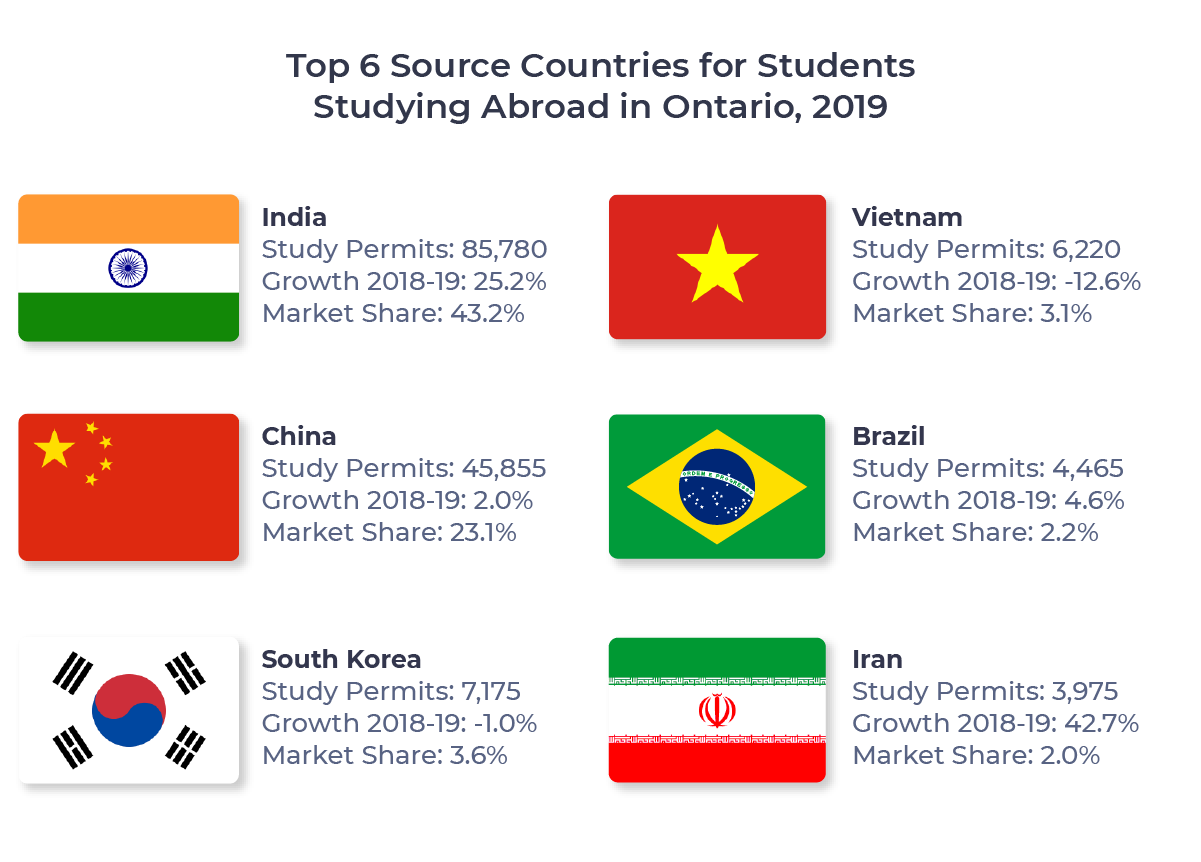

The following figure provides a summary:

Led by India and China at 43.2% and 23.1%, respectively, these six countries together supplied just over three-quarters of Ontario’s international student population in 2019, 153,470 students in total.

Let’s take a look at each source country in detail.

India

India is the runaway leader in supplying international students to Ontario. 85,780 Indian students held study permits in the province in 2019, representing a 43.2% market share. This runs ahead of India’s share of the full Canadian market, where it is still number one at 34.6%. 61.4% of Indian students in Canada chose Ontario as their destination in 2019, well above the all-countries average of 49.1%.

Despite already being the leading supplier of international students to Ontario, the province’s Indian student population continues to skyrocket. This segment grew 25.2% between 2018 and 2019.

Indian Students in Ontario by Study Level

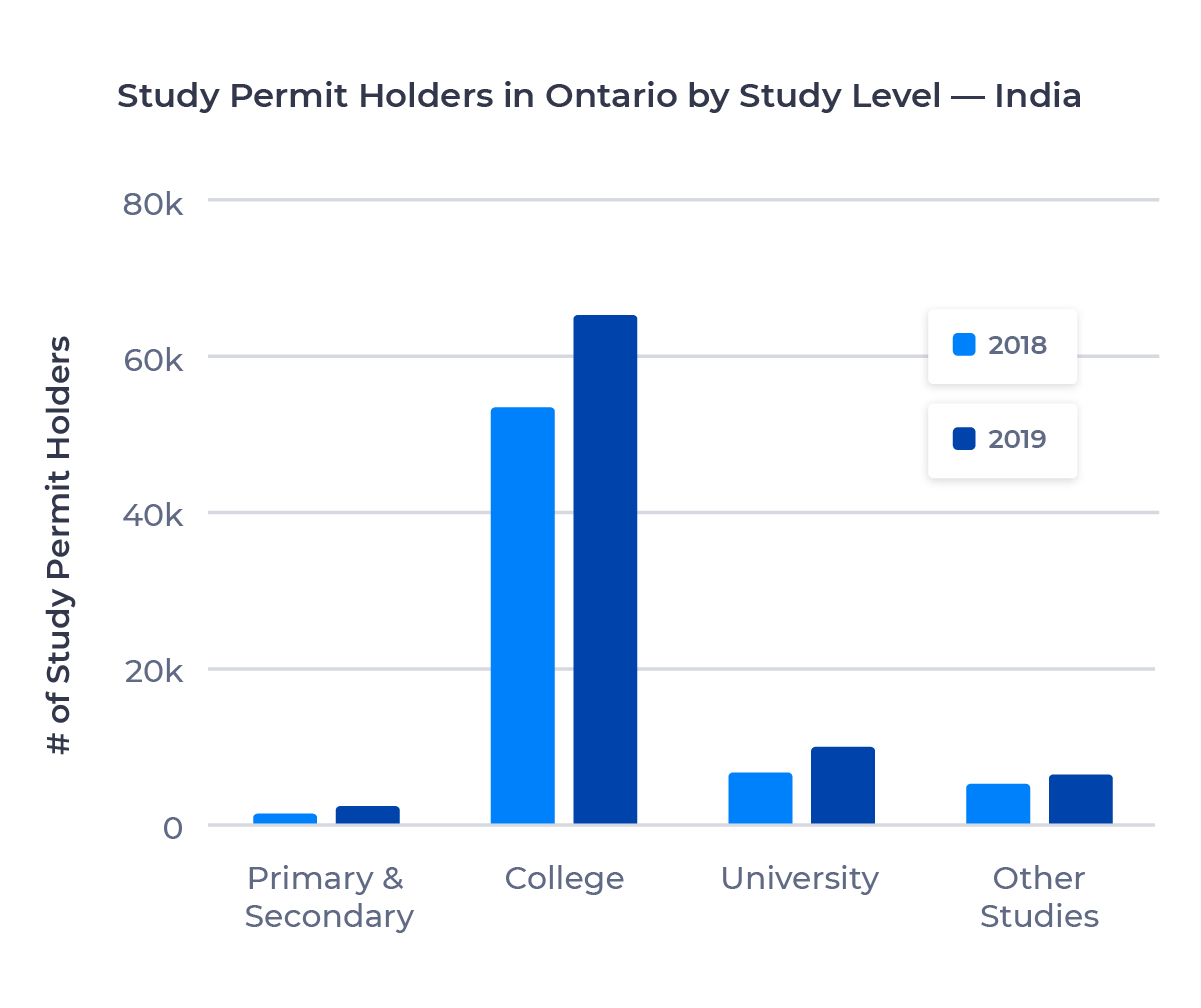

The figure below shows the breakdown of Indian students in Ontario by study level:

The vast majority (77.9%) of Ontario’s Indian students attended college in 2019, while only 11.7% were enrolled in university. However, study permits issued to Indian university students increased almost 50% between 2018 and 2019, suggesting we may see the universities begin to close that gap post-COVID-19.

