The Institute of International Education (IIE)’s Open Doors 2020 report breaks down international student enrollment by academic level in detail. For today’s ApplyInsights, I’m going to dig into some of that data to see how trends are shifting.

Here’s what this blog post will cover:

- A look at overall trends in international student enrollment in the US by academic level

- Breakdowns of the undergraduate, graduate, non-degree, and Optional Practical Training (OPT) markets by source country, focusing on areas of growth

This article is the third in a series exploring trends surfaced in Open Doors 2020. See my previous posts for a breakdown of international students in the US by field of study and a look at regional and state-level trends in US international education.

US International Education by Academic Level

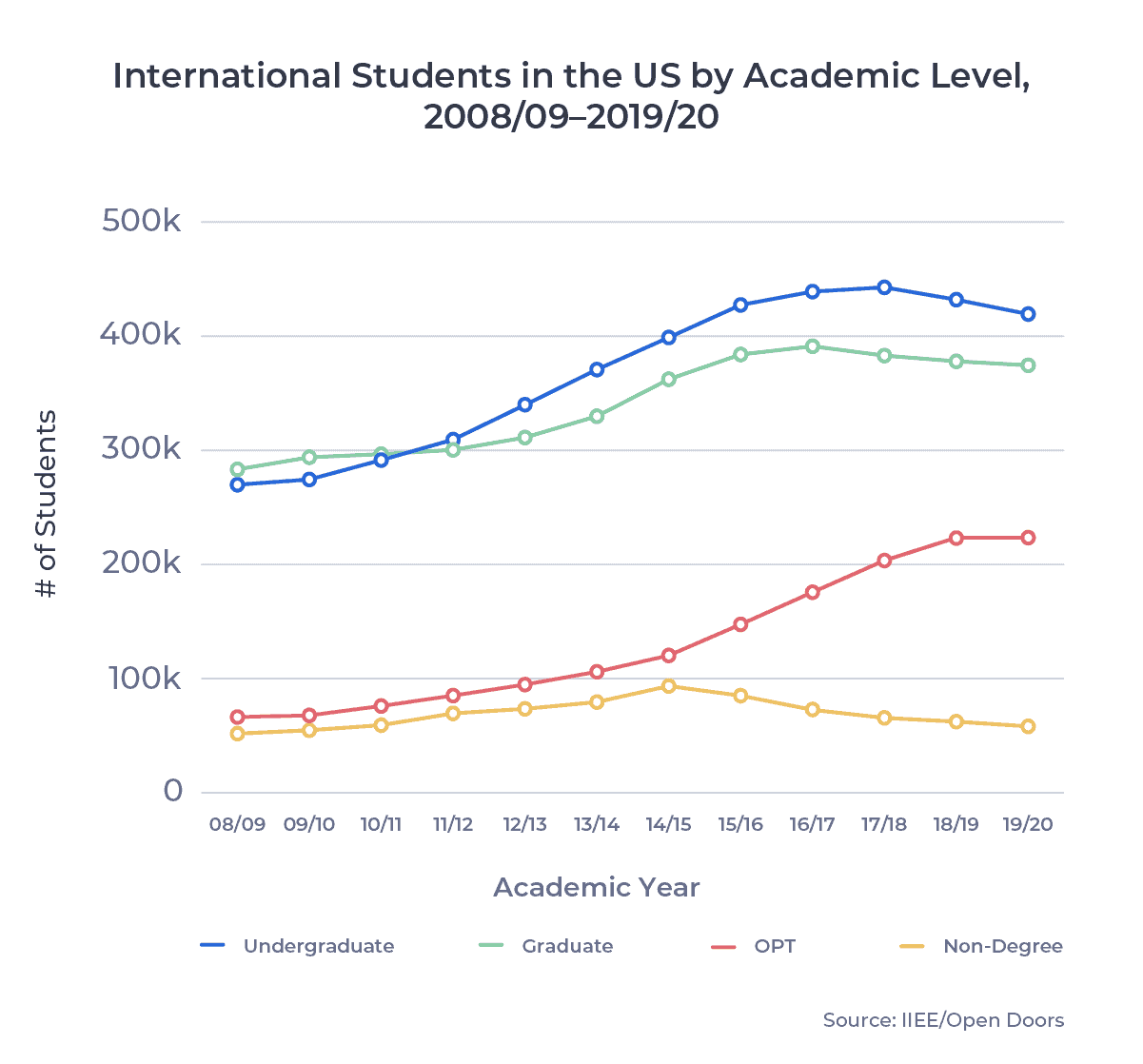

We’ll start with a look at the overall numbers by academic level.1 The chart below shows total international student enrollment in the US by academic level since the 2008/09 academic year:

New graduate enrollment increased in both 18/19 and 19/20 even as new undergraduate enrollment continued to fall. Generally, graduate programs were able to better resist the decline of the Trump years than undergraduate and non-degree programs. This likely reflects the stronger competition in undergraduate and non-degree markets across the other English-language study abroad destinations. With international students warming to the US in the Biden era, look for undergraduate programs to again begin widening the gap.

Optional Practical Training Remains Popular

Among the four academic levels, only Optional Practical Training (OPT) grew in 2019/20. OPT added a net 454 students, growing 0.2% year-over-year. This came after 9.6% growth in 2018/19 and double-digit growth in the previous eight years.

OPT is finally seeing the downstream effects of declining new enrollment across the other academic levels. However, the program remains popular, and recent proposals from the Biden administration recognize the importance of work opportunities in attracting international students.

The US Citizenship Act, introduced in the House of Representatives last month, includes a provision to make it easier for international graduate students with advanced STEM degrees to stay in the US. It also permits student visa applicants to claim “dual intent” on their application, meaning they couldn’t be penalized for indicating an intention to remain in the US to work after finishing their studies.

Let’s shift now to looking at how various source markets are shifting by academic level.

International Students in the US for Undergraduate Studies

Chinese students have dominated the US undergraduate market for years. The number of Chinese undergraduate students in the US fell slightly in 2018/19, by 0.5%. But because this was less than the all-countries decline of 2.9%, Chinese undergraduate market share actually grew, from 34.5 to 35.3%.

India pulled ahead of South Korea as the number two source country for international undergraduates in the US with 0.9% growth year-over-year. South Korea saw the second-largest net loss of students among all source countries after Saudi Arabia. Saudi enrollment continued to decline from its 2015/16 peak, which saw changes to the popular King Abdullah scholarship program.

Joining India on the positive side were Brazil and Taiwan. Brazil grew its undergraduate enrollment by more than double the next-best country, adding a net 604 students (7.8%) in 2019/20. Taiwan broke into the list of top 10 source countries for undergraduates with an additional 123 students and 1.7% growth.

The table below shows the 2019/20 top 10 and how they fared year-over-year:

| Rank | Source Market | 2018/19 Enrollment | 2019/20 Enrollment | Change |

|---|---|---|---|---|

| 1 | China | 148,880 | 148,160 | -0.5% |

| 2 | India | 24,813 | 25,032 | +0.9% |

| 3 | South Korea | 25,161 | 23,415 | -6.9% |

| 4 | Saudi Arabia | 21,778 | 16,839 | -22.7% |

| 5 | Vietnam | 17,048 | 16,589 | -2.7% |

| 6 | Canada | 12,470 | 12,409 | -0.5% |

| 7 | Japan | 9,001 | 8,684 | -3.5% |

| 8 | Brazil | 7,768 | 8,372 | +7.8% |

| 9 | Mexico | 8,549 | 7,993 | -6.5% |

| 10 | Taiwan | 7,262 | 7,385 | +1.7% |

International Students in the US for Graduate Studies

Together, China and India accounted for just under 60% of all graduate students in the US in 2019/20. This collective market share was largely unchanged from the previous year. However, the two markets went in different directions in 2019/20. Chinese enrollment in graduate programs grew by a net 3,700 students, or 2.8%, while Indian enrollment fell by 5,173 (5.7%).

Three African countries were among the top five countries overall for net graduate students added:

- Ghana gained a net 410 students, equivalent to 22.0% growth.

- Nigeria added 291 students, a 5.5% increase year-over-year.

- Kenya’s graduate student population went up by 185, a 19.9% spike.

Bangladesh was the other big winner among the top 10, adding 509 students (9.6%). Saudi Arabia and Iran declined the most, down 1,056 (11.2%) and 499 (5.5%).