Primary and secondary students made up just 2.0% of Indian students in Ontario in 2019, but again, there was robust growth in the sector—71.3% year-over-year. India is unique among top source countries in that it sent very few students to language training programs.

Top Ontario Schools for Indian Students

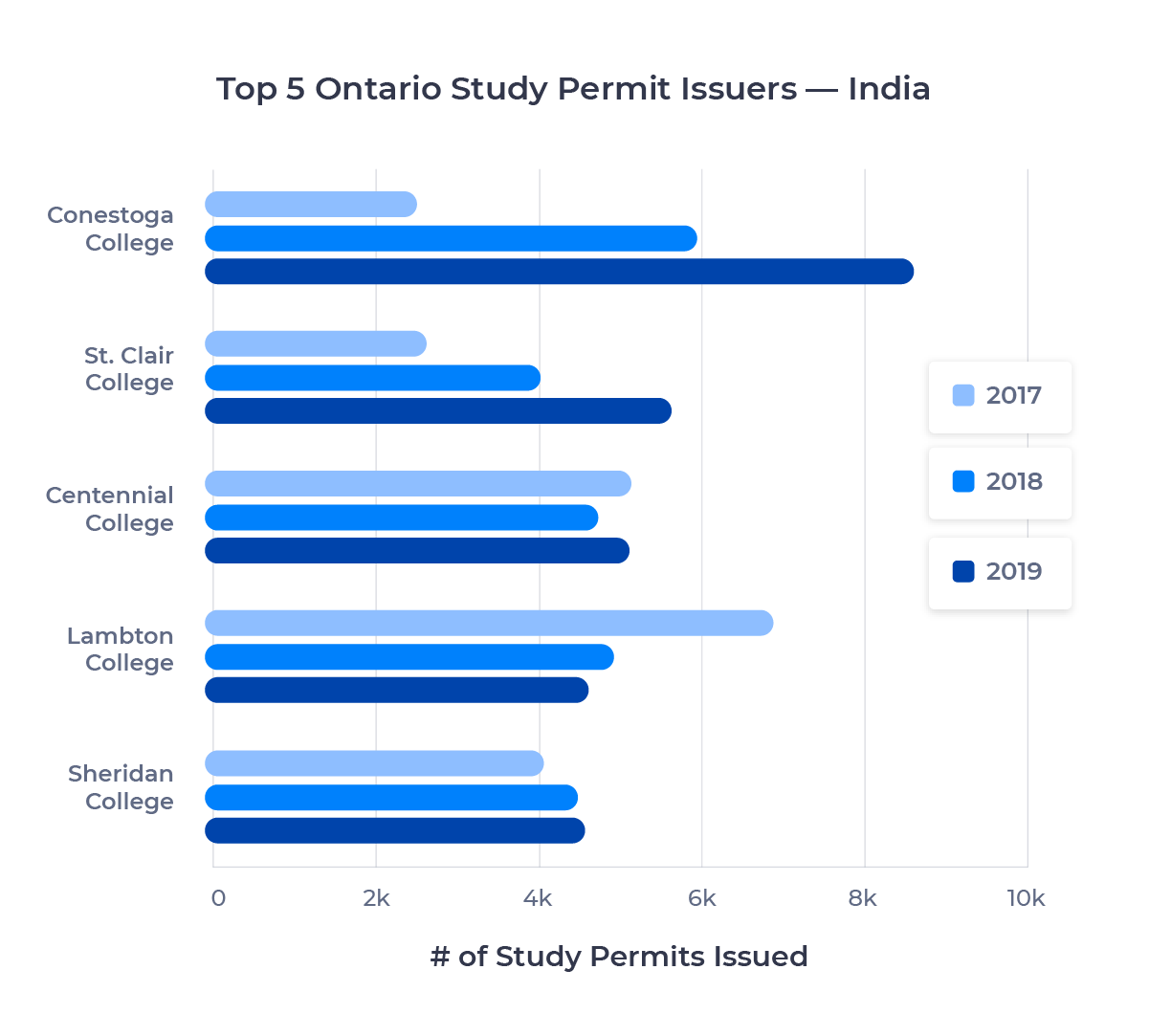

The 16 most popular Ontario schools for Indian nationals last year were colleges. Let’s take a closer look at the top 5:

Conestoga College rose from the eighth-most-popular Ontario institution in 2017 to lead the pack in 2019, growing more than 250% over the two years. The 8,560 Indian students at Conestoga last year comprised the largest segment of international students at any Ontario school across the sample. St. Clair College grew 116% over the same time frame, while Lambton College went the other way, shrinking 33% between 2017 and 2019.

Among universities, the University of Windsor was the top school, with 1,823 students. Algoma University grew from just 9 Indian students in 2017 to 1,052 in 2019.

For a wider look at trends in the Indian student population across Canada, check out the in-depth look I took back in March in ApplyInsights: India.

China

China is comfortably the number two provider of international students to Ontario, sending 46,645 students to study in the province in 2019. This accounts for a 23.1% market share, just ahead of China’s share of the full Canadian market (21.0%). 54.1% of all Chinese students in Canada came to Ontario to study, a cut above the all-countries average of 49.1%.

Ontario’s Chinese enrollment saw modest 2% growth between 2018 and 2019.

Chinese Students in Ontario by Study Level

The figure below breaks down Chinese students in Ontario by study level:

China is far and away the top supplier of university students in Ontario, sending 21,205 study permit holders in 2019. That was good for 10.2% growth in China’s university population year-over-year, a significant contrast with the primary and secondary, college, and other studies sectors, all of which shrank between 2018 and 2019. Despite this decrease in other studies enrollment, China remains the number one source country for ESL and other language training programs in Ontario, with 4,770 study permits issued in 2019.

Based on this data, I’m comfortable predicting that a university education will continue to be the key draw in Ontario for Chinese students moving forward.

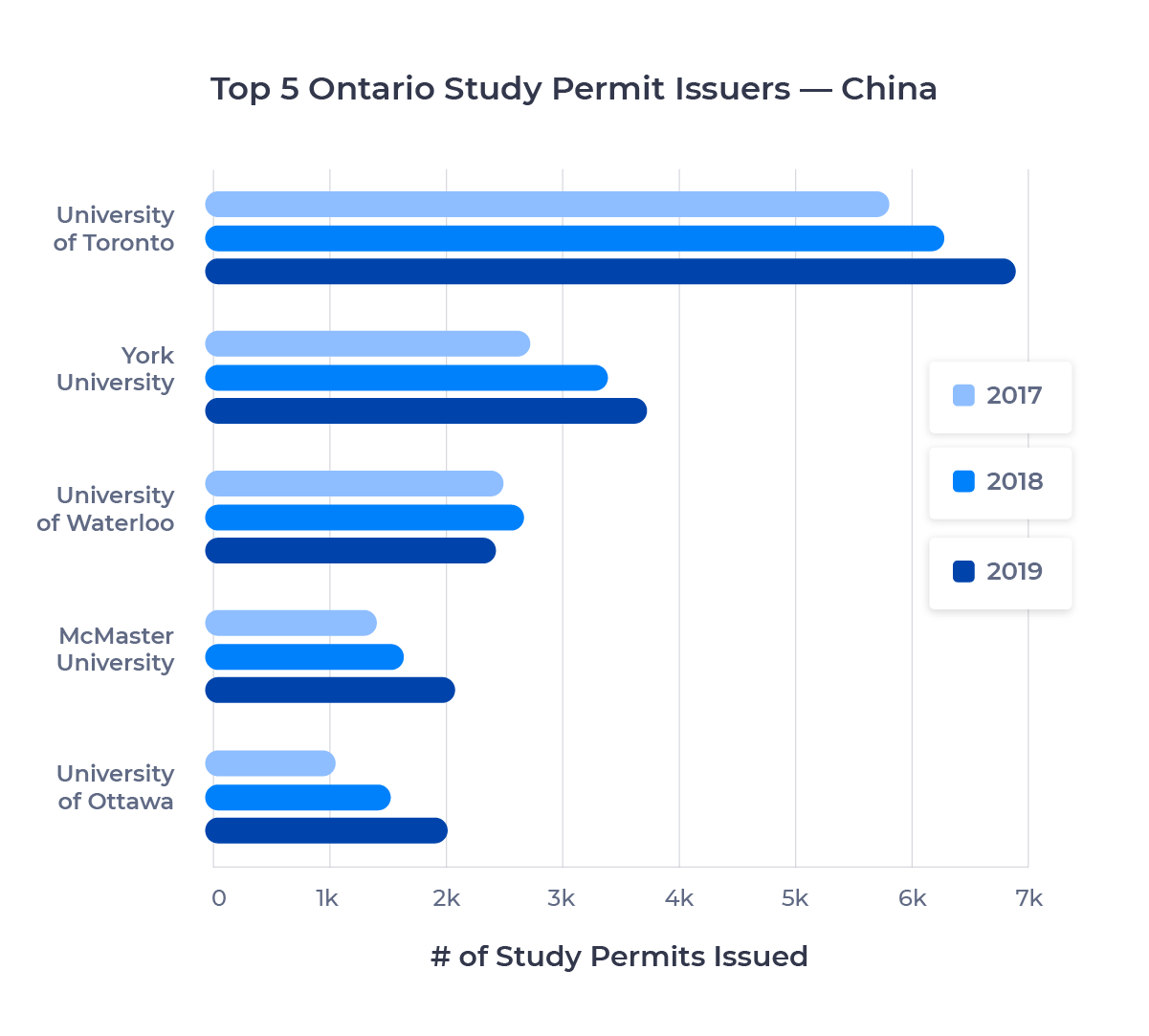

Top Ontario Schools for Chinese Students

The top five institutions for Chinese students in 2019 were all universities:

Two Toronto universities, the University of Toronto and York University, were the top two draws for Chinese students in Ontario in 2019. With 6,891 students, the University of Toronto’s Chinese contingent formed the second-largest segment of international students at any Ontario school. The University of Ottawa saw more than 90% growth between 2017 and 2019 to climb into the top five.

The top three colleges for Chinese students in 2019 (Seneca College, Centennial College, and George Brown College) are also based out of the Greater Toronto Area (GTA). Seneca led the way with 1,109 students. However, all three schools saw their Chinese enrollment shrink over the sample.

This data supports what I’ve heard from ApplyBoard’s recruitment partners. In choosing where in Canada they want to study, Chinese students are driven by location and school ranking (the University of Toronto was the highest-ranked Canadian school in the recent ARWU 2020 list), favouring large metro areas like the GTA over smaller cities.

For more observations and analysis on Chinese students studying in Canada, check out my recent deep dive on the topic, ApplyInsights: China.

South Korea

As source countries for international students, India and China are in a class of their own, together supplying almost two-thirds of Ontario’s study permit holders. South Korea leads the next tier of source countries. It sent 7,175 students in 2019, good for a 3.6% market share. 42.1% of South Korean students in Canada studied in Ontario in 2019, well below the all-countries average of 49.1%.

South Korean enrollment in Ontario schools shrank 1.0% in 2019 despite growing Canada-wide.