The table below shows the full top 10:

| Rank | Source Market | 2018/19 Enrollment | 2019/20 Enrollment | Change |

|---|---|---|---|---|

| 1 | China | 133,396 | 137,096 | +2.8% |

| 2 | India | 90,333 | 85,160 | -5.7% |

| 3 | South Korea | 15,518 | 15,219 | -1.9% |

| 4 | Canada | 9,471 | 9,488 | +0.2% |

| 5 | Taiwan | 9,348 | 9,315 | -0.4% |

| 6 | Iran | 9,017 | 8,518 | -5.5% |

| 7 | Saudi Arabia | 9,418 | 8,362 | -11.2% |

| 8 | Bangladesh | 5,278 | 5,787 | +9.6% |

| 9 | Nigeria | 5,274 | 5,565 | +5.5% |

| 10 | Brazil | 4,732 | 4,811 | +1.7% |

International Students in the US for Non-Degree Programs

Just 5.4% of international students in the US in 2019/20 were enrolled in non-degree programs, the smallest share of the market since 2004/05. Non-degree program enrollment has declined every year since 2014/15.

Intensive English programs accounted for roughly a third of all students enrolled in non-degree programs in 2019/20. Enrollment in these programs fell by 13.1% year-over-year.

China and India were among the countries that saw the largest declines, as we can see in the table below:

| Rank | Source Market | 2018/19 Enrollment | 2019/20 Enrollment | Change |

|---|---|---|---|---|

| 1 | China | 17,235 | 15,896 | -7.8% |

| 2 | Japan | 4,713 | 4,621 | -2.0% |

| 3 | Saudi Arabia | 3,881 | 3,832 | -1.3% |

| 4 | South Korea | 3,497 | 3,301 | -5.6% |

| 5 | Germany | 2,809 | 2,835 | +0.9% |

| 6 | France | 2,123 | 2,085 | -1.8% |

| 7 | India | 2,238 | 1,759 | -21.4% |

| 8 | Spain | 1,582 | 1,613 | +2.0% |

| 9 | United Kingdom | 1,726 | 1,606 | -7.0% |

| 10 | Taiwan | 1,655 | 1,517 | -8.3% |

International Students in the US for Optional Practical Training

As we’ve seen in previous analysis of the Canadian market, post-graduation work is a top priority among Indian students. This is true in the US as well, where Indian students make up the largest group of students in the OPT program (36.3%). Despite this, Indian enrollment in the OPT program dropped by 3,457 students in 2019/20, or 4.1%. This was, by far, the largest decline among source markets.

Just as we saw with graduate studies, China enrollment in OPT grew as Indian enrollment declined. 1,343 additional Chinese students enrolled in the OPT program in 2019/20, representing a 1.9% increase.

Among other top 10 OPT markets, Nigeria and Nepal saw double-digit growth, as the table below shows:

| Rank | Source Market | 2018/19 Enrollment | 2019/20 Enrollment | Change |

|---|---|---|---|---|

| 1 | India | 84,630 | 81,173 | -4.1% |

| 2 | China | 70,037 | 71,380 | +1.9% |

| 3 | South Korea | 8,074 | 7,874 | -2.5% |

| 4 | Taiwan | 5,104 | 5,507 | +7.9% |

| 5 | Canada | 3,593 | 3,550 | -1.2% |

| 6 | Vietnam | 2,496 | 2,718 | +8.9% |

| 7 | Nigeria | 2,093 | 2,583 | +23.4% |

| 8 | Nepal | 1,594 | 2,232 | +40.0% |

| 9 | Iran | 2,269 | 2,213 | -2.5% |

| 10 | Brazil | 2,044 | 2,109 | +3.2% |

Looking Forward

As I wrote in a previous article, I’m excited about the Biden administration’s plan for international education. The US Citizenship Act contains a number of key provisions that will make international education in the US more accessible. I’ll dig into what those are and how they reflect the administration’s priorities in an upcoming ApplyInsights.

While the Democratic Party’s razor-thin voting margin in the US senate may restrict the scope of the bill, I expect the elements focusing on international education to be among the least contentious, and I’m optimistic Biden and his team will be able to get meaningful changes to the system, such as the “dual intent” provision, across the finish line.

Like other international education stakeholders, I’ll be following the bill’s progress closely. Reversing some of the negative trends we saw above, and ensuring a strong recovery from the Trump years and the COVID-19 pandemic, will mean supporting the student journey across all academic levels.

Published: March 18, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of the Institute of International Education (IIE).