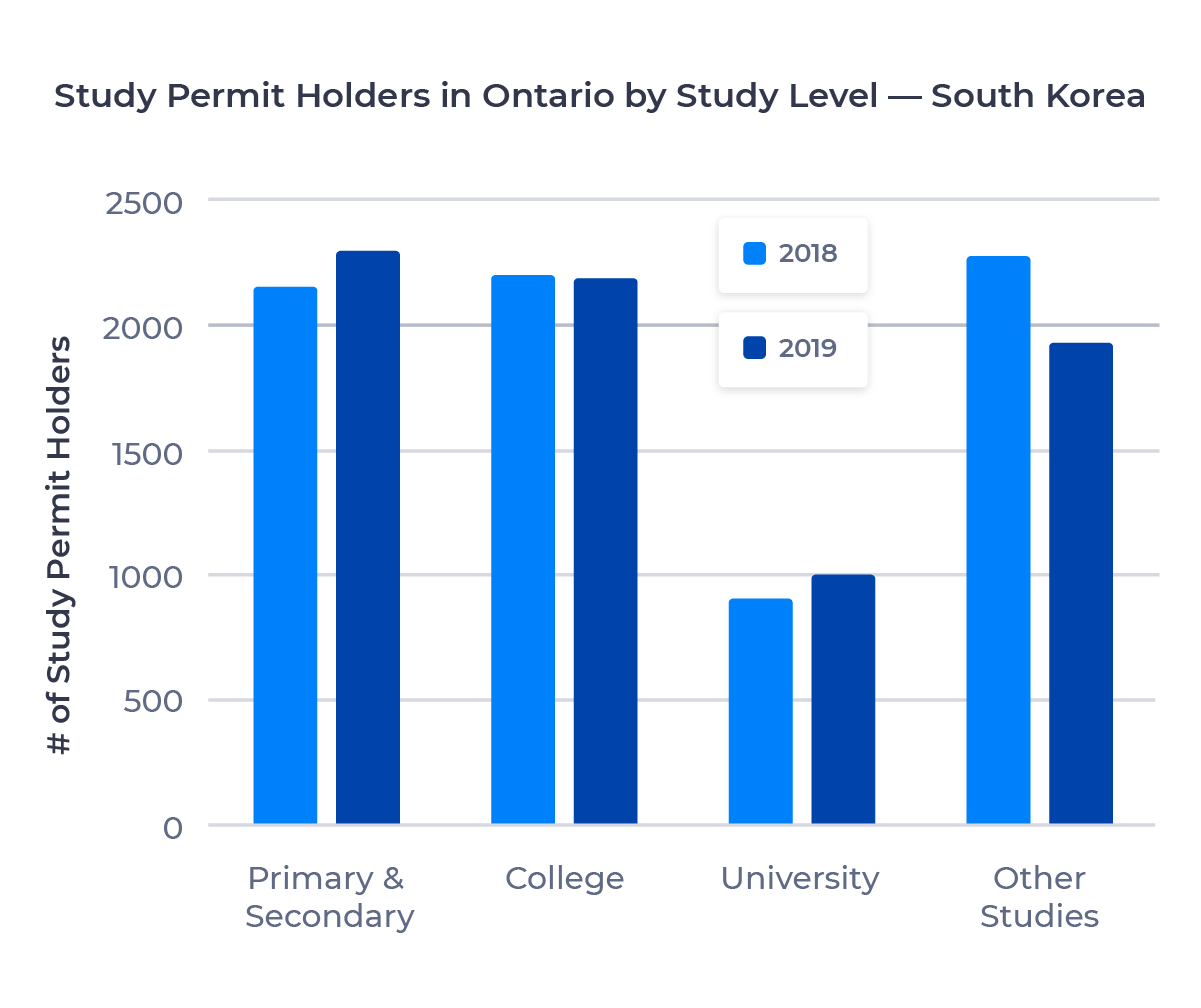

South Korean Students in Ontario by Study Level

For a breakdown of South Korean students by study level, see the figure below:

South Korean students are fairly evenly distributed across the primary and secondary, college, and other studies study levels. The university sector is the laggard. However, university was the fastest-growing sector for South Korean students in 2019, at 10.4% growth year-over-year.

While other studies numbers fell in 2019, that sector remains 30.2% of the study permit market for South Korean nationals. This signifies the large draw that Ontario’s language training programs are for students from South Korea. These schools enrolled 1,915 South Korean students in 2019.

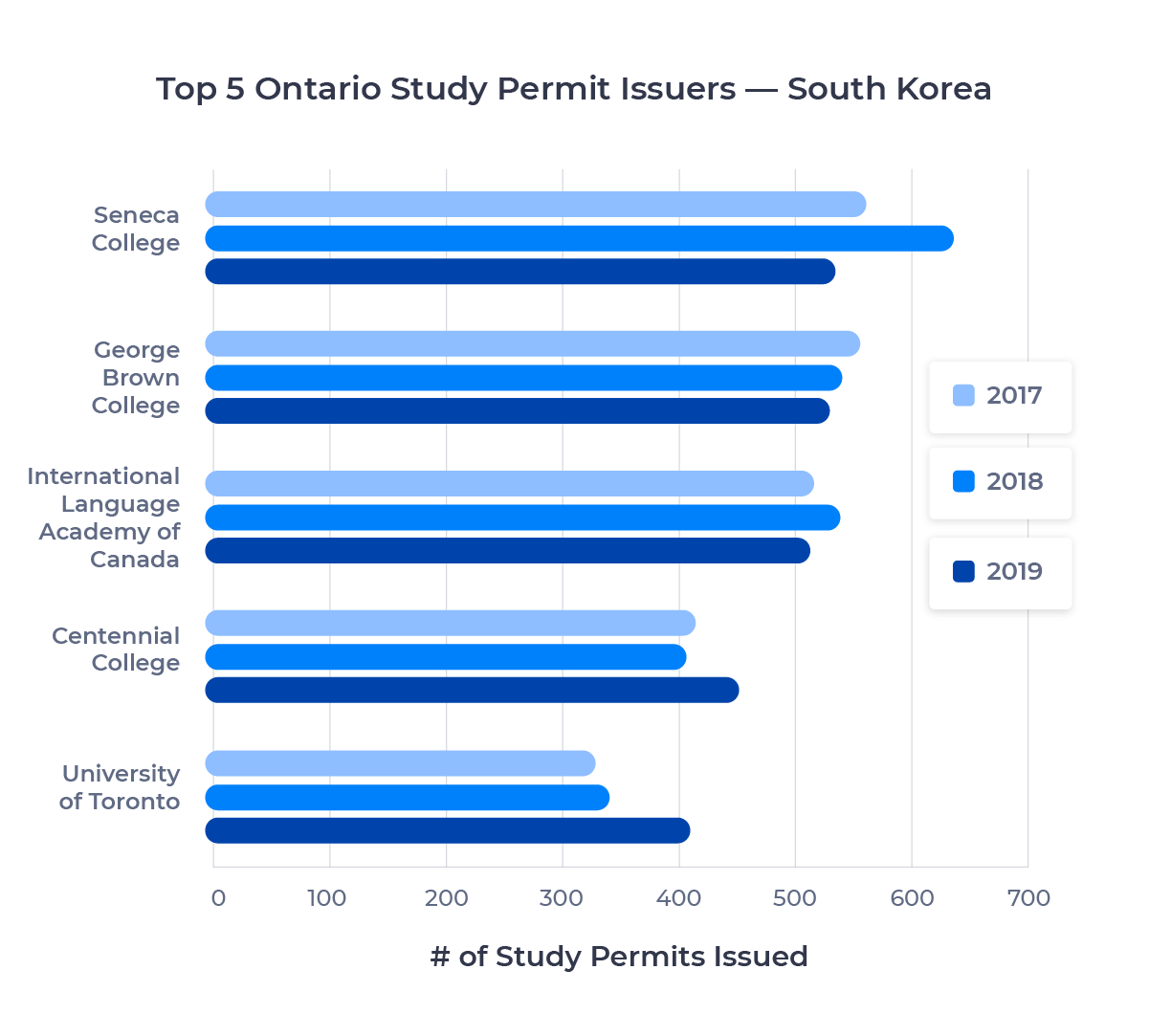

Top Ontario Schools for South Korean Students

The top five schools for South Korean students in 2019 were as follows:

Three of the schools are colleges, with Seneca and George Brown leading the way. But the top takeaway here is that the top five institutions for South Korean students in 2019 are based in the GTA.

We again see the appeal of language training programs to the South Korean market. The International Language Academy of Canada (ILAC) is a private language school with six boutique-style campuses in Toronto. Four other language schools joined it in the South Korean top 20: ILSC Toronto (8th), English School of Canada (11th), EC Toronto (16th), and Kaplan International English (17th).

The University of Toronto was the top university for South Korean nationals. It issued 412 study permits in 2019 and saw 25.2% growth from 2017 to 2019.

The data for South Korea is noisy, with various institutions both adding and losing students over the 2017 to 2019 period. I’ll be monitoring the South Korean market carefully going forward to see what trends emerge post-pandemic.

Vietnam

6,220 Vietnamese students came to Ontario to study in 2019. That made Vietnam the fourth-largest source country for international students in Ontario, but it represented a 12.6% decline in students. This was easily the most significant drop among the top six source countries.

Vietnam’s share of the Ontario market was 3.1%, down from 4.1% in 2018. 53.2% of Vietnamese students coming to Canada studied in Ontario in 2019, ahead of the all-countries average of 49.1%.

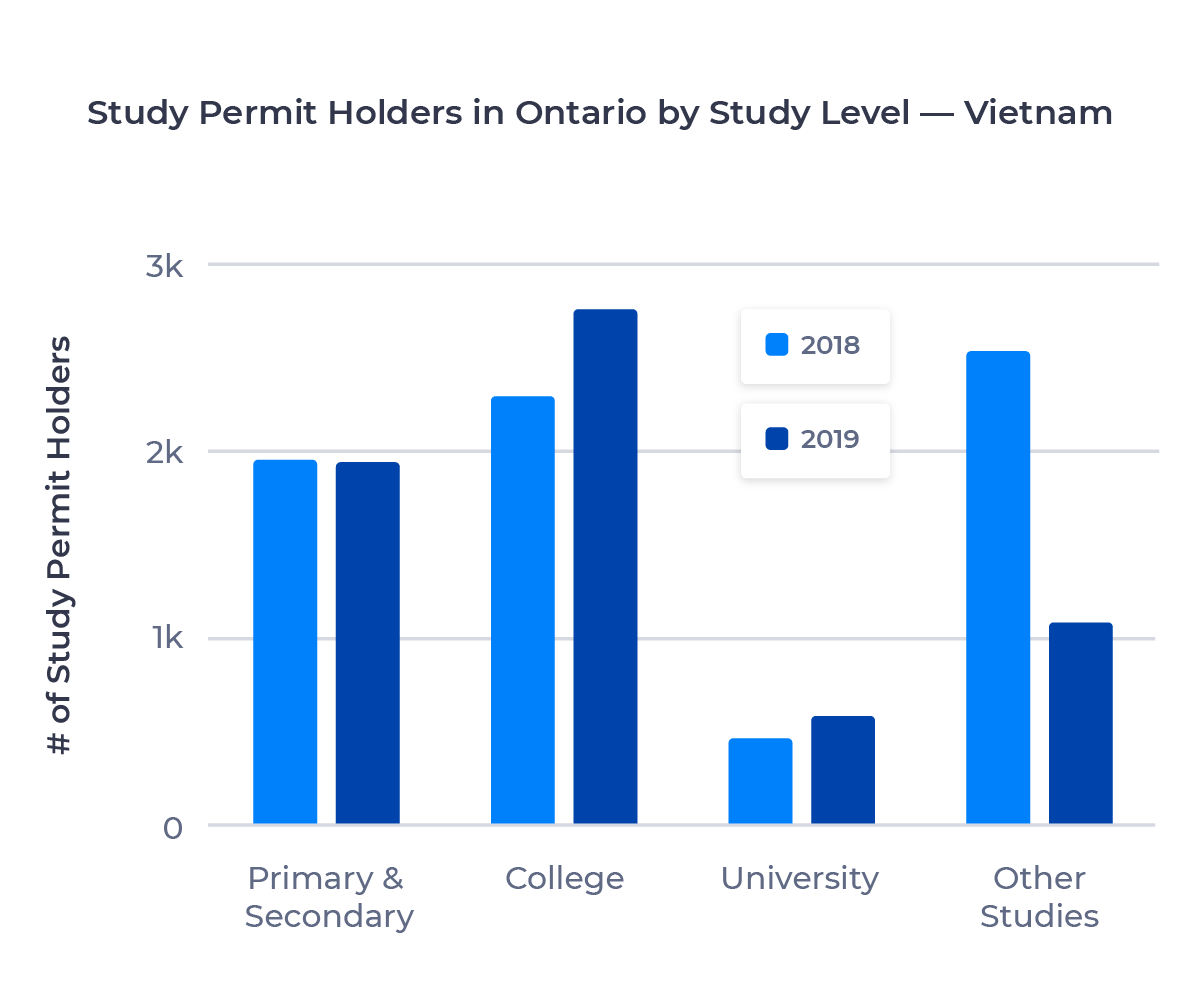

Vietnamese Students in Ontario by Study Level

The figure below shows Vietnamese students in Ontario by study level:

In 2019, college passed other studies to become the top draw for Vietnamese students studying in Ontario, posting 20.1% growth year-over-year. University students remain just a small percentage of the Vietnamese segment, but there was strong growth (25.3%) in that sector as well, and I expect this to continue post-pandemic. The biggest story in this data is the huge drop in other studies enrollment, where the number of students in language training programs shrunk by more than half.

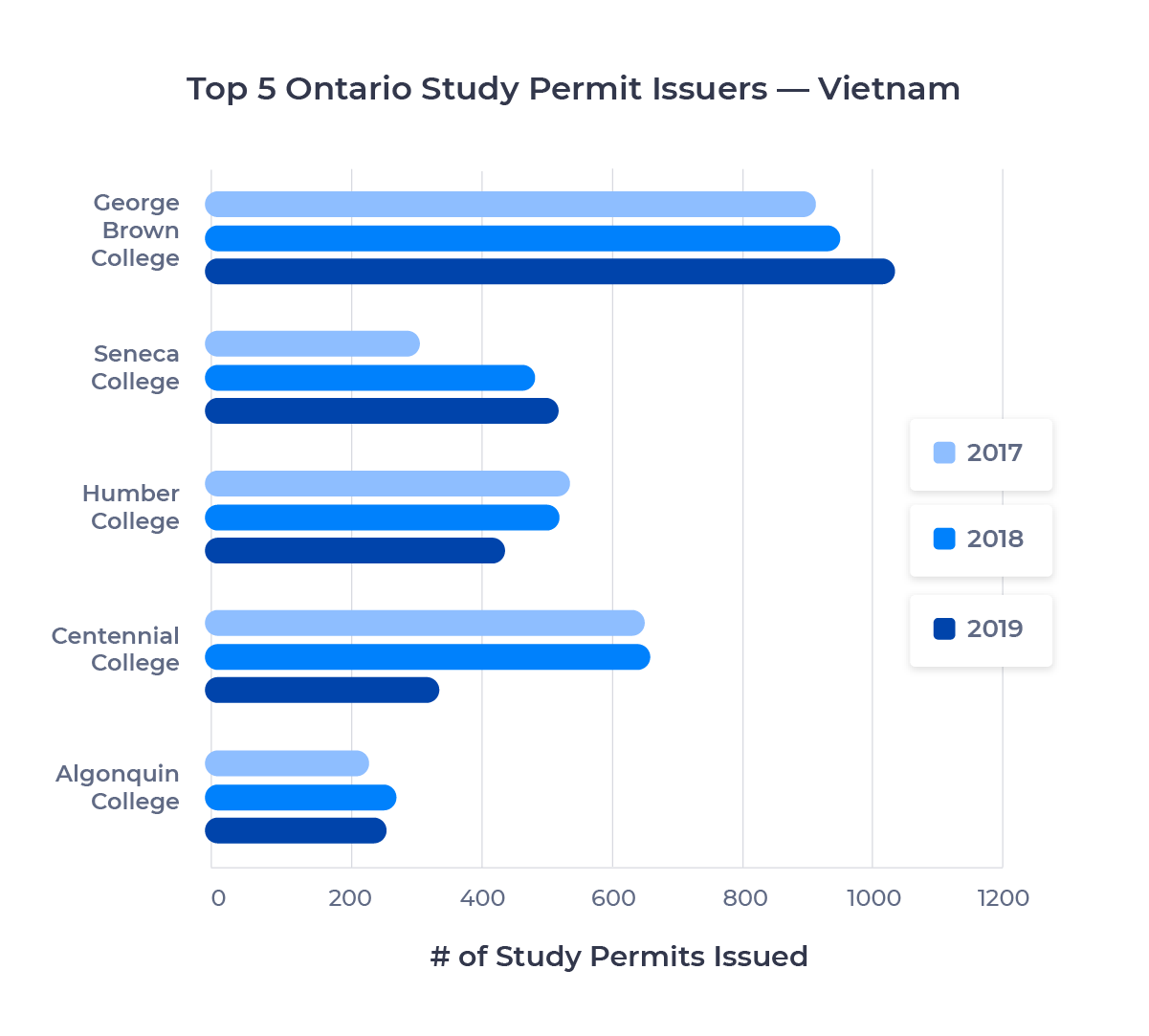

Top Ontario Schools for Vietnamese Students

Here are the top five institutions for Vietnamese students in 2019:

It’s a list dominated by Toronto colleges, with only Ottawa’s Algonquin College sneaking into the top five from outside the GTA. Vietnamese enrollment at George Brown and Seneca grew over the sample (13.3% and 67.4%, respectively), while it shrunk at Humber and Centennial, the latter by almost 50%.

Toronto’s three universities, York, Ryerson, and the University of Toronto, led the university contingent, with York (127) and Ryerson (115) both topping 100 students.

In total, 8 of the top 10 schools for Vietnamese students are based in the GTA. This suggests that Vietnamese students, like Chinese students, are attracted to large, cosmopolitan cities.

Brazil

Brazil sent 4,465 students to Ontario in 2019, good for fifth on our list. Growth from 2018 to 2019 was a healthy 4.6%, besting the three countries immediately above it.

The country’s share of the Ontario market was 2.2% in 2019. 43.5% of Brazilian students in Canada studied in Ontario, below the 49.1% all-countries benchmark.

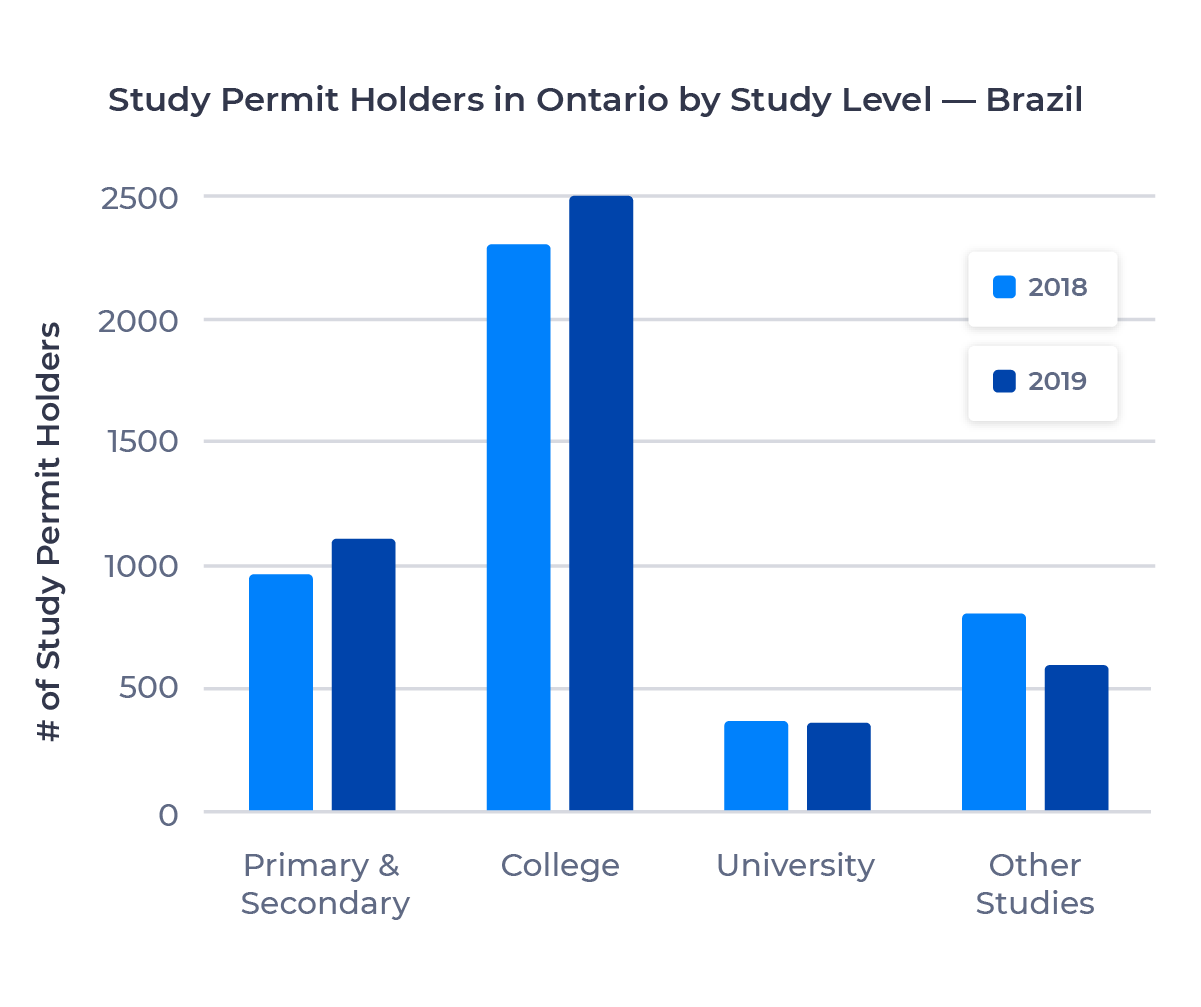

Brazilian Students in Ontario by Study Level

The figure below shows the breakdown of Brazilian students in Ontario by study level:

There are some interesting parallels to India in this data. 54.6% of Brazilian study permit holders in Ontario studied at colleges in 2019. Among the top six source countries for international students, this was the second highest proportion of college students, after India. 24.2% of Ontario’s Brazilian students were enrolled in primary or secondary schools, the second lowest proportion after India.

One key difference between Brazil and India, aside from the total number study permit holders, was the number of language training students, captured in the other studies data. Though Brazil’s other studies numbers dropped in 2019, there were still 535 more Brazilian students than Indian students enrolled in these programs despite India’s huge advantage overall.

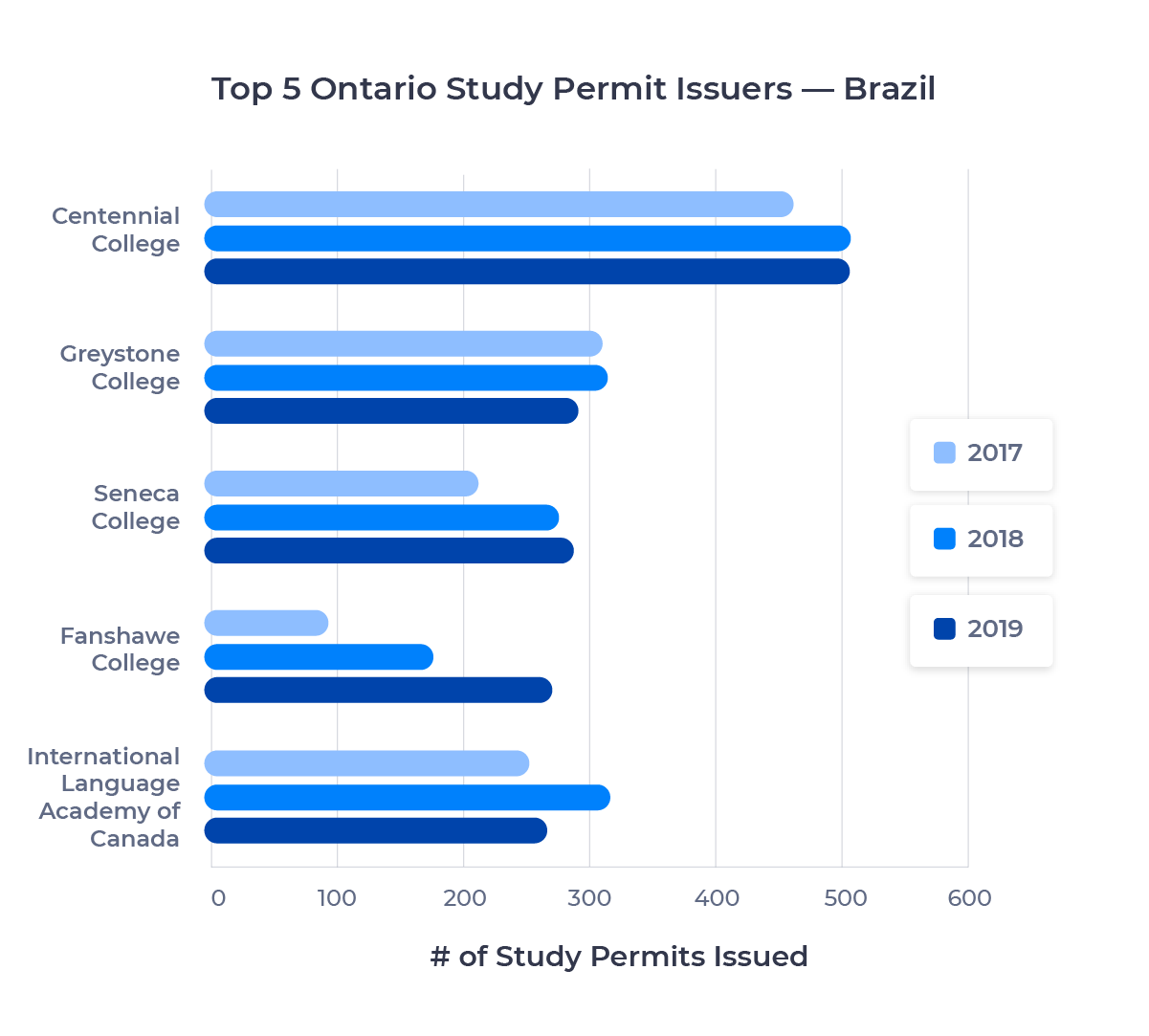

Top Ontario Schools for Brazilian Students

Let’s move to the top five institutions in Ontario for Brazilian students in 2019:

We see the excellent college numbers borne out in this school-by-school comparison, with three Toronto-based schools in the top five: Centennial, Seneca, and Greystone College, a private career college whose Toronto campus offers programs in business and hospitality. London’s Fanshawe College grew its Brazilian enrollment by almost 200% between 2017 and 2019 to enter the top five as well.

For more observations and analysis about Brazilian students in Canada, check out ApplyInsights: Brazil.

Iran

Rounding out the top 6 providers of international students in Ontario is Iran. 3,975 Iranians studied in Ontario in 2019, a whopping 42.7% increase over 2018. That earned Iran a 2.0% share of the Ontario market. Just 40.6% of the study permits issued to Iranian nationals in Canada last year came from Ontario institutions, well below the average of 49.1% for all countries.

With the political situation between Iran and the United States deteriorating over the past few years, it’s no surprise to see that Iranian enrollment in Ontario, and Canada as a whole, grew rapidly between 2018 and 2019, continuing a trend we’ve seen since the beginning of 2016.

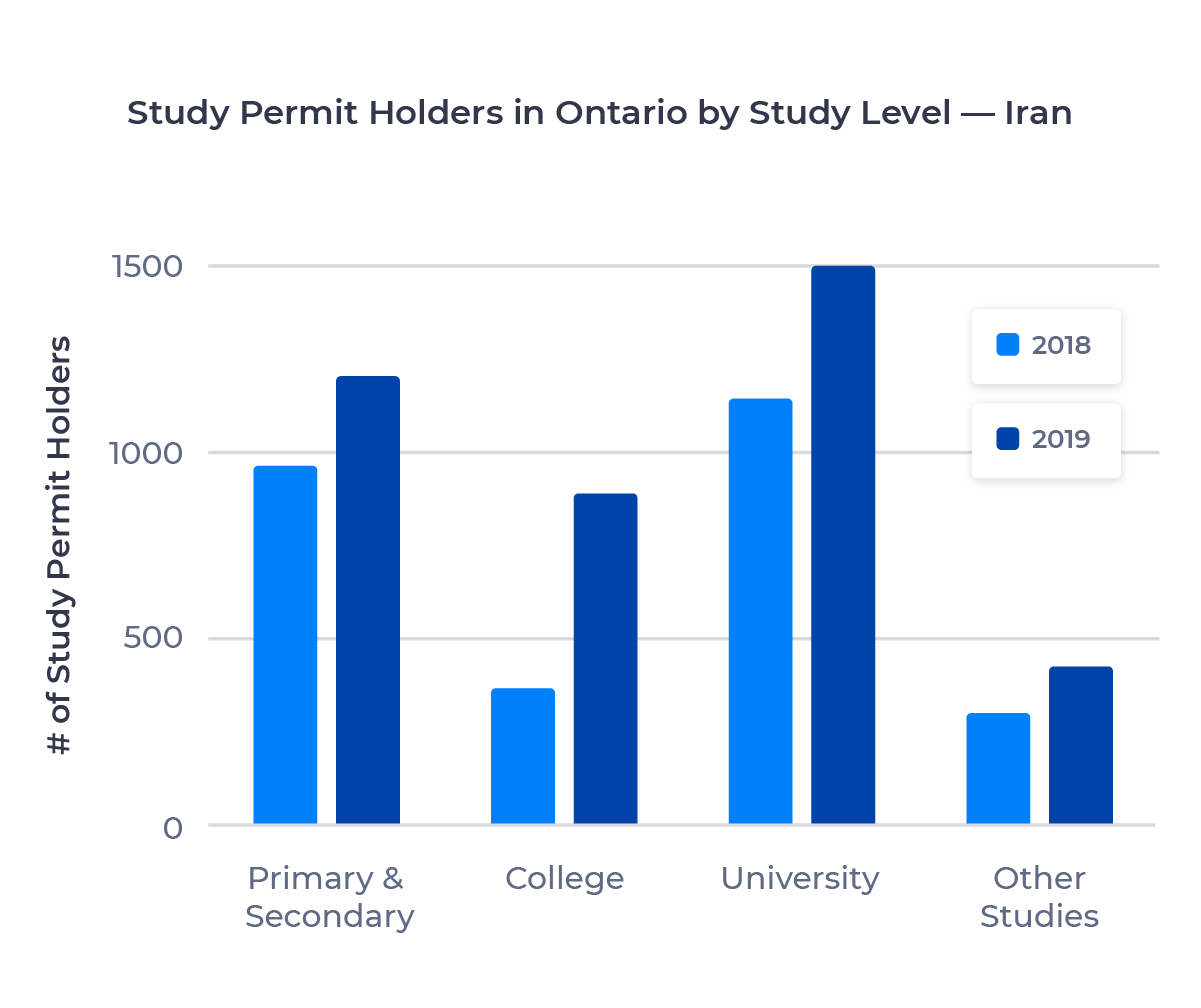

Iranian Students in Ontario by Study Level

Breaking down Iranian students in Ontario by study level, we have the following:

The massive growth in Iranian enrollment comes through in the visual, with all four sectors up at least 25%. University led the way, with 1,510 students and 37.2% of all study permits issued to Iranian nationals, but college made up ground in 2019, growing a whopping 138.7% year-over-year.

With the pandemic ongoing and a US election looming, there’s a lot of uncertainty in the Iranian international student market right now. I’m not comfortable predicting whether these trends will continue. However, this is a market I’ll be watching closely as the calendar shifts to 2021.

Top Ontario Schools for Iranian Students

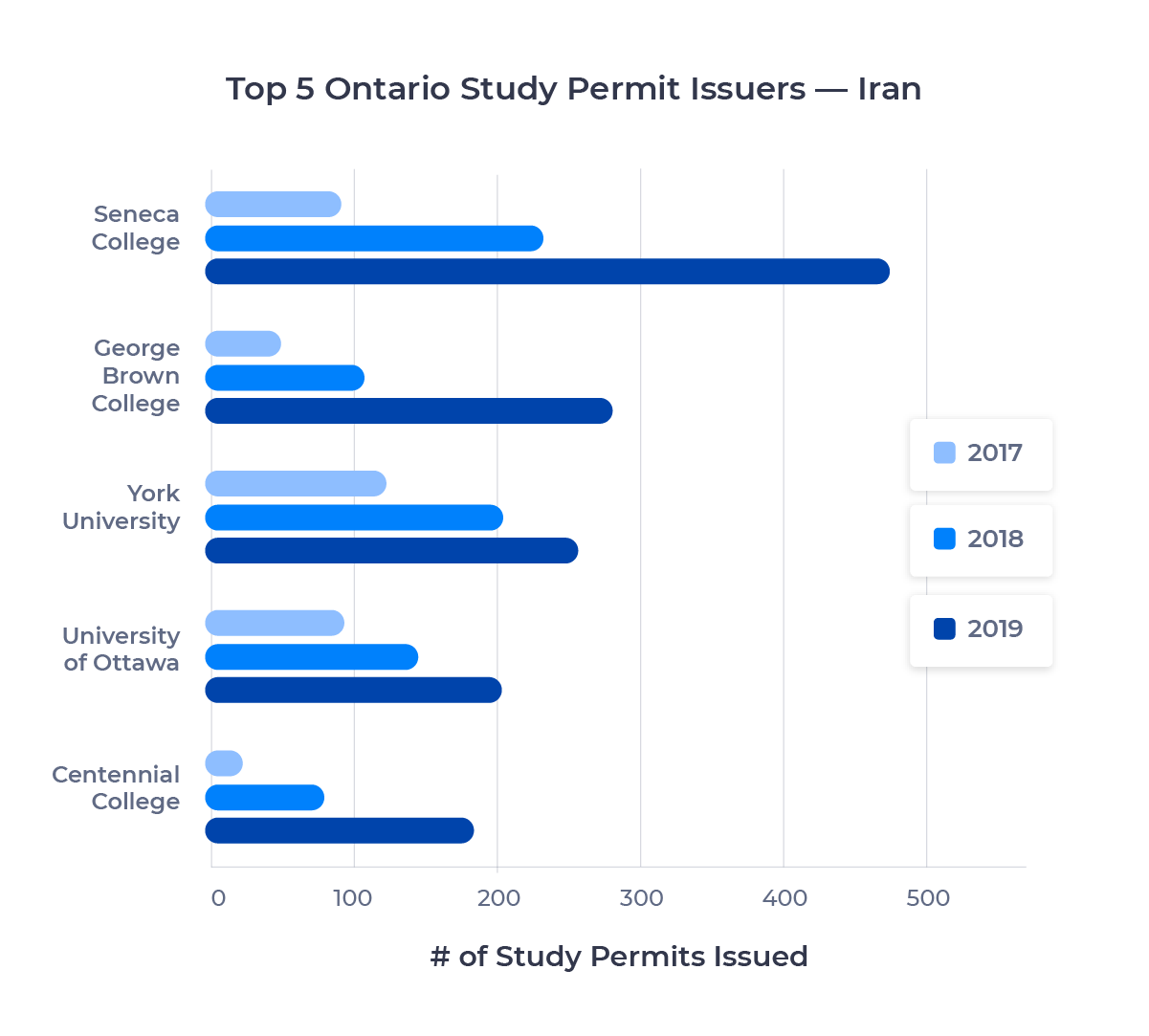

Here are the top five Ontario institutions for Iranian students in 2019:

Again, the huge growth is evident in the visual. All five schools more than doubled their Iranian enrollment over the two-year period, with Seneca and George Brown growing more than 400%. As with many of the other source countries we’ve examined, many of the most popular schools are located in the GTA, with the University of Ottawa the only exception here.

Ottawa and York led the way among universities, with the next two universities on the list, the University of Waterloo and the University of Toronto, actually losing Iranian students between 2018 and 2019.

Study Permit Trends in Ontario – Summary

There’s a lot of data here, so I’d like to quickly review some of our key findings:

- Ontario is the most popular destination for international students in Canada, and its growth outpaced the rest of the country’s between 2015 and 2019.

- The post-secondary sector drove most of this growth, up 128.4% over that four-year period.

- India accounts for 43.2% of the Ontario international student market. The vast majority of Indian students in Ontario attend college, but all sectors are growing.

- China provides 23.1% of Ontario’s international students. It’s the leading source country for university students, who are driven by location and ranking when selecting schools.

- South Korea, Vietnam, Brazil, and Iran are also key source countries for Ontario.

The Future of International Education in Ontario

It’s difficult to forecast which of these trends will continue due to the disruption of the pandemic. We’ve seen immense efforts from Ontario schools to put in place services that focus specifically on the needs of international students, as well as critical government policy changes to ensure the long-term success of international education in Canada. Because of this, I’m comfortable projecting a strong, if long, recovery. I also think we’ll see many of the strongest trends, such as the growth in the Indian market and Chinese students’ preference for university, continue post-pandemic.

However, the volatility among some of the smaller markets, particularly Vietnam and Iran, makes them difficult to project even in a more typical economic environment. I’ll continue to monitor these markets closely moving forward and update my Ontario projections in early 2021.

In the meantime, check back for my thoughts on British Columbia in a few weeks!

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America and the United Kingdom. Working with over 4,000 international recruitment partners, ApplyBoard has assisted over 100,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.